In 2008, I came across a slide deck circulating among VCs on Sand Hill Road from a PV panel electronics firm with an interesting patent, four unsalaried employees, and no funding. The buzz called it an "inverterless inverter."

Fast forward five years and millions of VC dollars later: ArrayPower, which aimed to commercialize an innovative "sequenced inverter" for solar panels, is closing up shop and selling its assets.

Wendy Arienzo, the CEO of the firm, told GTM, "We are ramping the operation down. The good news is that we have a U.S. acquirer of the assets. Hopefully, the software-defined inverter will be resurrected and find a place in the solar ecosystem in the future."

In October 2011, the 35-employee ArrayPower came out of stealth with investors including DFJ, Firelake Capital, Partech International, and Trident Capital. Board members include representatives of those VC firms, as well as Solaria's Daniel Shugar, Jon Bonanno and Kevin Surace, formerly of Serious Energy.

Bonanno has since formed Empower Micro Systems, an inverter technology company raising money on Gust, an angel-investor/crowd-funding platform. (New times and new technologies require new investing models.)

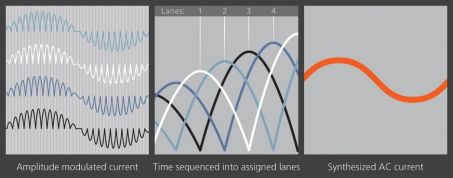

As we wrote in an earlier article, ArrayPower's direct current to pulse amplitude modulated (PAM) current converter system consists of distributed power modulators tied into an array controller. The PAM technology "senses the grid and synchs its pulse output" to the amplitude of the 50 Hz or 60 Hz grid waveform. Each unit's waveform is slightly shifted in time. When combined, those rough waveforms yield a grid-quality signal.

The firm claimed to provide all of the function of a microinverter at the price of a string inverter without the necessity for electrolytic capacitors. The company had some traction with Canadian Solar, but never garnered enough business to survive.

MJ Shiao, Solar Analyst at GTM Research, notes the forces arrayed against ArrayPower:

- High-incentive distributed generation markets that would favor the exploration of radically different power electronics are fading.

- Inverter manufacturers are facing extreme pricing pressure and thus the price targets for new power electronics have to be much lower than planned (think thin-film in the past couple of years).

- Module companies have reduced capital to spend on the R&D for power electronics integration -- some of the Chinese module manufacturers, such as Yingli, have put these projects on hold. However, there are some that are aggressively pursuing the technology (e.g. Trina, Upsolar, and ReneSola).

- Most of the power electronics companies haven't raised funds in a while, and, as you can see from Enphase's balance sheet, running these companies isn't cheap.

ArrayPower entered a market where there is price pressure on every element of the solar value chain, from module to installation to electronics. According to a forecast from GTM Research, inverter prices will fall 10 percent annually over the next few years, from $0.22 a watt in 2012 to $0.14 per watt in 2016. Former DOE Secretary Steve Chu's SunShot program wants to see inverters at $0.10 per watt.

Power engineering is an underappreciated science. Last week, in a speech at Stanford, Chu noted that most U.S. universities don't have programs focused on power engineering and that finding power electronics specialists is a challenge. VC investor Vinod Khosla is looking for innovations in power electronics.

Stand-alone distributed electronics firms are experiencing the same attrition as the rest of the solar industry. ArrayPower joins Azuray, EiQ, et al. on the RIP list. The current standalone survivors in this business are Enphase (ENPH) in microinverters and SolarEdge and Tigo in the optimizer segment. SolarBridge (which just got a new CEO, Bill Mulligan), Enecsys, and Petra are still alive. SMA and Power-One have their own microinverter products and better balance sheets than the startups. Acquisition might be the best result for the standalone survivors.

Module-Level Power Electronics (MLPE) Taxonomy

Taxonomy from The Global PV Inverter Landscape 2013 report. Visit the report's web page at www.greentechmedia.com/research/report/the-global-pv-inverter-landscape-2013.