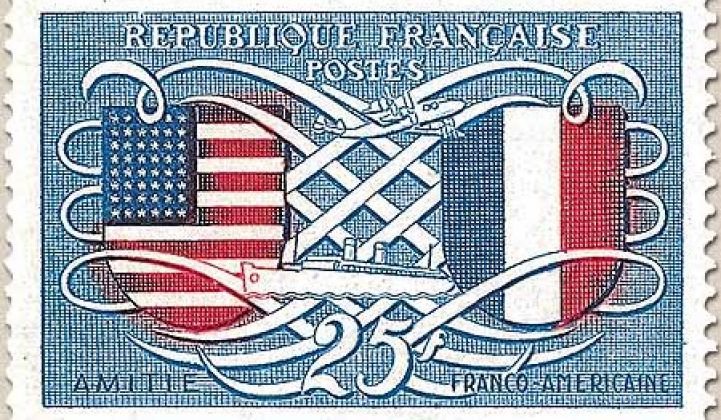

Red letter dates in Franco-American history:

- 1770s: France provided soldiers to the American independence movement, making France America's oldest ally

- 1803: Napoleon sells Louisiana Territory to the U.S. for $15 million.

- 1884 Statue of Liberty presented as a gift to America from the people of France

- 1926: Jerry Lewis born

- 1949: France and the U.S. become formal allies through NATO military alliance

- 2011: Total becomes major shareholder in SunPower

Total SA (NYSE:TOT) of France, one of the world's largest energy companies, gained ownership of 66 percent of America's SunPower (SPWR), the leader in solar panel efficiency, in 2011. SunPower is vertically integrated with a high-performance (and higher-cost) c-Si solar cell technology, as well as a strong downstream dealer network for residential and commercial rooftops and a gigawatt-scale project pipeline of utility-scale solar power plants. SunPower has also raised funding for third-party financing of residential solar rooftops.

We sat down recently with SunPower CEO Tom Werner and Philippe Boisseau, Total's President of Marketing & Services and President of New Energies, to discuss their two-year-old partnership and how the firms are navigating the dynamic shifts in today's global solar market.

The SunPower Acquisition

SunPower CEO Tom Werner said, "Being the Silicon Valley guy of the company and being part of many acquisitions previously, this one is going shockingly well. [...] And the reason is because I think we were honest, upfront as to what our motivations were, and they're aligned really well, to a true north. When the proverbial stuff hits the fan, and you have to make a call, we fall back on what's true north, taking solar mainstream, making it an alternative energy choice to conventional energy, not necessarily replacing but making it a competitive energy option."

Philippe Boisseau of Total added, "With regards to the nature of the partnership -- it's not an integration. We respect the entrepreneurial spirit of SunPower, and we want to keep it that way, which is very, very important, because diluted in a big oil company, SunPower would die." He added, "What we wanted is to not destroy that entrepreneurial spirit that made the success of SunPower."

Boisseau led Total's team on its search, and he stresses that the firm looked at "200 firms in its search" for an ideal acquisition target.

The Transition From Modules to Energy

SunPower's CEO said, "The transition happening in the solar market isn’t so much in my mind the Chinese lowering prices and companies going out of business, [but rather] a transition from selling modules to selling energy. You have a very sophisticated buyer, you either convert capital cost to LCOE or they buy under PPA. So in either case, you're buying energy. Our commercial customers almost exclusively buy PPAs, and now we have residential customers buying energy."

Boisseau said, "[W]e're not only competing against solar. We are competing against traditional forms of producing electricity. And this market is absolutely huge compared to what solar is producing today." He explained, "It's not a matter of competing against solar," adding, "When you have a gas power plant, you compete against electricity producers."

Vertical Integration and High-Efficiency Cells

According to Boisseau, SunPower's vertical integration is one of reasons Total partnered with the solar company. "Vertical integration is basically one of the key answers, because we are dealing with capturing the value down to the customer, which has nothing to do with just selling cells or panels. And there, SunPower has a value which is incredible because the very high efficiency of the cells leverages the cost of the whole system." He noted, "The added value of having a 24 percent or 23 percent cell creates a leverage on the balance of system, which is unbeatable. [...T]he more the price of modules and cells will be reduced, the higher the competitive advantage of SunPower will be. So we are in a virtuous circle."

"For those who want to be leaders of the market, which is our case, and who will benefit from the high-efficiency cell, we need to be vertically integrated, otherwise -- at the same time, we cannot survive if we don’t do that, but we can win, and then really make money and grow if we really compete against our real competitors, which are the other sources of electricity. And that's why I'm absolutely convinced that's a business model. I cannot tell whether the commoditized module market will survive longer or not, but at least our business model will be a growing part of the business."

China Solar

Boisseau said, "We are convinced that China industry will be restructuring starting this year or the following because a decision has been made by the Chinese authorities to stop this dreadful path through which some of the companies are going through. Some of them are losing half of their revenue. This is not a sustainable situation, so some restructuring will take place."

The Power of Total

"We have two roles vis-a-vis SunPower. We have the role of a shareholder. And there is another role, which is partner, and this partnership takes place in various areas. R&D is one. We reoriented our R&D, and the R&D that Total is making is complementing the R&D that SunPower is making. As a matter of fact, during these two years of struggle, very few solar companies in the world have continued to spend money in R&D. So we are convinced that we gained some advantage versus the competition because we didn’t cut R&D spending."

"Opening new markets is another one. Just figure that out when you go to Saudi Arabia, just be in their shoes. They want to create 16 gigawatts of solar in the next twenty years. [...] What if five years after you've invested, the solar system doesn’t work, if you had bought from an unknown company?"

Total cannot afford to lose credibility in Saudi Arabia, said Boisseau. "So in the shoes of the Saudis, having Total on board is a guarantee of credibility. And Total's credibility plus SunPower's product reliability makes for a fantastic value proposition. And they say that to us. They say, 'We want Total, because we trust that Total will be there for the long term.'"

Total is a partner along with Masdar in the recently inaugurated 100-megawatt Shams 1 in the United Arab Emirates -- the largest concentrated solar power plant in operation.

Boisseau added, "We have some projects in South Africa, in Chile, that we're bringing to SunPower. That's another one of the benefits we are bringing, access to the world where it is economical with no subsidy to produce electricity."

***

With subsidies coming to an end in a chaotic and consolidating global market, solar firms continue to struggle for customers, markets, and margins. For the time being, a pure-play module player exists in an oversupplied, margin-free, commodity-level market.

But the kilowatt-hour commodity energy market is different than the dollar-per-watt commodity panel market. And solar project developers are able to compete at the kilowatt-per-hour level with conventional power plants.

SunPower recently signed a twenty-year power purchase agreement (PPA) with California utility PG&E at a price below the 10.4 cent per kilowatt-hour MPR on the 115-megawatt (DC) Henrietta project. First Solar's Macho Springs project is in the 8.5 cents per kilowatt-hour range.

SunPower is one of the largest utility project developers in the U.S., behind only First Solar (FSLR), with over 1.2 gigawatts in projects contracted, accord to GTM Research.

Construction has started on SunPower's Antelope Valley Solar Projects in Los Angeles/Kern Counties -- the 579-megawatt project owned by Warren Buffett’s MidAmerican Solar is the world’s largest permitted solar development.

However, revenue from the utility solar business is lumpy and arguably a business at its peak. Fortunately, SunPower has its robust residential and commercial business to smooth things out and better leverage its efficiency advantage.

In the coming years, does SunPower (or First Solar) unlock more value if its EPC and module groups are broken out more distinctly?

The value of Total's involvement in SunPower and the solar market remains to be seen. Oil companies have a spotty record in the solar business. BP abandoned its longstanding solar business, although Chevron has Chevron Energy Solutions, Royal Dutch Shell backs Solar Frontier, while Saudi Aramco is developing solar projects in MENA.

Total's support notwithstanding, SunPower still has to stop its cash burn, flip to profitability, and continue to scrub cost from its solar cell manufacturing process.