GlassPoint Solar just won $26 million in Round B financing from an impressive list of investors. GlassPoint’s Enclosed Trough Concentrating Solar Power (CSP) enhanced oil recovery (EOR) process attracted oil giant Royal Dutch Shell (NYSE:RDS.A) as well as RockPort Capital, Nth Power, and Chrysalix Energy Venture Capital.

GlassPoint’s 300 kilowatt Kern County 21Z solar EOR project is presently at work in partner Berry Petroleum's McKittrick, California field. Another 7 megawatt project is nearing completion in a Petroleum Development Oman field in the south of Oman.

“Played out” wells still hold a third or more of their potential in heavy oil that is not recoverable by conventional drilling and pumping methods. For decades, natural gas has been used to boil water into pressurized steam that, flooded into the well, can turn the oil more fluid so that pumping can keep it coming up.

In 1983, ARCO’s solar subsidiary used a one-megawatt solar power tower project to generate steam in its Taft, California, field. Though the concept proved feasible, it was not cost-effective and ARCO dropped the experiment.

BrightSource Energy (BSE)’s 29-megawatt pressurized steam solar power tower CSP technology is presently doing EOR in Chevron’s Coalinga oil field. According to BSE’s S-1 report, Chevron (NYSE:CVX) contracted for its solar EOR services at $27.8 million in 2008, and the project, which was initiated in 2011, has cost BSE $67.3 million.

But the project is essentially R&D, said BSE’s Keely Wachs, and paved the way for BSE’s landmark three-unit, 370-megawatt Ivanpah electricity generating facility scheduled to go on-line in California’s Mojave Desert next year.

The project’s purpose is to prove the BSE solar EOR system’s viability, said Chevron spokesperson Madonna Smith. Production is not even being tracked.

Areva’s Compact Linear Fresnel Reflector (CFLR) technology is also a candidate for a share of the solar EOR market, but to date has built only projects that augment steam production in conventional fossil electricity generating plants.

An EOR method’s rate and percentage of recovery from any well is reservoir-specific, explained GlassPoint CEO Rod MacGregor, but an oil company will keep pumping as long as the process renders the product economical.

MacGregor said studies show solar EOR is able to produce approximately 16 percent more oil from a well than natural gas because gas has a fuel cost. Even the historically low $3.50 to $4.00 per MMBTU current price detracts from the economic viability of production.

Solar, MacGregor said, has no fuel cost and its operational cost, approximately $0.35 per MMBTU, is essentially fixed for the life of the project.

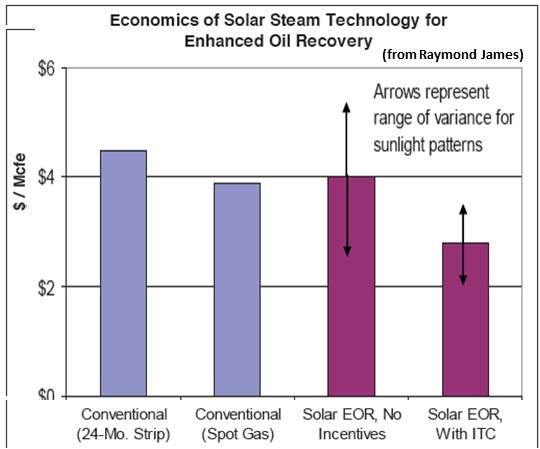

Though solar pricing varies with insolation and natural gas pricing just varies, CSP can produce steam at rates competitive with natural gas, according to a 2011 Raymond James evaluation. It put solar EOR at $2.00 per million cubic feet equivalent in the Middle East to $4.00 per million cubic feet equivalent in California.

That is the range in which natural gas spot market prices have hovered, though there is little reason to think they will remain below $5.00 per million cubic feet much longer.

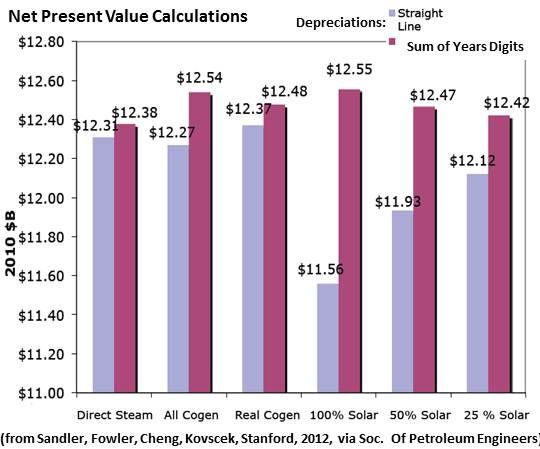

“All natural gas cogeneration and 100 percent solar fraction scenarios had the largest and nearly equal net present values of $12.54 billion and $12.55 billion, respectively,” according to a 2012 paper from Stanford researchers presented to the Society of Petroleum Engineers. The 100 percent solar scenarios are achievable, the Stanford researchers say, from CSP with storage.

Solar power tower technology seems to be winning favor away from the older and more proven parabolic trough technology GlassPoint uses because it is capable of getting its operating fluids to higher temperatures.

The very efficiencies that make power tower technology able to achieve the higher temperatures, MacGregor said, are why trough technology is better suited for EOR. Both a Ferrari and a Ford F150 pickup can pull a trailer, he said, but it is not economic to use the Ferrari.

GlassPoint’s technology is designed, MacGregor said, to handle dirty feed water and harsh low maintenance conditions in an oilfield. And GlassPoint’s facilities require less capital and less land because they do not have to achieve the high temperature.

With GlassPoint’s technology, aluminum parabolic trough mirrors on single-axis trackers are enclosed in agricultural glass houses. Because they have been in use for decades, there is no need to scale up a supply chain. And because the trough units are enclosed in rectangular buildings, they can be readily cleaned robotically.

There is some loss of solar power, about 8 percent, to reflection by the glass, transmission through the glass, soiling and shading, MacGregor said, but the mirror and fluid system requires less land and less maintenance and it can be built with materials that do not have to stand up to the harsh desert environment because it is protected by the glass house.

One recent research study predicted the global EOR market will be $16.3 billion in 2014. Over 40 percent of California’s century-old oil wells now require enhancement and that is expected to be 60 percent in the next few years. But the real market, MacGregor said, is the Middle East, where a “perfect EOR storm” is setting in.

With light crude in many Middle East fields largely played out, they will be turning to heavy oil soon, he said. And there is a shortage of natural gas. And there is plenty of sun.