8minutenergy is a pure-play solar developer with 12 large utility-scale solar PV farms in various stages of development. The proposed solar farms in their portfolio total 1,300 megawatts of power, are due for completion between 2012 and 2014, and are located on over 10,000 acres in 12 locations in California’s Imperial Valley.

"In various stages of development" can mean a lot of things and it is by no means a sure bet that these projects will cross the finish line. That said, having a signed PPA is no guarantee that a project gets completed, either. Aspiring long-shot solar firms like Solaren (solar in space), Enviromission (solar updraft towers) and Greenvolts (CPV) have signed PPAs, as have dozens of solar developers, but until the lights go on -- none of them are close to a sure thing.

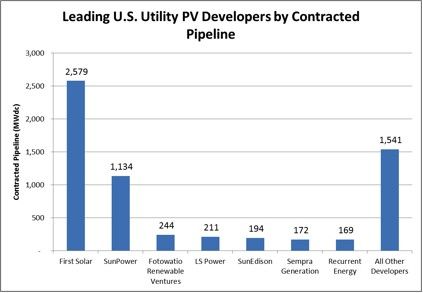

Contracted Utility PV Pipeline Market Shares, Leading Developers

As analyst Shayle Kann revealed in GTM Research's recent utility PV report, "First Solar and SunPower dominate the utility PV market in the U.S. today; one of the two companies has been involved in every one of the 11 largest operating projects in the country. But they are not nearly alone in the market. Rather, there are 55 different project developers with at least one signed utility PPA, and at least 25 more that have not yet signed any off-take agreements."

8minutenergy is in the long tail of small solar developers. The firms's solar projects include:

- Chocolate Mountains Solar Farm: a 50-megawatt joint project of 8minutenergy and Gestamp Solar, located on 320 acres in the foothills of the Chocolate Mountains in California's Imperial Valley, near the Salton Sea. Chocolate Mountains Solar Farm has completed the CUP process and is currently in the advanced development and engineering stage.

- The Calipatria Solar Farms: two utility-scale 50-megawatt PV power plants in advanced stages of development. The two projects occupy close to 600 acres, and are targeted to begin generating electrical power in 2012.

- Midway Solar Farm: four PV power plants that will produce, respectively, 50 megawatts, 155 megawatts, 200 megawatts and 50 megawatts of electrical power by 2013 and 2014.

- Salton Sea Solar Farm I: a 50-megawatt PV power plant located on 320 acres.

- Salton Sea Solar Farm II: a 100-megawatt project which occupies 622 acres of land.

- The three Mount Signal Solar Farms will occupy a total of 3,800 acres in the Imperial Valley of California and each will generate 200 megawatts of solar power.

All of these solar farms will be constructed on private, disturbed, low-productivity and irrigated farm land which helps the permitting, CEQA chances and environmental viability of the site. Note: megawatt figures quoted in AC.

I spoke with Martin Hermann, the CEO and Founder of 8minutenergy, and former chief strategy officer with Advent Solar. (Applied Material acquired Advent Solar in 2009.) The firm is focused exclusively on solar PV at utility scale and has been focused on the California energy market for the last two years. Hermann wants to "focus on one thing and do it better than anyone else."

According to the CEO, "We were the first company that received an environmental permit in Imperial county -- a very desirable area." He added, "There are lots of developers there. but we were the first one -- doing pioneering work for us and the local planning department." He added that they were one of the few projects in the region with environmental permitting.

Hermann said the firm is "agnostic in our approach; projects have a two- to four-year development time" and it "doesn't make sense to make the decision in advance." He suggested that the vendor volatility in the PV space demands that type of restraint, saying, "Look at the top solar suppliers in 2000, 2004, 2008 -- each year, it's a completely different list."

The CEO also contends that, "The economic value of the land we take out of production gets boosted by a factor of three or four and achieves a water reduction of up to 95 percent on the marginal farmland." The company looks for this type of land, as it tends to minimize problems.

As for the challenges to the firm's strategy to not go first for the PPA, as well as the common contention that if you don't have a PPA, you're not for real? Hermann answers that 8,000 megawatts of PPAs have been closed but a lot of projects are under water and will never be built as they are simply not financeable, adding that every 50-megawatt project requires more than $150 million to see the light of day.

8minutenergy claims to have developed a proprietary process to deliver operational solar PV generators. The process takes into account favorable locations for transmission and interconnection, what the developer calls "a rare commodity within the WECC (Western Electricity Coordinating Council) power grid."

With their tools, 8minutenergy claims it can gauge the extent to which a prospective project is economically feasible and determine the overall economic attractiveness of a particular solar PV generator (e.g., price for land, interconnection gear, transmission upgrades, solar technology, array design, etc.).

8minutenergy is self-funded.

For more details on utility scale solar, see GTM Research's recently published comprehensive U.S. utility PV market report, The U.S. Utility PV Market: Demand, Players, Strategy and Project Economics Through 2015.