Closing out last week's Solar Summit Conference in Phoenix, Senior Solar Analyst Cory Honeyman shared GTM Research's outlook on the U.S. solar market with the 600 energy professionals in attendance.

To set the stage, Honeyman noted that 94 percent of all U.S. PV installations came on-line between 2010 and 2014. In the same time period, solar's share of new generating capacity grew from 4 percent to 32 percent, second behind only natural gas last year.

Framing GTM Research's outlook of U.S. solar over the next two years, Honeyman identified "five numbers that tell you everything you need to know about U.S. solar in 2015 and 2016."

5.7 gigawatts

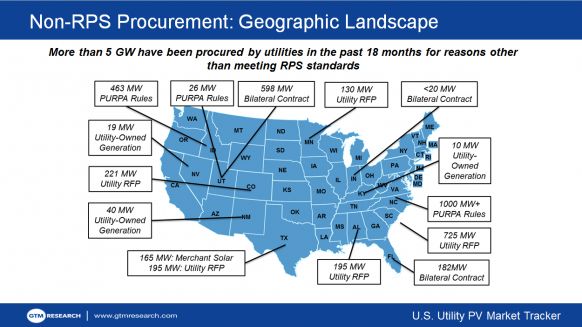

The first number of note is the 5.7 gigawatts of utility-scale solar procured by utilities outside of RPS obligations.

Honeyman cited what's driving this growth: PURPA rules, utility-owned generation, merchant solar, bilateral contracts, and utility RFPs. As the map below shows, non-RPS growth is not limited to any particular region -- it's a nationwide trend.

3.5 gigawatts

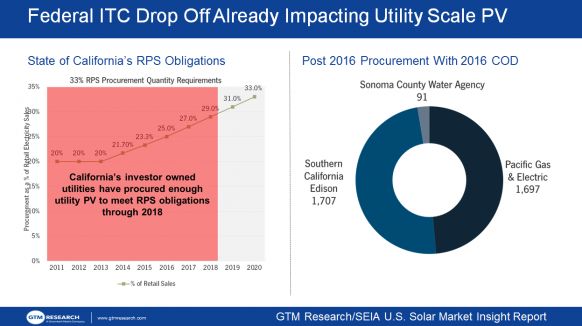

Honeyman's second number, 3.5 gigawatts, is the amount of utility-scale solar with PPAs that start after 2016 but which are planning to come on-line before the federal ITC drops to 10 percent.

14 states at the tipping point

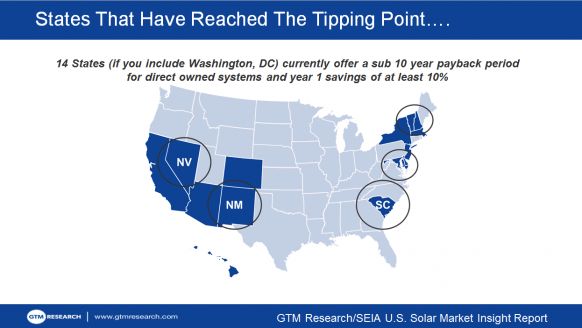

GTM Research identified 14 states that have reached a residential solar "tipping point," meaning they are economically viable for the system owner.

More specifically, these are markets where direct ownership of a PV system has a 10-year payback period (or better), in addition to offering savings of at least 10 percent in the system's first year of use.

Honeyman noted that a number of major installers have opened offices in up-and-coming residential solar states like South Carolina, New Mexico and Nevada. However, Honeyman cautioned that California made up half of all U.S. residential solar in 2014 -- and that the market will remain consolidated across a small number of states through at least 2016.

21 states where compensation for PV is eroding

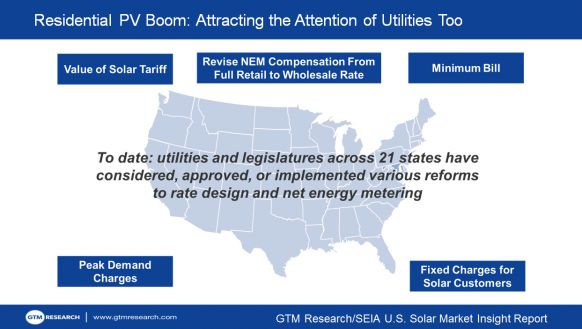

Change is afoot in the U.S. residential solar market. Honeyman described 21 states where utilities or legislatures have proposed lowering compensation for residential solar.

The proposed rate-design reforms can be grouped into five key archetypes: a value-of-solar tariff, peak demand charges, revised net metering compensation, minimum bills, and fixed charges. State-level policy changes will have major impacts on markets in the coming years.

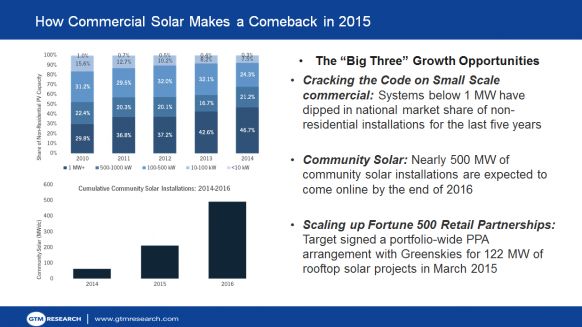

3 big growth opportunities for commercial solar

Finally, Honeyman described three ways commercial solar will make a comeback in 2015: small-scale commercial, community solar, and Fortune 500 partnerships.

Commercial solar is slated to grow 40 percent over 2014 levels this year. GTM Research forecasts the U.S. to install 8.1 gigawatts of PV in 2015 and 11.8 gigawatts in 2016.