An IPO or acquisition is the promised land for VC-funded startups -- but those have been rare cleantech events over the last few years. The fact is that most cleantech companies require a longer time frame, a bigger budget, and a different set of investor skills than do IT software startups.

Will we see any IPOs from the renewable energy and cleantech sector in 2014?

In the past decade, companies such as SunPower, First Solar, EnerNOC, Comverge, GT Advanced Technologies, and more recently, Tesla, SolarCity, Silver Spring Networks, Enphase, Intermolecular and Control4 have made it onto public exchanges. Biofuel startups Solazyme, Gevo and KiOR also went public. A123 went public -- and then went bankrupt. BrightSource, Luca, and Enerkem filed for an IPO but had to withdraw, as did biofuel maker Mascoma. DIRTT went public on the TSX exchange.

What must a cleantech firm possess to win the favor of investment banks and institutional investors for an IPO in 2014? We asked some investor colleagues for their guidelines, and they replied:

- At least $50 million in revenue

- Profitability or near-term sightlines to profitability

- A compelling growth story

- Not remotely involved in solar panel manufacturing or biofuels production

Here are some obvious and not-so-obvious potential IPO candidates for 2014.

Energy Efficiency: Opower

Opower, the utility-serving home energy efficiency and behavioral modification firm, is headed toward an IPO. Sources suggest that the IPO registration is already confidentially filed with the SEC. Morgan Stanley and Goldman Sachs are said to be the lead underwriters, according to the WSJ.

Opower claims there are 80 million U.S. households that could be cost-effectively served with behavioral programs. The company is also looking at demand response programs and working deals with fellow list-member Nest. Sealing deals with utilities such as TEPCO, E.ON, Avista Utilities and many more, the company is showing a growth path and gaining revenue. The S-1 will reveal the size of margins that this type of business gains.

VC investors include KPCB, NEA, Accel Partners, MHS Capital, Founder Collective, and Ali and Hadi Partovi.

Distributed Generation: Bloom Energy

Bloom Energy builds fuel cells of the solid-oxide variety with natural gas as the fuel. The 200-kilowatt units are intended for commercial and industrial applications, and the firm boasts an all-star list of customers, including Adobe, FedEx, Staples, Google, Coca-Cola, and Wal-Mart.

After raising almost $1 billion in venture capital over a decade from investors including GSV Capital, Apex Venture Partners, DAG Ventures, KPCB, Mobius Venture Capital, Madrone Capital, NEA, SunBridge Partners, Advanced Equities, and Goldman Sachs, this could be the year. Bloom's valuation dwarfs the collective market cap of the public fuel cell firms and its revenue is greater than the collective revenue of those firms.

Scott Sandell, a partner at NEA and Bloom board member, was quoted by Reuters as saying that Bloom will likely attempt an IPO in late 2013 or early 2014. Bloom is Kleiner Perkins' first cleantech investment and, at more than twelve years old, an old maid in VC years. A successful IPO from the company would be a testament to the viability of capital-intensive, VC-funded cleaner energy breakthroughs -- and the virtue of investor patience and distributed power generation.

Home Energy Management: Nest Labs

A beautiful consumer product with Apple cachet that actually saves energy dollars. What's not to love? According to a report from Re/code, Nest may soon close a $150 million VC round led by Yuri Milner's DST Global that values the company at more than $2 billion.

VC investors in Nest include Kleiner Perkins, Google Ventures, Shasta Ventures, Generation Investment Management, Venrock, Lightspeed Venture Partners and Intertrust.

According to GigaOm, Nest was shipping 40,000 units per month this time last year with a goal of hitting a 1 million unit per year run-rate. As GTM's Stephen Lacey reported, the company is also working on a smoke detector and possibly other in-home devices.

Sources suggest that although Nest is growing like mad, it is also consuming massive amounts of capital and may not be a great cleantech IPO story just yet.

LED Lighting: Intematix

Intematix's phosphor materials enable LEDs for general illumination to achieve better quality light and efficiency. Intematix's IPO registration is currently under review by the SEC, according to the company. Paperwork was filed under the new JOBS act, so details on the filing are confidential, for now.

Intematix's customers include the big LED vendors, as well as TV manufacturers.

Intematix has won more than $65 million in VC funding from DFJ, Crosslink and East Gate, but more recent funding has come from strategics including Samsung and Sumitomo. The LED lighting market actually seems to be poised at a true tipping point with the end of 60-watt incandescents and the introduction of sub-$10 LED bulbs.

Solar Finance: Sunrun

While solar panel startups might be shunned, downstream solar is a sought-after sector. Residential solar is the only U.S. solar segment that has grown consistently with no seasonal booms or lapses over the last few years. Residential solar installation prices continue to drop.

Third-party ownership currently dominates the financing choices of residential solar customers and represents 60 percent to 90 percent of the solar financing in California, Arizona, Massachusetts, and Colorado. Sunrun helped originate the solar financing idea and can be viewed as "SolarCity without the trucks."

VC investors in Sunrun include Sequoia Capital, Accel Partners, and Foundation Capital.

Dark Horses and Other IPO Aspirants

Distributed solar electronics maker SolarEdge has been weighing an IPO for some time. SunEdison is potentially offering a YieldCo in 2014. Distributed intelligent lighting firm Digital Lumens is bringing in revenue, as is energy efficiency firm Next Step Living. Clean Power Finance is showing strength and could be considered a potential 2015 IPO or acquisition candidate. Some consider Kurion's strong business in nuclear waste cleanup an untold cleantech story that goes along with IPO-size revenue. Blackstone might want to take the Vivint Solar piece of Vivint public as well.

Keeping Perspective

The IT industry does not have to work as hard as the cleantech sector to make lists of IPO candidates. Firms such as Box, Dropbox, Palantir, Cloudera, New Relic and Sugar CRM are some 2014 IPO candidates from VentureBeat.

Keep in mind that the new energy IPO business is booming -- if you consider shale gas infrastructure "new energy." SNL Energy notes that almost $6 billion has been raised through midstream gas and merchant generator IPOs year-to-date in 2013. Eight of the ten IPOs in that market segment tracked by SNL were organized as MLPs. Another data point for staying humble is the IPO of Rice Energy -- what is considered a "small exploration and production firm," which was looking to raise as much as $800 million to back drilling in the Utica and Marcellus shale plays.

Tesla and SolarCity notwithstanding, greentech IPOs have lagged and shown weak aftermarket performance. But sentiment in the VC, limited partner, and banker world is improving as more startups in generalist VC funds that touch on cleantech (Climate Corp, Nest, Opower) start to make money and thaw the IPO freeze.

Tesla (TSLA)

- Market cap $18.4 billion

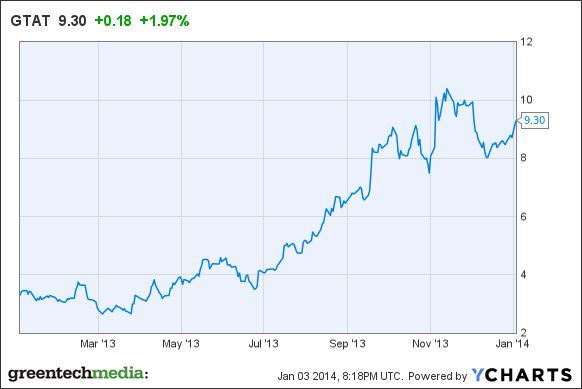

GT Advanced Technologies (GTAT)

- Market cap $1.21 billion

Enphase (ENPH)

- Market cap $285 million

SolarCity (SCTY)

- Market cap $4.96 billion

Silver Spring (SSNI)

- Market cap $977 million

EnerNOC (ENOC)

- Market cap $468.9 million

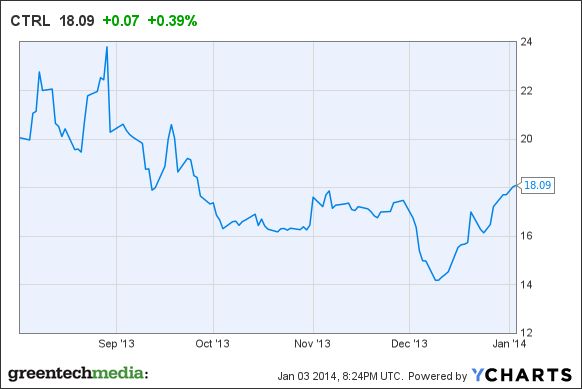

Control4 (CTRL)

- Market cap $410.3 million

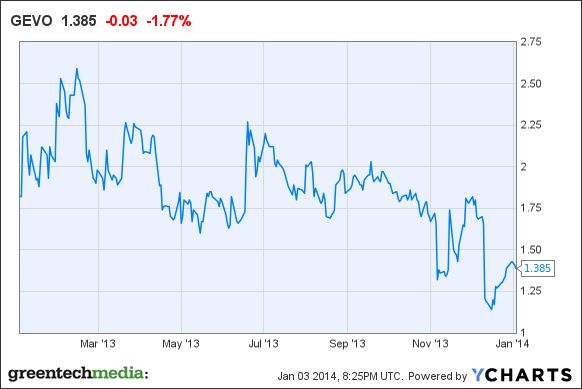

Gevo

- Market cap $65 million

Solazyme

- Market cap $762.6 million

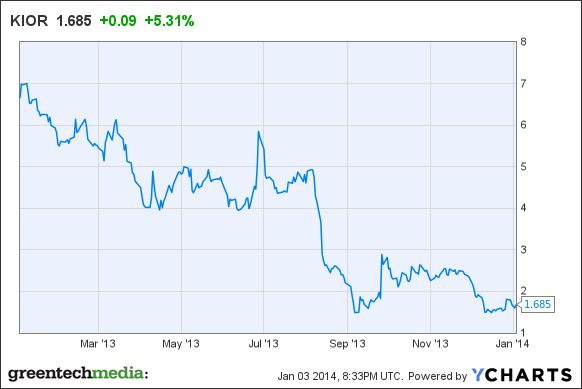

KiOR

- Market cap $176.1 million