Los Angeles, California -- In his first interview with the American press on this topic, Claus Rubenius, founder and inventor of Denmark's Amplex, spoke to me about his company's massive and audacious plans for a first-of-its-kind energy storage warehouse in Mexico. It's a big deal.

This is a bold plan, and the company will require billions of dollars, hundreds of acres of land, the alignment of regulatory stars and not a little bit of luck to pull this off.

But if it becomes reality, it could make fundamental changes in the way renewable energy (and conventional energy) is generated, transmitted and valued.

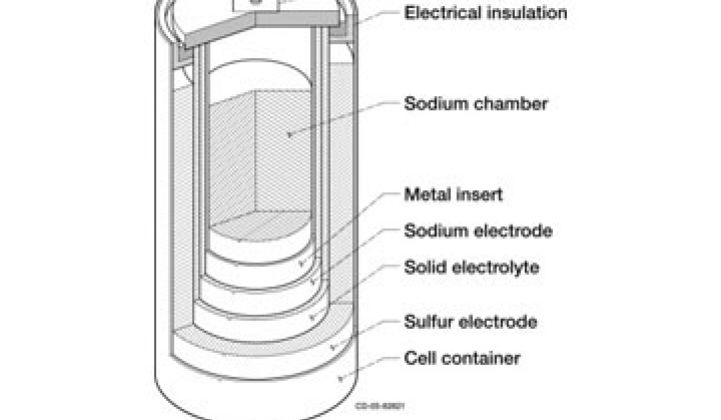

Rubenius refers to the concept as an "energy warehouse" and the plan is to use 1,000 megawatts of sodium sulfur (NaS) batteries funded with the help of Japan's Export/Import bank.

Rubenius has already purchased the 350 acres of land in Baja California, Mexico and looks to install one fat gigawatt of NaS batteries at a fully commissioned cost of over $4 billion. Rubenius looks to offer the storage space to energy companies and utilities in both the U.S. and Mexico.

The site chosen is Silicon Border’s Science Park -- developed for manufacturing high technology products in Mexicali, Mexico. The location was chosen because of its existing infrastructure and close proximity to both the Baja California power grid and the U.S. grid, including the new Sunrise Power Grid expansion. In the United Arab Emirates (U.A.E.), the Amplex Group (a RUBENIUS subsidiary) has installed and commissioned the largest energy storage system in the world. The Baja California operation hopes to create more than 200 direct green jobs and 800 indirect green jobs in the region.

Interestingly, U.S. wind and solar developers are also eyeing plans to build power plants in Mexico for California.

I spoke with Claus Rubenius this morning and these are some of the questions that came up:

- Are U.S. utilities and energy producers equipped with the regulatory framework to allow this this type of energy storage option?

- Are the transmission lines robust enough to transport this volume of power?

- Where is Rubenius going to get one gigawatt of NaS batteries?

- How much is energy storage really worth?

Transmission is already in place and one of the reasons that site was chosen.

"We believe centralized storage makes sense for mega-regions," according to the CEO. There are around 40 mega-regions in the world. So we're not talking about ancillary services in this instance but massive storage capacity for hundreds of megawatt-hours.

If you follow the energy storage industry, you know that NaS batteries are bankable and that they work. You also might know that Japan's NGK is the world's only volume producer of the product (originally, the technology came from Ford of the United States). And you might also know that NGK is sold out.

Who is buying all that capacity? That's right: Amplex and Rubenius, which have a deal to take NGK's entire production capacity for the next six to ten years. If you're in the market for NaS batteries, you'll have to find another source. Mr. Rubenius sees this battery technology as the only proven choice at the moment. According to the CEO, NGK has spent 20 years making the technology viable. One of the stipulations of the project is that NGK will locate some manufacturing at the storage site itself.

Mr. Rubenius cited California's recent passage of an energy storage bill as an indication that the regulatory framework is moving towards a storage solution.

Mexico's President Calderon gave his support for the project.

“This is the kind of collaboration we should be doing more of with Mexico, the United States, and private businesses from around the world. Our two countries offer the largest markets and workers who are second to none. With our efforts to accelerate the use of alternative energy it is an area of tremendous focus,” said President Calderon in a prepared statement.

Grid power storage has the potential for utilities and large power generators to optimize their networks by generating power during off-peak periods and storing it for use during times of peak load. That's the theory, at least.

Energy storage at the utility-scale can serve different needs, including:

- Grid stabilization

- Frequency regulation

- Voltage support

- Power quality

- Load shifting

- Energy arbitrage

The firm claims, arguably, that energy storage is the "only near-term solution for the intermittent nature of most renewable energy sources. When intermittent power sources [e.g., wind power] reach high levels of penetration, energy storage provides the critical buffer to the power grid."

Other parties in the wind industry and elsewhere believe that the grid can handle the intermittent nature of renewables with only minimal help from energy storage.

In any case, the Rubenius plan has the potential to solidify renewables' place in the energy mix and create innovative new business models for utilities as well as entrepreneurs.