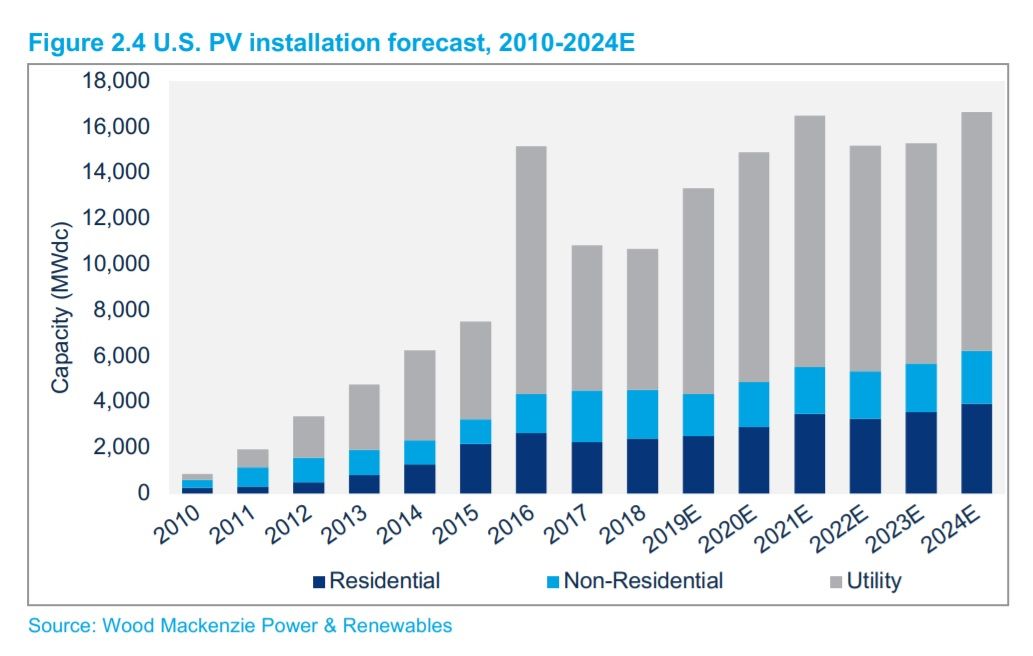

Unexpectedly rapid growth in solar markets like Florida and Texas is driving up expectations for U.S. solar installations, with Wood Mackenzie Power & Renewables now forecasting more than 13 gigawatts of capacity additions in 2019.

That sets the U.S. solar market up for 25 percent growth compared to last year's 10.6 gigawatts, in what would be its second biggest year of all time, according to the latest U.S. Solar Market Insight Report from Wood Mackenzie and the Solar Energy Industries Association (SEIA).

Since last quarter, announced solar procurements and shifts in the market have led WoodMac to increase its forecast for 2019 utility-scale installations by 1.2 gigawatts, and by 5.1 gigawatts for the 2019-24 period.

Texas accounts for much of the increased forecast for this year, while Florida has driven the five-year boost thanks to ambitious solar growth plans at utilities including NextEra Energy's Florida Power & Light and Duke Energy Florida. Last month Florida Power & Light announced the start of construction on 10 new solar plants totaling more than 700 megawatts, as the economics of solar in the Sunshine State look increasingly favorable against gas-fired generation.

The U.S. solar market pulled back sharply after its peak year in 2016, but it’s climbing rapidly once again as costs fall and developers move to take advantage of the investment tax credit’s (ITC) phasedown.

Over a longer time horizon, solar is expected to benefit from its increasing competitiveness against wind energy in a growing number of central U.S. states where wind has long been the dominant source of new renewables capacity. The wind industry's production tax credit is phasing down more rapidly than solar's ITC, and unlike the PTC, which is on its way to zero, the ITC is scheduled to stop phasing down indefinitely at 10 percent for commercially owned projects.

By the mid-2020s, WoodMac expects utility-scale solar to be cheaper than wind on a levelized cost basis in a number of states within grids operated by the Midcontinent Independent System Operator and the Southwest Power Pool — including Illinois, Iowa, Kansas, Michigan and the Dakotas.

“Solar’s growth is increasing everywhere, including traditional solar states — but also pretty rapidly in less traditional solar states,” Colin Smith, senior solar analyst at WoodMac, said in an interview.

Total installed solar capacity is expected to more than double over the coming five-year boom period, cresting at 16.4 gigawatts in 2021 as the ITC phases down, WoodMac predicts. Solar developers are in the process of finalizing their strategies for maximizing the ITC, as wind developers did several years ago for the PTC.

Other highlights from the report include:

- The U.S. installed 2.7 gigawatts of new solar capacity during the first three months of the year, making it the market’s largest first quarter to date.

- Solar accounted for 51 percent of all new U.S. power generating capacity during the first quarter, an unusually high share. Analysts say that elevated level will not necessarily hold steady throughout the remainder of the year.

- During the first quarter, the U.S. installed its 2 millionth solar panel — just three years after crossing the 1-million-panel milestone.

- PV system prices are at historic lows across the various market segments, despite the Trump administration’s tariffs on imported equipment. Last week the U.S. granted another round of tariff exemptions that includes bifacial modules, which are expected to play a larger role in the market in the years ahead.

While utility-scale projects remain the market’s primary driver, accounting for 61 percent of U.S. solar installations in the first quarter, the residential market continues its rebound. The residential market crumpled in 2017 after one-time national leader SolarCity (now Tesla) fell on hard times and reined in its aggressive growth strategy, but the market has since stabilized — installing 603 megawatts during Q1, up 6 percent year on year.

Weak growth in former powerhouse residential markets like California and the Northeast is being offset by strength in a number of “emerging” state markets, including Florida and Texas. Nearly one-third of new residential capacity during the first quarter came from markets outside the top 10 in cumulative capacity, the highest share ever.

WoodMac forecasts growth in the residential market of 5 to 20 percent during the 2019-21 period, pointing to new drivers like Maryland’s renewable portfolio standard increase, the removal of South Carolina’s net metering cap, and Illinois’ Adjustable Block Program. And California’s home solar mandate will begin fueling the market there beginning in 2020.

In contrast to the growing utility and residential markets, non-residential installations continue to struggle, with 438 megawatts put in place during the first quarter, down 18 percent from last year. But WoodMac expects the non-residential market to see a modest rebound over the next few years as community solar programs takes off in states like New York, Maryland and New Jersey.

***

For more insight, the free executive summary from WoodMac and SEIA is available here.