Last week, the Fort Calhoun nuclear power plant in Nebraska became the fifth nuclear power station to shut down in the last five years.

Fort Calhoun was the smallest nuclear plant in the U.S., with less than 500 megawatts. The generation from Fort Calhoun will likely be replaced by wind and natural gas, according to data from the U.S. Energy Information Administration. However, Nebraska is a coal-heavy state, and like some other states with recently shuttered nuclear plants, coal could also fill some of the energy void.

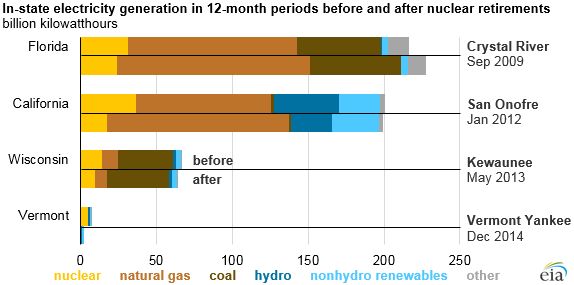

Low-cost renewables and natural gas are putting some nuclear plants out of business, but it is the latter that is most often replacing the offline nuclear capacity. Wind, solar and energy efficiency do play a role in making up for the lost nuclear power generation, but EIA data shows it is natural gas, and in some cases coal, that is largely making up the difference.

The closure of Vermont Yankee was perhaps the exception, with additional generation coming from electricity imports in Canada, which is primarily hydro. California has called for the San Onofre Nuclear Generating Station to be replaced in part by a mix of renewable energy, efficiency measures, demand response and energy storage. Although the utilities are investing in batteries, demand response and renewables, most of the replacement capacity in the year after the closure consisted of natural gas.

The decision on what can replace nuclear is a precarious issue in some states. In New York, for instance, the governor has mandated that upstate nuclear plants stay open using new subsidies to help the state meet its goal of 50 percent electricity by 2030, while at the same time calling for the downstate Indian Point nuclear power plant to close. The deal for subsidies for nuclear in upstate New York is now the subject of a lawsuit.

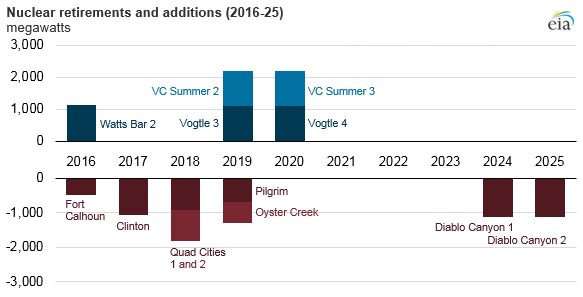

There are a handful of other nuclear plants that will retire in the next two years, including three of Exelon’s in Illinois and Massachusetts and Entergy’s Oyster Creek plant in New Jersey.

There are also a few new nuclear plants coming on-line in the U.S., most with significant budget and timeline overruns. Watts Bar 2, which began operation earlier this month, came on-line more than 40 years after construction began. Georgia Power’s Vogtle expansion is facing about $1.7 billion in cost overruns.

Although there is more new nuclear coming on-line in the U.S. in the next few years than there has been in the past two decades, there is still a very limited role for new nuclear in most parts of the world.

“The static, top-heavy, monstrously expensive world of nuclear power has less and less to deploy against today’s increasingly agile, dynamic, cost-effective alternatives,” Jonathon Porritt, co-founder of the Forum for the Future and former chairman of the U.K. Sustainable Development Commission, wrote in the forward to the World Nuclear Industry Status Report 2015.

Although fossil fuel generation is still largely replacing retired nuclear capacity in the short term in the U.S., the 2015 World Nuclear Industry Status Report suggests that clean, renewable energy could ultimately be the replacement fuel.

Even in regions where nuclear is a priority, renewables are still seeing far greater investment. China, for example, leads the world in new nuclear builds and spent about $9 billion in 2014 on the technology, but invested more than $83 billion on wind and solar in the same year.