Last week, a tiny, self-funded University of Maryland spinout called Redox Power Systems unveiled a fuel cell technology that could, if it works as promised, pretty much break the mold for the industry.

Redox’s promised fuel cell, dubbed "The Cube," is a refrigerator-sized solid-oxide fuel cell (SOFC) in the same general class of fuel cell being made by Bloom Energy, the Silicon Valley startup with Fortune 500 customers and nearly $1 billion in venture capital. Bloom’s Energy Server costs an estimated $10,000 per kilowatt, in terms of the capital costs for the stacks of cells that convert fuel -- in this case, natural gas -- into electricity.

Redox, on the other hand, applies several materials science techniques to build fuel cells that run at much lower temperatures, and with much greater conductivity and power density, than the SOFC competition. That, in turn, could lead to fuel cells that are expected to cost about $1,500 per kilowatt at low production scales, and as little as $800 per kilowatt at volume production, CEO Warren Citrin said in a Tuesday interview. That’s less than one-tenth the cost per kilowatt of Bloom’s fuel cells.

To get there, the Fulton, Md.-based company has raised less than $5 million dollars to date, he said, though that figure doesn’t include the funding and work put into the research and designs of Eric Wachsman, the scientist whose 25 years of fuel cell research underlies Redox’s patented technology. The company, founded last year, is entirely owned by the five investors that make up its board of directors, aside from the shares it has given to the University of Maryland to secure its rights to the underlying intellectual property, he said.

Now, all Redox needs to do is make good on its promises -- something that has been a problem for a long list of fuel cell companies. As Greentech Media’s Eric Wesoff is fond of noting, the list of profitable fuel cell companies now stands at zero, Bloom included. What's more, the industry is littered with failed companies, whether they're startups and spinouts promising fabulous advances that have failed to materialize, or full-blown commercial scale companies that haven't been able to make it.

Redox still has a long way to go on that front. In fact, it hasn't even built its first Cube yet -- the devices that have appeared on spec sheets and in photographs given out by the company are mock-ups, not working fuel cells. But by December, Redox plans to turn on its first prototype 25-kilowatt working SOFC, Citrin said.

“That’s what we’re doing instead of a PowerPoint presentation," he said. "We’re going to actually show the machine, and overcome all the skeptics.” From there, Redox plans to expand its existing relationships with U.S.-based manufacturing partners to be ready to start setting up production lines by the end of this year. At that point, it will need to seek more funding to set up its own assembly and testing facility, with an eye on being ready to start mass production at some point in late 2014, he said.

One key problem he and his partners have faced in presenting Redox’s technology to potential investors and partners has been the poor track record of fuel cell companies, he noted. Redox may have thoroughly documented the science behind its groundbreaking claims, but turning that science into functioning, mass-producible fuel cells will be its next challenge.

Building the cube: A primer in radical fuel cell cost reduction

Wachsman, director of the University of Maryland’s Energy Research Center and Redox’s director and science advisor, told me Tuesday that the concepts behind the Cube stretch back to the 1980s. Over the past 25 years, “with little bits of money here and there, I’ve been able to develop the electrolyte, demonstrate that it works, and patent it,” and then build up the engineering and materials science expertise to prepare it for its real-world debut, he said.

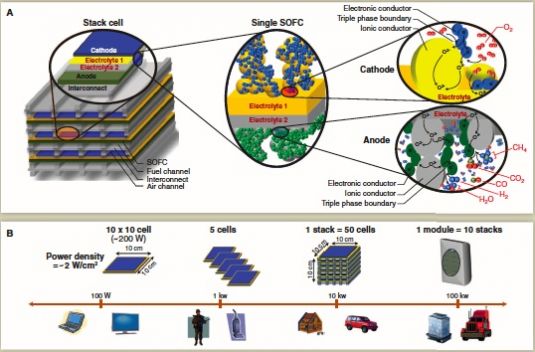

That science, described in a 2011 paper written by Wachsman and colleague Kang Taek Lee (PDF), is centered around the use of a novel “ceria/bismuth-oxide bilayered electrolyte,” a combination of rare earth materials that makes up one of many such mixes that fuel cell developers have tested over the years. The goal is to find the combination that can support high conductivity and power density while lowering the super-high temperatures at which SOFCs operate, he said.

As the 2011 paper notes, “the vast majority of SOFCs use a zirconia-based electrolyte, typically yttria-stabilized zirconia (YSZ), because of its superior stability. Although a good oxygen-ion conductor, it is far from having the highest conductivity.” Bloom, on the other hand, uses a zirconia-based electrolyte, but with scandium oxide as the stabilizing agent, which yields a higher cost, but greater conductivity, cell.

Redox uses "aliovalent-doped ceria and isovalent-cation-stabilized bismuth oxides in the electrolyte," which allows it to accomplish a few different things, Wachsman said in Tuesday’s interview. First, it allows for a much higher conductivity -- about ten to 100 times more than many other SOFC materials can yield, he said.

Secondly, it allows it to move from an “electrolyte-supported cell” structure, which Bloom uses, to the “electrode-supported cell” structure taken up by Redox and other SOFC developers today. That’s important, because electrode-supported cells, also known as anode-supported cells, can be created using deposition processes that yield a much thinner cell than electrolyte-supported cells, he said.

Thinness accomplishes two things, according to Wachsman. First, the thinner the electrolyte, the greater the power density of the cell. Redox is achieving power densities of about 2 watts per square centimeter, as compared to about 0.2 watts per square centimeter for Bloom’s cells, or about 0.5 watts per square centimeter for other fuel cells being developed to run at lower temperatures, he said.

Secondly, thinner electrolytes allow for much lower operating temperatures, he said. That’s important because the higher the temperatures, the more complex the engineering, and the more expensive the materials that go into the device.

Most SOFC makers, including Bloom, are operating at about 900 degrees Celsius, he said. The Department of Energy has set a goal to bring SOFC operating temperatures below 800 degrees Celsius, but Redox is able to bring those temperatures down to about 550 degrees or so.

That’s still hot enough to allow flexibility in fuel types that can be used, he noted. Redox is now working on natural gas-fueled cells, the same fuel that Bloom now uses, but plans to incorporate propane, gasoline, biofuel and hydrogen as fuels as well.

At the same time, Redox’s lower temperatures allow for “flexibility in balance of plant,” or what goes into the remaining portions of a complete fuel cell, such as electronics, “and we also have the ability to start up much more rapidly,” he said. In other words, the lower the temperatures that need to be reached to get the fuel cell going, the faster the fuel cells can fire up to full capacity.

In fact, Redox believes that its approach can support SOFC designs that, unlike almost all those out there today, can run efficiently and cost-effectively at rates other than full-blast, Citrin said.

“You’d like to be able to cycle these devices,” he said. “But in order to do that, one of the key breakthroughs that Eric has made (which will be in our next generation of cells released next year) will be a be new anode that doesn't contain nickel,” he added.

By substituting ceramic materials for nickel, which breaks down into nickel oxide and degrades the integrity of the cells, “within certain bounds, you can throttle this fuel cell, you can load-follow,” and in other words, perform a whole series of power-balancing tasks that just aren’t practical for fuel cells today, he said.

The path to mass manufacturing and new markets

Redox’s first 25-kilowatt units, which won’t have this ramping capacity, are being built to supply backup power plus baseload power, Citrin said. They’re designed to fill the constant power needs of buildings at a price that can compete with grid power, while also providing always-on power at times when the electricity is knocked out, but natural gas lines remain intact -- such as during and after grid-disabling weather events like Hurricane Sandy.

“The other alternative is to create power, and then in states where you have net metering, you can sell the excess back out onto the grid,” he said. “I really believe that these cell breakthroughs we have made are so significant [that] the competition is going to be generators and the grid.”

Redox has been working with its partners on the manufacturing processes, such as sintering, casting and laminating of the cells, that would allow the company to move from lab-scale production to commercial-scale production, he said. “The process for doing that is very complex,” with careful attention to eliminating impurities, ensuring that the combination of cell materials and laminates are all properly heated at specific series of temperatures to prevent curling and improper contraction, and the like. “Doing that at large scale ended up being quite a challenge.”

As for potential markets, they could range from always-on building power, to powering remote cell phone towers and military outposts, and even automotive applications, he said. Companies that have approached Redox with interest in its technology include defense contractor Raytheon, Baltimore construction firm Whiting-Turner and Bay Area-based Clark Construction Group, he said.

Citrin and fellow Redox board members David Buscher and Robert Thurber were partners in radar technology company Solipsys, which was acquired by Raytheon in 2003. They then launched a string of other companies, before meeting Wachsman and fellow Redox Director and research colleague Bryan Blackburn last year at the Maryland Technology Enterprise Institute’s VentureAccelerator program.

While Citrin wouldn’t reveal how much money Redox needs to raise to bring its manufacturing and commercialization plans to fruition, "our desire is to always seek funds that are non-diluting,” he said. “We have a matrix of what we’d need to seek in terms of funding, depending on what markets make sense, and how we form these relationships with various markets.”

“If I had $10 million today, would I be able to push this forward? Absolutely,” Citrin said. “But we don't plan to go seeking hundreds of millions of dollars in equity.”

If Redox can indeed produce its fuel cells at anything close to the cost and performance figures it’s claiming, that feat alone would represent a breakthrough in the industry. Doing it on a relative shoestring, funding-wise, and without tapping multiple sources of incentives to make them cost-competitive, might even put it in contention for actually making fuel cells a technology, not of the future, but of today.