Grid operators around the world are unusually busy these days, but few have quite as much on their minds as NYISO, the independent system operator that manages New York state's bulk power system and wholesale energy market.

New York state’s zero-carbon energy goals will require new transmission to carry upstate wind and hydro to downstate markets, plus a wave of new batteries and other balancing agents to balance the state's increasingly intermittent renewable mix. The state is pushing to electrify its vehicles and buildings and will roll out a carbon-pricing regime to encourage development of clean resources where they're most valuable.

NYISO’s Power Trends 2020 report released Wednesday highlights the challenges and opportunities for a grid in flux.

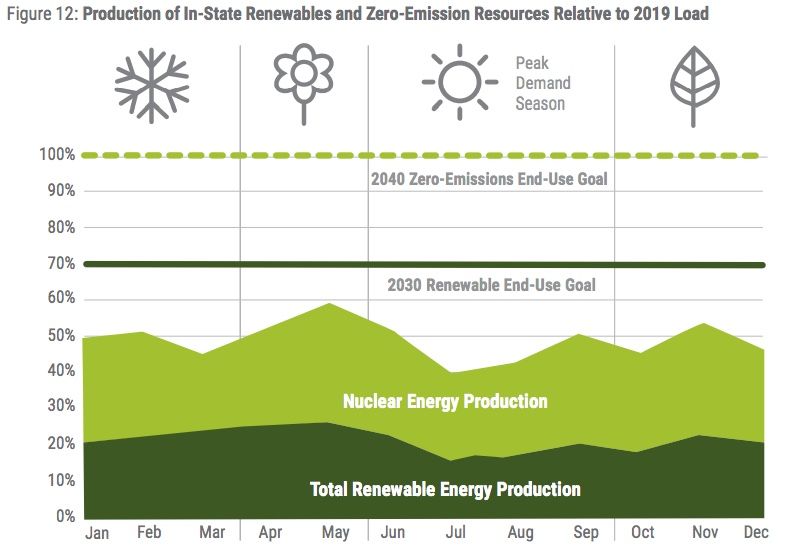

Last year’s Climate Leadership and Community Protection Act (CLCPA) calls for getting 70 percent of the state’s electricity from renewables by 2030, up from 26.8 percent in 2018, and hitting 100 percent zero-carbon emissions by 2040. That leaves a massive gap to be filled by clean energy, since more than half of the state’s carbon-free emissions today come from nuclear power, as shown in the chart below.

Source: NYISO

To fill this gap, NYISO is working toward growing transmission capacity for its ample upstate hydropower and wind power resources to reach New York City and downstate population centers, which will also be served by the 9 gigawatts of offshore wind the state is seeking by 2035. Solar power will play an increasingly important role, including both utility-scale and behind-the-meter solar, which is set to grow from about 2 gigawatts today to 6 gigawatts by 2025 under the CLCPA.

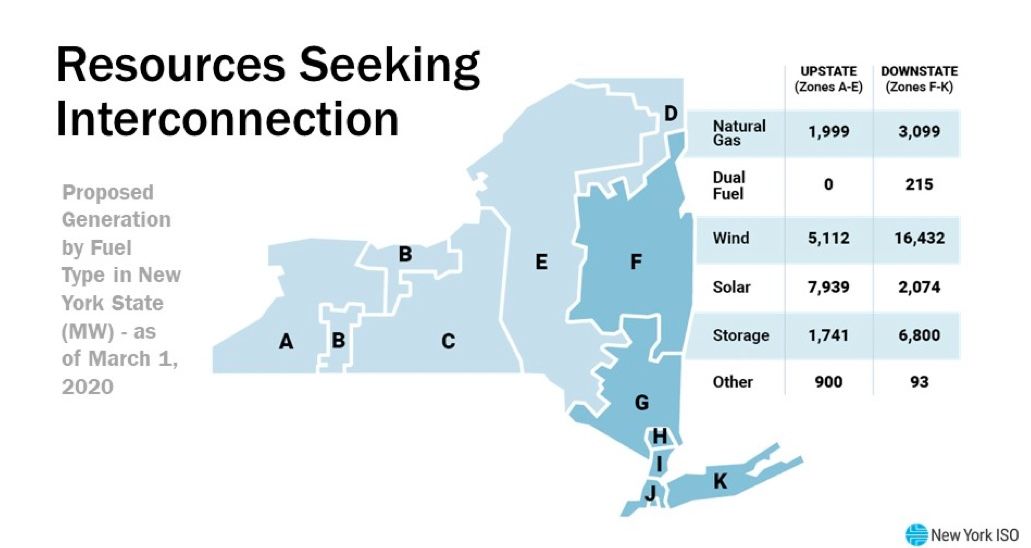

But the amount of energy generated by intermittent wind and solar doesn’t equate to capacity during times of peak demand, which NYISO is responsible for securing across the state. New York’s mandate for 3 gigawatts of energy storage by 2030 will play a vital role in storing and discharging wind and solar energy to match demand, much of it targeted for downstate, according to the following snapshot of interconnection requests.

Source: NYISO

“We look at this as a grid in transition,” NYISO CEO Rich Dewey said in a Wednesday press conference. “We’re looking not only at how we maintain reliability of the system as the grid radically changes, but how we provide the right investment signals” to match resources to where they’re needed most.

NYISO’s carbon-pricing plan, which still requires approval by state regulators and the Federal Energy Regulatory Commission, is, according to Dewey, “the most effective way to do that as quickly...and as cost-effectively as possible." Adding a yet-to-be-determined societal cost-of-carbon price into every energy market transaction “will lead to more rapid deployment of more carbon-free resources, and with the location signal that’s so valuable” to encourage development “not only when we need them, but where we need them.”

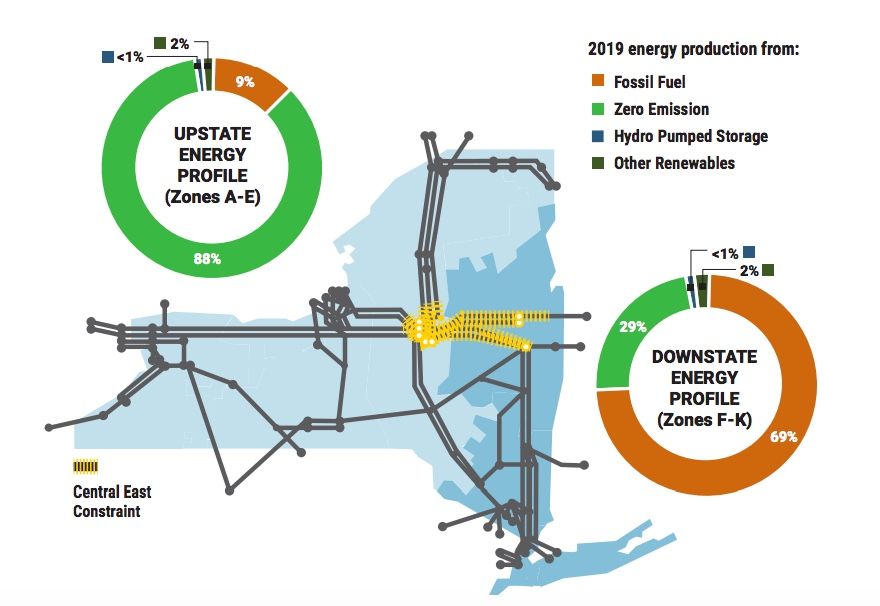

That’s particularly valuable for encouraging renewables, energy storage, demand response and energy efficiency that can serve to replace the fossil fuels that supply the majority of energy and capacity for downstate New York. Only 29 percent of downstate’s resources are zero-carbon, and most of that comes from nuclear power plants, including the Indian Point reactors that are set to close in the coming years.

Source: NYISO

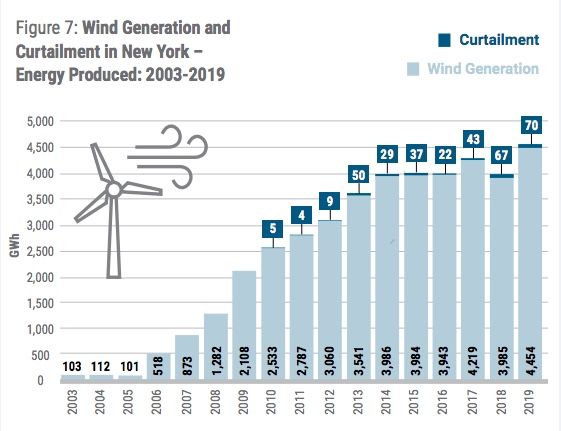

Upstate New York, by contrast, already gets 88 percent of its electricity from zero-carbon resources, mostly hydropower but also significant amounts of onshore wind power. NYISO has been pushing for increased transmission to carry upstate clean energy to New York City and the surrounding area to capture the lower cost of rural-sited renewable projects and reduce curtailment of wind power for lack of available transmission capacity, which has been growing in recent years, as the following chart shows.

Source: NYISO

“We think that’s going to continue to be a bigger and bigger problem…unless we upgrade the transmission infrastructure,” Dewey said.

“Certainly the AC transmission project that’s going through siting right now will help a great deal,” adding about 1 gigawatt of capacity between the two regions if it’s able to receive final siting approvals and be completed on schedule by 2023.

Larger-scale transmission projects aimed at carrying Canadian hydropower and wind power downstate, such as the $2.2 billion Champlain Hudson Power Express project, are far less certain but could also prove valuable, he said.

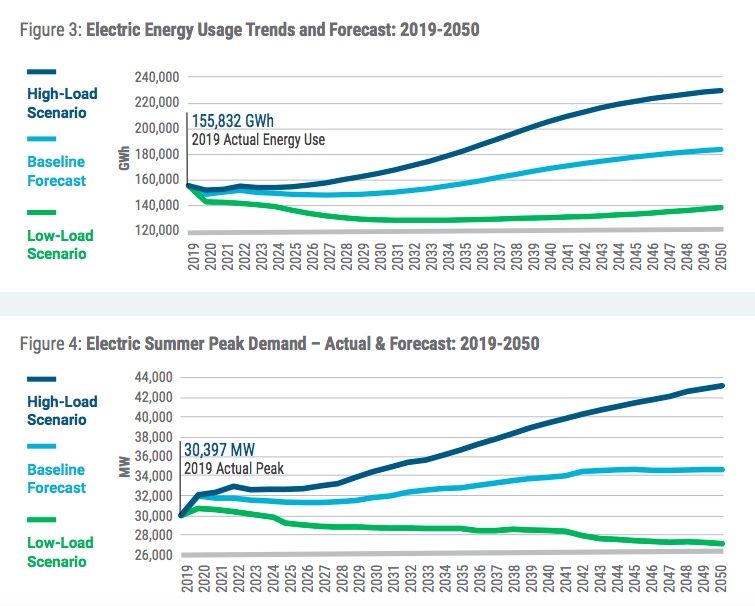

The COVID-19 pandemic has lowered commercial and industrial energy demand this year and led NYISO to revise its 2020 and 2021 energy consumption forecasts downward. But in the longer term, demand is expected to grow significantly as New York seeks to shift transportation and building heating from fossil fuels to electricity.

Just how much that demand will grow depends greatly on how electric vehicle charging is managed, NYISO Executive Vice President Emilie Nelson said on Wednesday’s call. “The time [at which] those vehicles are charged will impact both the peak times on our system and the total load on the system,” as the divergent forecasts of load through 2050 indicate, as shown in the following figures.

Other factors influencing these forecasts include how much energy efficiency the state is able to achieve, how quickly building electrification takes hold, and how much behind-the-meter solar comes online over the decades to come.

These forms of distributed energy resources aren’t a traditional focus for grid operators including NYISO, Dewey said. But, he added, “we need to look into the future and model what this system is going to look like 20, 30, 40 years in the future."