Sunrun has firmly secured its leadership position in the U.S. residential solar market. But that wasn’t enough to impress the stock market following the company’s second-quarter earnings call.

Last quarter, Sunrun logged the largest quarterly installation volume in the company’s history. With 91 megawatts deployed serving more than 12,000 customers, Sunrun beat guidance and achieved 20 percent year-over-year growth.

The company reaffirmed its full-year guidance of 15 percent growth in deployments, and it expects to deploy 100 megawatts in the next quarter.

Revenues for Q2 grew to $170.5 million, coming in ahead of the consensus estimate of $167.7 million and up from $130.6 million a year ago. Sunrun also continued to be cash flow positive, ending the second quarter with $270 million in total cash, up $27 million from the previous quarter.

The creation cost per watt was $3.12 in the second quarter, compared to $3.37 a year ago, showing an improvement of 7 percent year-over-year. Sunrun has had higher creation costs than its competitors in the past, but recent performance shows the company is coming more in line with the industry.

The problem for stockholders was earnings. Sunrun reported a second-quarter profit of $7.4 million or $0.06 per share, which is down from $18.3 million or $0.17 per share last year. Analysts polled by Thomson Reuters were expecting earnings of $0.28 per share for the quarter.

In response, Sunrun’s stock dropped 13 percent in after-hours trading on Thursday. The stock was down 17 percent on Friday morning, and down 12 percent at the time of publication.

“This goes to what we’ve been saying about these big companies for a while — just because they’re growing and taking market share doesn’t necessarily mean they’re profitable or doing well by investors,” said Allison Mond, solar analyst at GTM Research. “Sunrun is still turning a profit, but this is an example of a quarter where they’re growing in terms of megawatts and market share, but because they’ve had to spend money to achieve that growth, it’s had an effect on their profits.”

For instance, the install costs for solar systems built by Sunrun were $1.95 per watt last quarter, reflecting a 4 percent year-over-year increase. Sunrun attributed that to deploying a higher mix of batteries.

While Sunrun's investors wanted higher returns, by most other market measures, “it seems like they’re doing well,” said Mond. “The only threat to them right now is that Vivint did pretty well this quarter too.”

Confidence in growth acceleration

There’s more to Sunrun’s story for the second quarter than profits, and those factors are “increasing our confidence for growth acceleration and continued market leadership,” CEO Lynn Jurich said on yesterday’s earnings call.

One of the sunny spots is that Sunrun’s direct solar installation business grew by more than 40 percent year-over-year in the second quarter, which co-founder and Executive Chairman Ed Fenster attributed to investments in improving the customer experience. The company now has more than 200,000 customers in 23 states, plus Washington, D.C. and Puerto Rico.

“Utilities are generally not loved by their customers, and so the market is wide open for Sunrun to become America’s most loved energy company,” Fenster said, in an interview. “The investments we have and are making specifically in customer experience and the customer onboarding process are really beginning to bear fruit.”

That’s evidenced by the growth Sunrun saw in its direct business, where leadership has the most control, he added. Sunrun also continues to operate its channel partner business.

Sunrun leveraged its channel network to enter the market in Puerto Rico last quarter, where it’s delivering solar-plus-storage to customers. In June, Sunrun officially launched operations in Florida after winning regulatory approval to sell third-party-owned solar in the state in April. The solar company also expanded further in Nevada, as the market continues to rebound from major policy shifts.

As for longer-term growth, Fenster argued that there are several reasons to be optimistic about Sunrun's prospects. For one thing, the company is in a good position to accommodate the step-downs in the federal Investment Tax Credit (ITC).

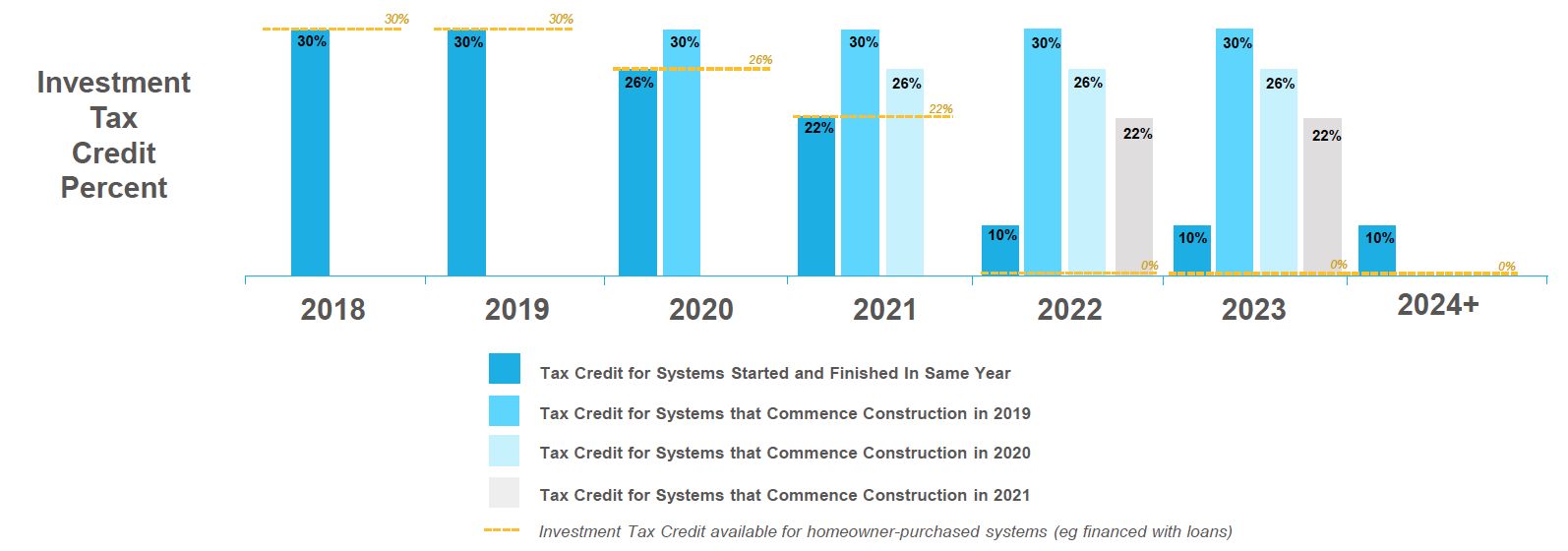

Based on the Internal Revenue Service’s recently updated guidance, by incurring at least 5 percent of project costs in advance, a company can delay the step-downs in the ITC. “In the most extreme example, by making a large advance purchase in December 2019, we can continue to claim a 30 percent ITC through December 2023, rather than have it phase down to 26 percent in 2020, 22 percent in 2021 and 10 percent in 2022,” Fenster said on the earnings call.

The guidance also specified that commercially owned (leased) residential solar systems will continue to qualify for the 10 percent tax incentive in 2024 and beyond. Customer-owned residential solar systems will eventually see the tax credit eliminated, however, which creates an advantage for leased solar systems over loans going forward. It was previously unclear how these projects would be treated.

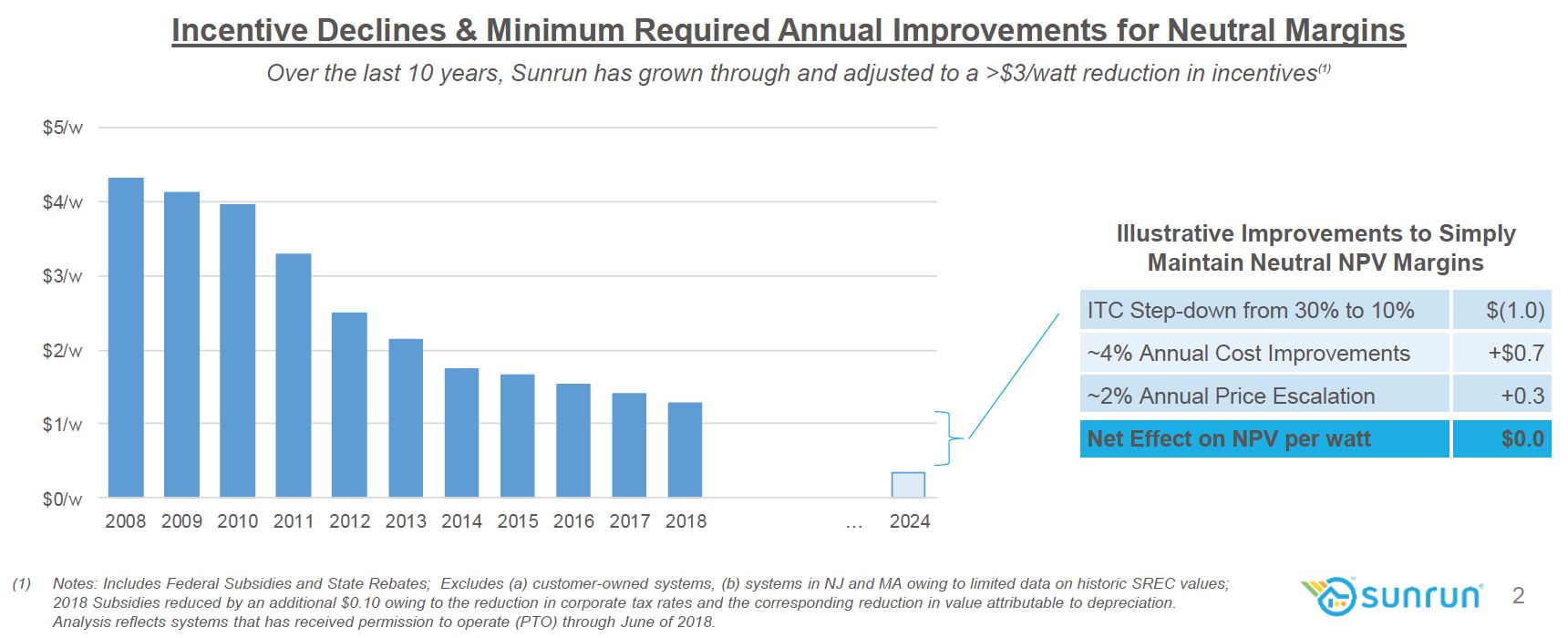

Based on that guidance, if Sunrun maintained its current margins, there would only need to be a 2 percent increase in residential utility rates and a 4 percent solar cost reduction between now and 2024 for the company to remain cost-competitive.

Fenster argued that that’s a conservative outlook. Over the last three years, Sunrun achieved 9 percent in cost reductions. At the same time, utility rates have typically increased by more than 3 percent per year. According to a study conducted by PA Consulting on behalf of Sunrun, customer rates are expected to grow by 3.6 percent annually over the next 10 years, based on an analysis of utility capex spending, wholesale market prices, transmission and distribution costs, and other factors.

“We have a plan to exceed the cost reductions necessary to maintain margins, and we expect 2024 will look better than 2018,” said Fenster.

He also pointed out that residential solar makes up less than 2 percent of all residential kilowatt-hours of electricity sold in the U.S “And that’s just the electricity market,” he said. “With the continued reduction in equipment prices, we’ll also be coming for natural gas and oil.”

Gas and oil are already starting to lose their grip on home heating as electrification emerges as a cleaner and potentially more affordable option. California’s recently approved solar roof mandate and other state policies will also drive more widespread electrification in homes, where solar, efficiency measures and energy storage will replace the use of fossil fuels.

Sunrun is not a major player in the new-home solar market. In fact, it doesn’t have much of a presence at all, while Vivint has already secured a partnership with a homebuilder. Fenster acknowledged that Sunrun’s installation volumes for new homes are small, but added that the company is now engaged in discussions with half of the top 10 homebuilders in California.

“So stay tuned,” he said.

Recovering from a market slowdown

When it comes to the retrofit side of the business, Fenster pointed out that Sunrun has a strong position relative to its competitors.

“As compared to the rest of the market, we have the broadest range of products, the broadest points of presence (for instance, our direct business, our channel business, Comcast, Costco, Home Depot, etc.), and the leading market share,” he said. “Those are among the reasons I feel confident about our market position.”

Plus, overall demand for residential solar is strong, said Fenster. GTM Research’s latest Solar Market Insight report shows that residential solar capacity additions are forecast to be flat this year, but that’s actually good news following a market downturn.

The downturn was due in part to a major scale-back at Tesla. But mature state markets also cooled and residential solar companies of all sizes had to slow down and restructure amid market changes.

Fenster said that’s all changing. Vivint, SunPower and even Tesla are all projecting growth in the second half of 2018 — although Tesla’s growth trajectory in residential solar has been called into question in light of Elon Musk’s proposal to take the company private.

“When you think about the overall industry growth rate, there were industry participants that had to shrink their businesses to get to profitability, and that’s starting to look like it’s behind us,” said Fenster. “So that headwind on the industry growth rate is going away.”

He also sees leases regaining popularity, now that companies have improved their financial standings. He pointed specifically to Vivint, which reported strong interest in solar leasing after improving its capital structure.

While it’s definitely a boost for leases, Vivint’s new way of accessing capital also amps up the competition with Sunrun, said Mond. “Previously Sunrun was the one standout company that had figured out a way to finance more leases and PPAs without having to use more of their cash to do so. Now Vivint is learning how to do this as well, and it’s threatening to Sunrun.”

Sunrun offers both leases and loans, but leases make up 85-90 percent of its sales. Fenster said he thinks any company that’s able to profitably offer leasing will see similar takeup rates.

Enhancing the customer experience

Besides interest in leases, Sunrun is seeing strong customer interest in residential solar overall, he added. Strong demand prompted the company to shift away from lead generation to enhancing the customer experience. Sunrun is now working to make the installation process easier, friendlier and “as close to Amazon’s one-click approach as we can,” Fenster said. “I think that’s the secret to accelerating growth.”

He added that with rise of energy storage, the value proposition that residential solar companies can offer customers is growing, because they can now offer reliability services, in addition to clean and cheaper electricity. With wildfires raging across California, utilities there are looking at proactively de-energizing the grid to prevent fires from spreading, while utilities on the East Coast are battling strong storms. With this shift, increased reliability has become a focus for customers, Fenster said.

In Sunrun’s direct battery business, takeup rates are now over 60 percent in certain parts of California and well over 20 percent in California overall. The company expects to double its storage deployments in the second half of the year compared to the first.

Grid services, meanwhile, remain a small part of Sunrun’s business. Last quarter, the company announced an expanded partnership with National Grid. The two companies have started to work on a small pilot project in Massachusetts that rewards customers for helping the utility better manage the electric grid.

Sunrun’s grid services business is seeing increased traction, said Fenster, “but it’s a multi-year process to develop that market fully.”