Solar industry stakeholders filed applications with the Office of the U.S. Trade Representative last week seeking exclusions from the Trump administration’s 30 percent tariff on imported solar products.

Requests were due Friday night and a total of 55 comments were ultimately received, according to the USTR docket.

California-based Solaria Corporation, Korea's Hanwha Q Cells and EU ProSun, a group representing 80 percent of European solar cell and module production, were among those to submit requests. Inverter manufacturers Enphase and SolarEdge also filed comments seeking exemptions for their integrated solar module products.

U.S. solar firm SunPower -- one of the companies hardest hit by the trade action -- made its case too. The company specifically requested to have its Copper-Plated IBC Cells and Copper-Plated Modules excluded from the safeguard measures Trump placed on imported crystalline-silicon (CSPV) solar cells and modules.

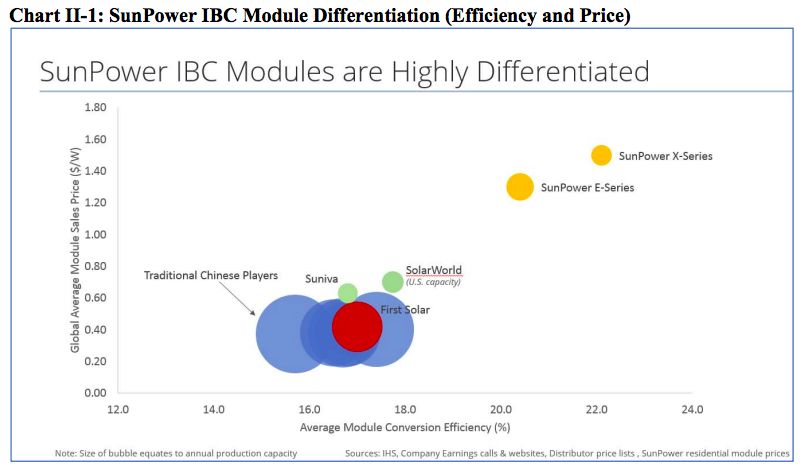

“Copper-plated, interdigitated back contact (IBC) technology is fundamentally different than other solar technologies, whether silicon-based or otherwise,” the filing states.

In the absence of a tariff exclusion, SunPower said it will have to follow through on layoffs and forego investments in U.S.-based solar manufacturing.

"We are a leading innovator that has made significant research and development investments in the U.S. and we have helped to stimulate the American economy with many thousands of jobs and billions of dollars in economic activity,” the filing states. “While the tariffs have contributed to layoffs for SunPower, those job losses would be materially reversed and manufacturing and research and development jobs added, should we receive an exclusion."

"In particular, an exclusion for both our Copper-Plated IBC Cells and Copper-Plated Modules would free SunPower to devote substantial resources that otherwise would be dedicated to satisfying its additional customs duty liability to investments in next-generation research and development in the United States, as well as the establishment of U.S. manufacturing facilities dedicated to SunPower’s P-Series modules, for which an exclusion is not being requested."

"The 201 process motivated us"

SunPower’s decision to establish new module manufacturing operations in the U.S. stems from the recent Section 201 trade case, said CEO Tom Werner.

“We’re always evaluating the state of manufacturing and where to manufacture, and the 201 process motivated us to further evaluate doing P-Series manufacturing in the U.S.,” he said in an interview.

P-Series panels are based on the technology SunPower acquired through Cogenra. The company claims the shingled design eliminates many of the reliability challenges associated with traditional front contact panels, while offering superior power and efficiency.

The U.S. is a well-suited location to manufacture these solar panels “because the equipment we acquired from Cogenra is unique and highly automated and configurable to satisfy local demand in a flexible way,” Werner said.

He added that opening new U.S.-manufacturing facilities -- should SunPower be exempt from the Trump administration’s safeguard measures -- would create jobs “on the order of hundreds.” Likely in the low hundreds, he said, but couldn't commit to a specific number at this point.

Meanwhile, one of the few companies to announce new or expanded U.S.-based manufacturing in the wake of Trump’s tariff decision, Jinko Solar, has dramatically scaled-down its plans. The Chinese company was initially planning to invest $410 million on a solar module assembly and distribution facility in Jacksonville, Florida and create 800 jobs in the process -- which was the most promising employment news to stem from the trade case. Under a new agreement, however, Jinko will invest a total of $50.5 million and create just 200 jobs.

SunPower argues its case

SunPower currently produces most of its solar panels in Asia and Mexico. But the company noted that its copper-plated, IBC technology was conceived and developed in the U.S. and claimed that the patents and manufacturing processes associated with it are considered American assets.

Trade actions disproportionately affect SunPower’s products because its technology comes at a higher price, which stems from higher-cost raw materials and considerably more complex manufacturing procedures. At the same time, because these products have a unique design and distinct features, they’re not directly competitive with conventional CSPV solar products, SunPower argued.

Solar modules made with copper-plated, IBC technology offer superior efficiency, superior durability, better aesthetics and better overall performance, according to SunPower. The technology is also available from only one source, and because of that a safeguard exclusion would be easy to administer.

Another one of SunPower’s key arguments is that granting an exclusion request furthers the objectives of the safeguard measures, while addressing unintended negative consequences. The Section 201 case, like previous U.S. solar trade cases, targeted artificially-low-priced solar products -- based on the conventional solar technology employed by petitioners in those cases -- that were being dumped in the U.S. market in increasing amounts.

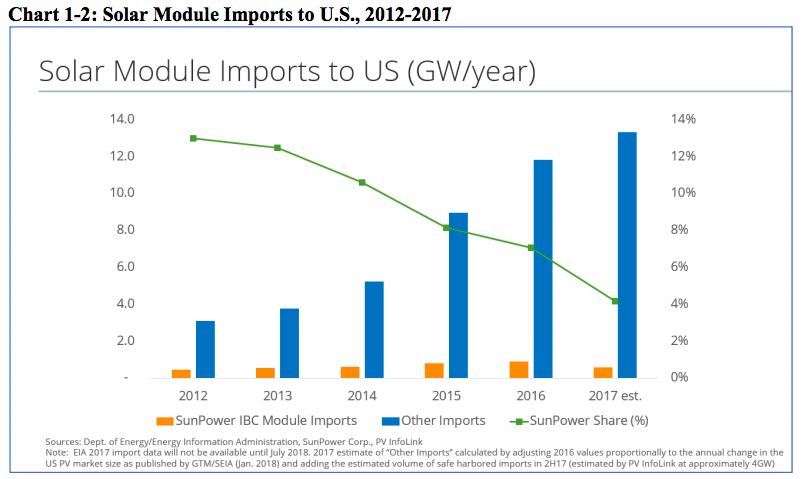

“Solar products based on copper-plated, IBC comprise a small percentage of total solar imports, have not been imported in materially increasing quantities, have not benefited from unfair trade practices, and have struggled to compete against products targeted in past trade actions,” SunPower stated.

Imports of copper-plated IBC products have been limited over the past few years, while imports of front-contact CSPV products surged. If excluded, SunPower IBC modules will continue to comprise a small share of total solar imports and “would not be a material threat to the domestic solar manufacturing industry.”

SunPower requested that exclusions for its products be applied retroactively to February 7, the effective date of the safeguard measures, and that U.S. Customs and Border Protection refund any tariffs paid on SunPower’s copper-plated products as a consequence of the trade action.

A decision on exemptions could come as early as late May, following a 30-day public comment period.

--

Join us for the 11th annual Solar Summit 2018 in San Diego, May 1-2. Powered by the unique blend of research and economic analysis from the GTM Research team, this year's agenda will feature themes from beyond traditional project finance to innovations in solar and the transformation of electricity.