Last month, the U.S. Supreme Court upheld the legality of regulating pollution from coal plants across state lines, providing a stronger case for upcoming carbon pollution standards.

The ruling thrilled environmental advocates looking to shut down more coal plants. And it likely sent another wave of panic and anger through the corner offices of coal-dependent utilities.

In a recent speech, Tony Alexander, the CEO of FirstEnergy, captured how many utility executives feel about upcoming EPA regulations of carbon pollution.

"Electricity is under attack in our country -- and this battle is being waged through largely untested policies that will ultimately impact the reliability and affordability of electric service, and the choices customers now enjoy," he said, speaking to a gathering at the U.S. Chamber of Commerce in April.

Alexander's anxiety is understandable. Coal makes up 56 percent of FirstEnergy's generation portfolio, and the Ohio-based company has already announced the retirement of 10 percent of its generation portfolio, citing EPA regulations.

That's just the start. The U.S. Energy Information Administration estimates that 60,000 megawatts of coal plants will be retired by the end of the decade -- roughly 20 percent of the country's entire coal fleet.

So companies like FirstEnergy that are dependent on coal are about to get decimated, right?

Well, only if they completely ignore the dozens of clean technologies available today that beat the cost of new coal plants.

When the EPA finalizes its carbon rules for coal and natural gas plants this summer, it will create a flexible compliance framework for states depending on their generation mix. It leaves open the possibility for any combination of clean generation, demand-side reductions and onsite pollution controls.

A decade ago, the case for economic alternatives to coal would have been much harder to make. But with so many cost-competitive options available today, there's really no good excuse for avoiding the replacement of aging coal.

In anticipation of upcoming carbon regulations, various organizations have been documenting the dozens of solutions available to fill in the gap left by coal plant closures. Here are some of the top takeaways from those analyses that show why utility executives may not need to be so scared.

Efficiency is cheap and abundant

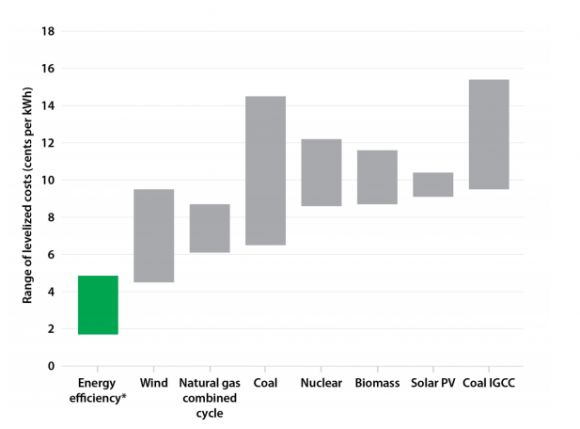

Efficiency beats everything in cost. A recent report from ACEEE concluded that a combination of energy-efficiency targets, improved appliance standards, adoption of new building codes and promotion of combined heat and power in states could bring about a 26 percent drop in carbon emissions by 2030 at "no net cost to the economy," cutting the equivalent of nearly 500 power plants.

There are at least three dozen competitive technologies that can fill in the gap

Advanced Energy Economy is out with a report today detailing 40 technologies that could be used to replace coal. The list is exhaustive, ranging from battery storage to industrial efficiency to anaerobic digestion. It's a powerful reminder of how many technologies are out there today that can compete with new coal facilities.

"States have many years of experience incorporating these technologies and services into the electricity system through policy mechanisms that are well known and understood. In short, these are energy solutions that can be readily mobilized, state by state, to make the U.S. electric power system higher-performing and lower-emitting, while producing economic benefits at the same time," state the authors of the AEE report.

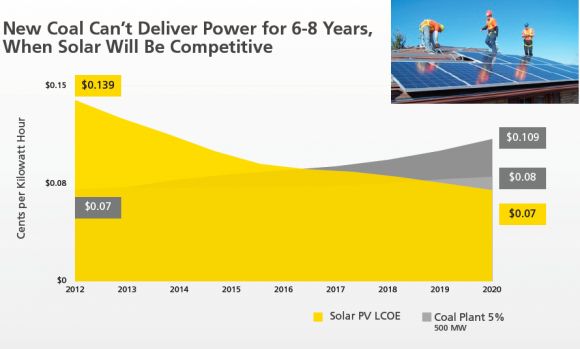

Even solar is becoming cost-competitive with coal. The chart above, taken from a SunPower presentation a few years ago, shows the crossover. In fact, since that chart was published in 2011, power purchase agreements have been signed for 4 to 5 cents per kilowatt-hour -- making select solar projects competitive with existing coal.

And as demand response markets mature, they are already helping utilities address coal plant closures. In PJM territory, gigawatts of coal facilities have already been slated to close. But the grid operator isn't worried, because it has enough demand response and new transmission lines to fill in the gap.

“Even with the retirement of older coal-fired generators, we will have enough existing and new resources in the region to keep the lights on,” said PJM CEO Terry Boston. “Strengthening the grid through PJM’s proven transmission planning process allows all resources to be used effectively, including renewables, demand response and storage.”

Previous predictions about regulation have been way off

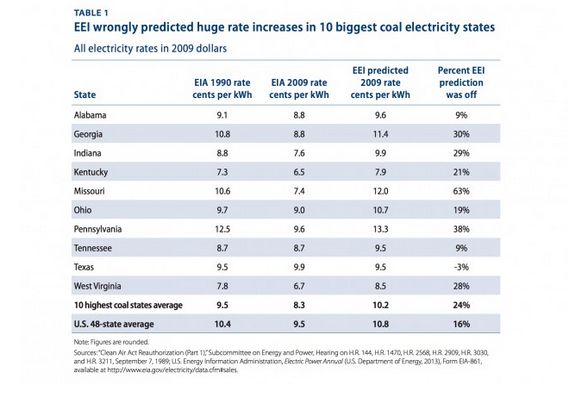

Every time new pollution regulations are proposed in the electricity sector, the power industry claims the rules will drive up energy prices and destroy the economy. But what does history really tell us?

Well, over the last 40 years that the EPA has been regulating industry, ozone, particulates, carbon monoxide, nitrogen oxides, sulfur dioxide and lead have dropped by more than 60 percent. Meanwhile, GDP has grown over 200 percent.

More specifically in the electricity sector, projections for rate increases caused by the Clean Air Act have been far off. In 1989, the Edison Electric Institute (EEI) claimed that new regulations limiting nitrogen oxide and sulfur dioxide would drive rates up by more than 3 percent. As the chart above from an analysis on the impact of EPA regulations shows, electricity prices actually fell in some coal-dependent states -- making EEI projections off by has much as 63 percent in some markets, and 16 percent overall.

The cost of meeting pollution standards is often wildly overstated -- and many believe the same is true for coming carbon regulations.

Many utility executives unable to see a world beyond coal aren't convinced, however. In his speech to the Chamber of Commerce, FirstEnergy's Tony Alexander knocked down every competitive technology that could help replace the aging coal fleet.

"In the electric utility industry, energy efficiency, renewable power, distributed generation, micro grids, rooftop solar and demand reduction are examples of what 'sounds good' – and while they may all play some role in meeting the energy needs of customers, they are not substitutes for what has worked to sustain a reliable, affordable and environmentally responsible electric system," he said.

It may not be regulation that challenges coal-dependent utilities most in the coming years. It might just be a failure of imagination.