GTM Research recently released a smart grid report, The Smart Grid in Asia, 2012-2016: Markets, Technologies and Strategies. This article is the part of a series of perspectives from the report's author on the tremendous smart grid opportunity in Asia.

In 2009, China embarked on a three-stage journey to become a world leader in smart grid technologies with its aptly named "Strong and Smart Grid" 11-year plan. The plan encompasses all aspects of the grid, including increasing generation and transmission capacity, a nationwide smart meter deployment, large-scale renewable energy integration, and a large substation build-out. Four years later, State Grid Corporation of China, the largest utility in the world and the brains behind China's smart grid plans, is in full swing with phase two of its ambitious smart grid deployment plans -- the Construction Phase, running from 2011 to 2015.

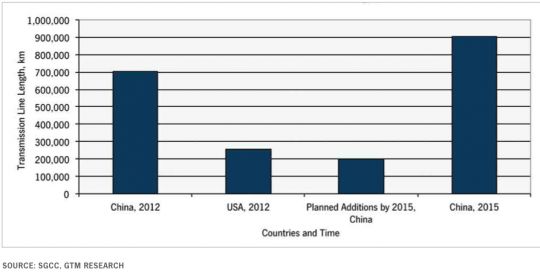

New transmission lines are a major focus for State Grid in the Construction Phase, which is struggling to meet the growing energy demands of the rising middle class in the East and South. Most coal, hydro, wind, and solar load sources are over 1,000 kilometers away from the populous east and south. High voltage (HV, under 300 kilovolts), extra-high voltage (EHV, 300 kilovolts to 765 kilovolts), and ultra-high voltage (UHV, 765 kilovolts and up) lines are being installed currently, with at least one 1,000-kilovolt UHV AC or DC line installed annually until 2015. Overall transmission line investments for 2015 are approximately $269 billion, equivalent to the combined market cap of ABB, GE, and Schneider Electric as of May 21, 2012. China is adding so much new transmission capacity and so many power lines that it could build three quarters the length of a new American transmission grid in just five years. When the dust settles, there will be over 200,000 kilometers of new 330-kilovolts-and-up transmission lines built, for a total of 900,000 kilometers of transmission lines, compared to 257,500 kilometers of transmission lines presently in the U.S.

Figure: Current and Future Transmission Line Length in China

At a cost of $1.05 million per mile for UHV transmission line and equipment, each UHV line requires billions of dollars to build, and State Grid put in a staggering $80 billion investment into 40,000 kilometer of UHV lines for the 2011 to 2015 Construction Phase. The business case is readily apparent: a 2,000-kilometer, 800-kilovolt UHV DC line has an incredibly low 3.5 percent line loss rate per 1,000 kilometer and a high 6.4-gigawatt transmission capacity, all the while being 30 percent cheaper than a 500-kilovolt EHV DC or 800-kilovolt UHV AC line of the same length. By 2020, UHV lines will have 300 gigawatts of transmission capacity, roughly split 60 percent AC and 40 percent DC.

The competitive business environment seen in the transmission grid build-out is indicative of the rest of the smart grid market in China -- high-quality goods, competitive costs, and a well-built relationship with State Grid all go a long way toward winning a contract. Fierce vendor competition exists, due in part to State Grid’s competitive construction procurement process. All projects costing over $300,000 to build are required to go through an open bidding process that aims to enforce fairness and transparency, but State Grid still holds the reigns tightly on choosing project developers. In the process, State Grid has the final say and does a rough 45/45/10 split when evaluating meters, based on quality, cost, and bankability of the company.

With the promise of power shortages disappearing and a stable energy supply base, the build-out of the transmission grid is ushering in the next era of smart grid opportunities in China. Smart meters and renewable integration are already big businesses, and new substation infrastructure has brought with it a vibrant and growing substation automation market. The need for better monitoring equipment has risen as China is keen on decreasing its system average interruption duration index (SAIDI) and improving power quality to its customers. State Grid has earmarked over $40 billion toward these smart grid technologies between 2011 and 2016, with smart meters alone being a $2.5 billion to $3 billion annual market.

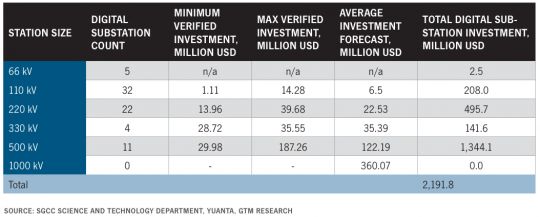

State Grid has paid special attention to substation automation technologies, and plans on installing 74 new digital substations for 63 kilovolts to 500 kilovolts by 2015. While this number is small compared to the existing 40,000+ substation base, State Grid has stated it intends to include digital technology in all new substations built. Companies such as BPL Global have been expanding their substation operations in China, which has been met with stiff domestic competition. The substation market offers promising growth over the next ten years.

Figure: Digital Substation Investments From 2011 to 2015

The transmission grid build-out also has an impact on technologies at the distribution level and downward. China is building 36 million new urban homes between 2011 and 2015, and modern building automation and smart meter technologies will be utilized. The coming years promise to create a new and vibrant building automation market, but for the time being, the market continues to focus on meeting demand shortfalls and other key infrastructure challenges. Expect to see an exciting shift toward technologies at the distribution level and downward in the next five to ten years, as China’s grid solidifies its transmission grid and generation sources. If the past three years have been any indication of future progress, expect to see China become a leading smart grid market for the next five to ten years. The distribution grid build-out and digitization will be the next major indicator of China’s smart grid prowess.

For more information on China's grid build-out and The Smart Grid in Asia, 2012-2016: Markets, Technologies and Strategies, visit www.greentechmedia.com/research/report/smart-grid-in-asia-2012-2016.