Oklahoma, historically known as a hub for fossil fuel production, will soon become home to one of the largest wind farms in the nation.

Invenergy and GE Renewable Energy announced yesterday they're building a 2,000-megawatt wind project in the Oklahoma panhandle, which, upon completion, could hold the title of second-largest wind farm in the world.

The Wind Catcher facility will generate electricity from 800 of GE’s state-of-the-art 2.5-megawatt turbines that will be installed, owned and operated by Chicago-based Invenergy. The project is already under construction and expected to be fully on-line by 2020.

The Wyoming Chokecherry-Sierra Madre wind farm, which boasts a nameplate capacity of 3,000 megawatts and started construction at the end of last year, is also scheduled to come on-line in 2020 and could claim the crown of largest wind farm in the U.S. But the Wyoming facility may face delays due to its sheer size. The Wyoming project is also being built in two phases, which will make Wind Catcher the largest U.S. project to be built in one go.

These mega-sized projects are indicative of the boom taking place in the U.S. wind industry, which saw development jump up 40 percent in the second quarter compared to the same period last year, according to new figures released today by the American Wind Energy Association. The U.S. Wind Industry Second Quarter 2017 Market Report shows that nearly 80 percent of current wind turbine construction and advanced development activity is found in the Midwest, Texas and the Mountain West, as rich wind energy resources draw even more business to heartland states.

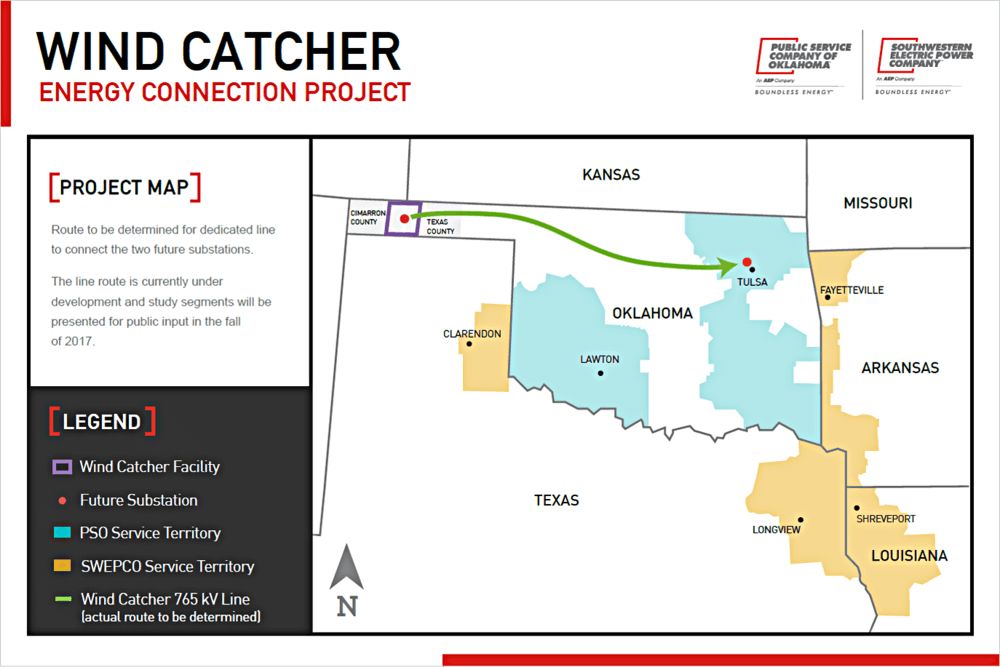

The new Oklahoma wind farm is part of the $4.5 billion Wind Catcher Energy Connection, which also includes an approximately 350-mile high voltage transmission line to carry the power to customers in Tulsa.

Once all of the turbines are up and operational, American Electric Power (AEP) subsidiaries Public Service Co. of Oklahoma (PSO) and Southwestern Electric Power Co. (SWEPCO) want to purchase the entire Wind Catcher project. The utilities are seeking regulatory approval in Louisiana, Arkansas, Texas and Oklahoma to buy the wind farm from Invenergy upon completion and build the high-voltage power line to serve PSO and SWEPCO’s more than 1.1 million customers.

This represents a new business model for utilities, as Bloomberg reported. Instead of purchasing wind and solar through power-purchase agreements (PPAs), utilities are now asking state regulators for approval to buy the projects outright and rate-base the costs.

“We keep wondering why utilities are always signing PPAs that pass the cost through to customers,” said Amy Grace, analyst at Bloomberg New Energy Finance. “If you put it in your rate base, you can get a guaranteed return on it. There’s a big upside to ownership.”

Rapidly falling costs combined with federal and state incentives have made solar and wind increasingly attractive investments for utilities, especially since low electricity demand growth is reducing the need for traditional investments. AEP CEO Nicholas Akins said on an earnings call today that the $4.5 billion Wind Catcher purchase, which relies on $2.7 billion in U.S. wind production tax credits, will not require a rate increase.

The utility expects to file its request with regulators on July 31, and is hoping for approvals by April 2018.

Utility engagement comes at a critical time

Wind Catcher will not benefit from Oklahoma's state tax credit, which played a significant role in launching the state's robust wind market, since legislators recently voted to close the program for new projects starting July 1. Meanwhile, federal tax credits for wind production are currently being phased out and will end after 2019.

"AEP’s engagement comes at a critical time, when renewable energy is seeking more commercial support as federal policy support wanes, and even state level support in light of the recent elimination of Oklahoma’s state zero-emission tax credits," said Daniel Shreve, partner at MAKE Consulting, a Wood Mackenzie company.

"The financial strength and buying power that major utilities have in these mega-projects aid in reducing the levelized cost of electricity for these projects, especially when leveraging the expertise of experienced developers like Invenergy," he said. Shreve added that the project serves as a big boost for Invenergy, which will continue to provide O&M services to Wind Catcher after it's built.

The interest in wind among major utilities highlights just how far the wind energy industry has come in terms of cost and reliability, said Jim Shield, Invenergy’s executive vice president and chief commercial officer.

"It shows that wind is economical," Shield said, in an interview. "I think a lot of utilities are turning to wind as an ownership option because it drives down the cost of energy for their ratepayers. And I think with this size project and scale, we’re able to do that."

"As the technology gets better in wind, we’re seeing that even with the phase-out [of the federal production tax credit], wind is competitive in the existing marketplace...and we see it continuing to be competitive into the future," he said.

The risks and benefits of Wind Catcher

Wind Catcher will help to advance the latest wind tech. The 2.5-megawatt turbines being deployed for Wind Catcher are GE's latest model, which the company says will allow for higher energy production and industry-leading reliability. GE will also implement its Digital Wind Farm solutions software to enhance performance and operations. All machine heads and hubs will be manufactured in the U.S., and additional components will be manufactured in Louisiana, Arkansas, Texas and Oklahoma -- conveniently where AEP needs to get regulatory approval.

The Wind Catcher facility is especially important to GE in light of increased competition from Vestas in the United States over the past 24 months, said Shreve.

Shreve added that the large-scale transmission line tied to the Wind Catcher project introduces some level of project risk, although a deadline in the 2020 timeframe should be ample time to build the power line. In general, “The ability to permit and construct longer transmission tie lines in a timely, cost-efficient manner will become more important as time goes on and developers look further afield for areas where they can build larger wind farms with favorable wind resources,” he said.

It doesn’t hurt that infrastructure spending has been identified as one of the Trump administration’s top priorities, which could help expedite the construction of wind-specific transmission lines.

Massive projects like Wind Catcher also come with the benefit of creating jobs in rural American communities -- another priority for President Trump. AEP estimates that the project will support approximately 4,000 direct and 4,400 indirect jobs each year during construction and 80 permanent jobs once operational. It also will contribute approximately $300 million in property taxes over the life of the project.

AEP forecasts significant benefits for ratepayers too. Wind Catcher Energy Connection is expected to save SWEPCO and PSO customers more than $7 billion over 25 years, according to the utility.

Meanwhile, clean energy advocates see Wind Catcher as proof that renewables are on an unrelenting progression to displace fossil fuels.

“We see this investment in Oklahoma’s future as further evidence that wind is simply a better deal for customers than dirty fuels like coal and gas,” said Al Armendariz, deputy director of the Sierra Club’s Beyond Coal Campaign.