Determining the value of batteries that can store, shift and dispatch solar energy requires some complex calculations, not to mention no small amount of faith in the future of real-world regulations and markets to allow them to get paid for it.

But in the context of California’s emerging net metering rules, here’s one simple figure for what solar-storage systems could be worth over their working lifetime: 25 cents per kilowatt-hour.

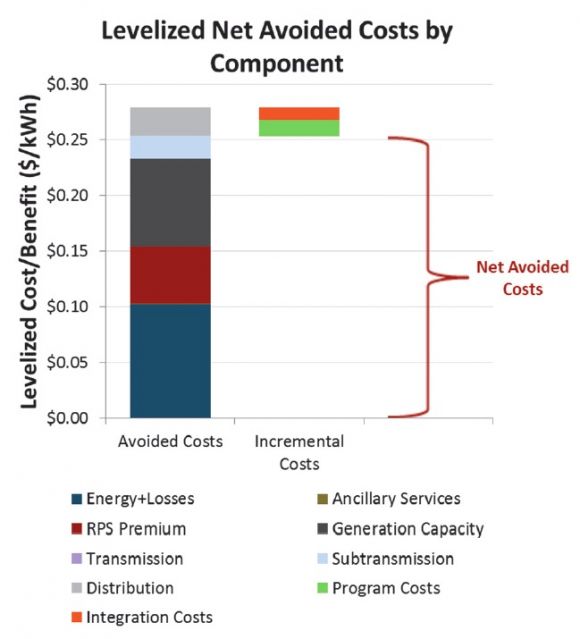

That’s the value that the California Energy Storage Alliance (CESA) industry group found for a generic solar PV system, backed with three hours of energy storage, when they plugged it into a software model being used by state regulators to measure the cost-effectiveness of different grid resources.

That’s a pretty significant value, compared to the retail rates paid to customers with net-metered solar in California. For the state’s big three investor-owned utilities, those range from about 13 cents per kilowatt-hour for low-energy users to as high as 42 cents per kilowatt-hour for the biggest energy users.

And that’s a “conservative” estimate of the benefits, CESA wrote in a filing with the California Public Utilities Commission this week. That’s because the “Public Tool” software, built to inform different proposals for the state’s overhaul of solar net-metering regulations, “undervalues energy storage in a variety of ways, such as in adding no flexible capacity value, minimal temporal granularity, and low transmission saving values.”

CESA’s calculation of a “sizable benefit stack of $0.25/kWh in levelized value” represents an interesting way to measure the benefits that could come from combining solar PV’s green power with the flexibility of energy storage.

To date, most solar-storage projects have defined their value based on what they can offer the customers who own them. That could include the availability of emergency backup power for homeowners, the ability to reduce demand charges in commercial buildings, or the promise of storing solar power when grid prices are low and discharging it when prices are high.

Other solar-storage benefits could accrue to utilities, like their ability to manage power quality and reliably provide capacity to bolster stressed-out grid circuits, or to mitigate the sudden spikes and drops in solar production that can come when clouds pass overhead.

But combining all these potential values, along with broader environmental and societal benefits, into a single figure -- one that could stand in as a commonly accepted rate or tariff for solar-storage systems -- is something that California regulators have only begun to contemplate.

San Diego Gas & Electric has proposed a pilot project that would create tariffs to pay customers with energy storage who are willing to turn it over to some level of utility control, but it hasn’t disclosed how those tariffs would be calculated.

In the absence of hard regulatory guidance, CESA decided to run its own model, Ed Burgess, manager at CESA consultant Strategen Consulting, said in an interview this week.

“We really think that solar-plus-storage is a unique combo here, because we’re getting a flexible resource that we can deploy to certain locations, and it provides value when you need it,” he said.

CESA made only two changes to the default settings of the public tool, he said. First, it changed the tool’s assumption of California’s statewide renewable portfolio standard (RPS) from today’s 33 percent to the 50 percent being proposed in state legislation.

Second, it assigned a “marginal avoided energy cost locational multiplier,” which stands in for the value it can provide on portions of the grid that are facing peak capacity conditions or other locational needs. California is in the midst of transforming its utility regulations to allow rooftop solar, energy storage, flexible load and other grid-edge systems to play a role in distribution grid planning and operations, which will bring these kinds of locational factors into focus.

CESA’s analysis comes amid a heated debate over the future of California’s solar net metering regulations. The state’s big investor-owned utilities have proposed slashing the compensation that solar-equipped customers receive and adding significant fixed charges to their bills. Solar companies and environmental groups say those changes would gut the state’s growing distributed solar market and have asked the CPUC to keep paying net-metered solar customers retail rates for the energy they produce.

CESA isn’t taking a direct stake in that debate. Instead, its filing in CPUC’s net metering proceeding calls for finding some way to include energy storage in the equation -- or at the very least, accurately calculating its value.

In the meantime, solar-storage partnerships like Tesla and SolarCity, Sungevity and Sonnenbatterie, SunPower and Stem, SunEdison and Green Charge Networks, and Enphase and Eliiy, to name a few, are starting to deploy systems in California in anticipation of new tariffs, programs and markets that will allow them to capture multiple values.