For a company just starting to bring its brand-new power conversion technology to market, Ideal Power has some pretty big ambitions: to disrupt the way that solar PV, grid-scale batteries and EV chargers are connected to the grid.

But if its technology works as promised, and as ongoing Department of Energy tests appear to indicate it does, then these ambitions may just be justified.

That’s the promise that this quiet startup turned Nasdaq-traded company is bringing to potential grid storage partners at this week’s ARPA-E Summit conference outside Washington, D.C. Armed with a roster of patents related to its “Power Packet Switching Architecture” technology and just under $26 million in grants, debt and public market financing, the Spicewood, Texas-based company is now developing a set of power converter devices that it says can beat existing inverter technologies for small-scale PV, energy storage and "hybrid" systems on a range of grid-edge performance features.

Those include size and weight. Ideal Power’s 30-kilowatt devices are less than one-fifth the weight of similar scale commercial inverters, based on their reduction of passive elements like electrolytic capacitors and magnetic components. Ideal Power's device also doesn’t require a transformer to electrically isolate batteries from the grid, as is required for other inverters serving that bi-directional storage-grid power flow capability, further reducing weight, complexity and efficiency losses.

But more critically, “It’s all an indirect power transfer process,” Paul Bundschuh, Ideal Power’s president and chief commercial officer, told me in a Monday interview at the ARPA-E Summit. That’s because, unlike traditional inverters, Ideal Power uses a magnetic storage mechanism, or “high-frequency AC link,” to manage the conversion of direct current to alternating current.

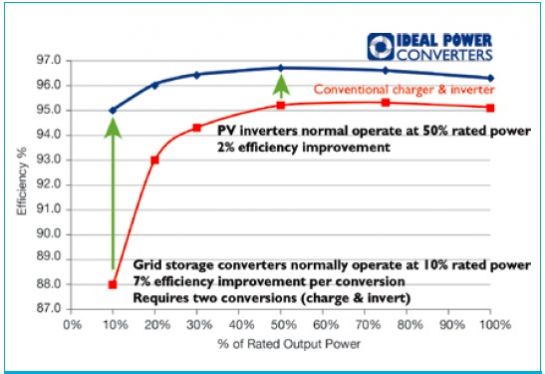

This unusual method of converting power can achieve DC-AC efficiencies in the high 90 percent range -- in and of itself, not that much better than the best inverters on the market today.

But unlike traditional inverters, which work best in conjunction with specific batteries, solar PV systems and loads operating at optimal levels, Ideal Power’s technology can keep high efficiencies with different mixes of systems, operating at changing rates and states of charge and discharge, Bundschuh said.

In particular, traditional battery-linked inverters that have high conversion efficiencies at near-full rates of charge and discharge tend to see efficiency drop significantly when the batteries they’re connected to are discharging only a fraction of that power. In general, the lower the “rated power output” from the battery, the worse the traditional inverter is at converting it efficiently, he said.

Because many battery systems “tend to run at 10 percent to 20 percent of rated power, having a low rated power efficiency is, we feel, a good attribute,” he said. "We think that traditional systems are, today, bad at that.”

Overall, Ideal Power claims that it can reduce power losses from traditional inverters by one-third to one-half over a typical span of operating conditions that pertain over the lifetime of a battery-grid interconnected system, as shown by this chart:

Backing Up Its Disruptive Claims for Energy Storage

These kinds of comparisons are sure to draw fire from inverter manufacturers, plenty of whom have done extensive work in energy storage-grid applications. Indeed, as the provider of a brand-new technology, Ideal Power has a lot to prove in bearing out its claims -- which is where third-party tests come into play.

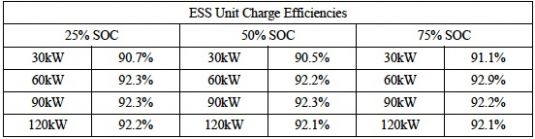

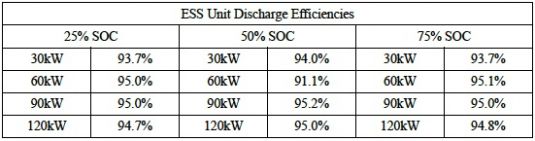

Take a recent report from the Bonneville Power Administration federal power agency, which tested Ideal Power’s battery converter devices in conjunction with a lithium-ion battery array from Powin Energy in Richland, Washington.

According to the BPA report (PDF), the combined system achieved a maximum round-trip efficiency of 86 percent and an average round trip efficiency of 84 percent, and high efficiencies in both charge and discharge achieved across low, medium and high states of battery charge. (While BPA did find Ideal Power's efficiencies a few percentage points lower than the company's stated claims, researchers noted that this could be due to the lack of revenue-grade metering at the test site, as well as the longer wire lengths used in the test.)

Ideal Power landed a $1 million grant from the Texas Emerging Technology Fund in 2010, an ARPA-E grant of $2.5 million in 2011, $4.75 million in convertible debt financing in 2012 from backer MDB Capital Group, and the $17.5 million raised in its December IPO. That’s not a lot of money to take on entrenched inverter giants, and it represents a “radically different approach” from raising lots of venture capital money, Bundschuh said.

Rather than build out its own manufacturing facilities, Ideal Power’s business plan is to license its Power Packet Switching technology to original equipment manufacturers, using primarily commercially available off-the-shelf materials and components, he said. “We develop and test prototype systems in our R&D shop, use a Texas-based subcontract manufacturer” for the reference products the company has deployed in tests so far, “and we can scale with anybody,” he said.

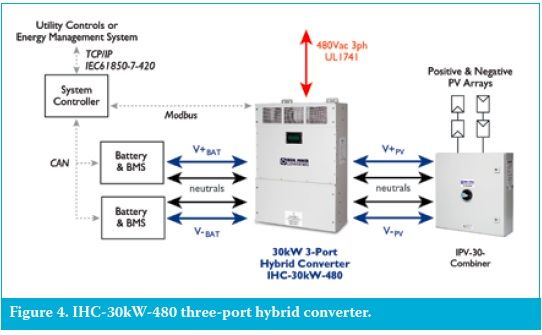

So far, Ideal Power has built its first two reference products -- a PV inverter that it’s sold to eleven different PV installer companies and an energy storage converter of the type tested by BPA. Its third product, a 3-port hybrid converter, has been part of a cooperative R&D partnership with DOE’s National Renewable Energy Laboratory (NREL) since May 2013, aimed at creating a reference architecture for systems that combine electric vehicle charging, solar panels, batteries and the grid.

A recent article (PDF) by John Merritt, Ideal Power’s director of applications engineering, lays out how the hybrid converter could combine solar PV systems and energy storage behind a single unit, which is a challenge for traditional inverters that tend to work best for either PV or batteries, but not both. (That’s one reason why SolarCity has so far chosen to put its PV systems and battery systems behind separate inverters for its storage-backed solar deployments, by the way.)

Buyers of Ideal Power’s reference devices include Johnson Controls, Sharp Labs of America, the U.S. Navy, NREL and NASA, according to the company’s S-1 filing with the Securities and Exchange Commission. In all cases, the main differences between the devices isn’t in the hardware, but rather in the software used to manage the indirect, AC-link-based system’s conversion of power from one side to the other, Bundschuh said.

“Most of our effort is going into embedded software development,” which is the key differentiator between the company's PV, energy storage and “hybrid” power converter systems, he said. That should provide a path toward increased cost reductions and flexibility over time, he said, driven by improvements in the core semiconductor materials that form the heart of Ideal Power’s stripped-down hardware architecture.

“The switches and the software get a lot cheaper every year, but that other stuff doesn’t,” said Bundschuh. Ideal Power’s $2.5 million ARPA-E grant is specifically aimed at incorporating “bi-directional insulated gate bipolar transistors (BD-IGBTs)” into its devices, which now use standard silicon switches, rather than more esoteric silicon carbide (SiC) or gallium nitride (GaN).

Ideal Power’s common, software-defined architecture also allows the company "to use a common platform for multiple markets, and gives us greater speed in addressing new markets,” he said. Because solar PV systems don’t vary their output that widely, “In general, our initial product for PV applications is interesting, but not disruptive -- and the market is so competitive with so many players, you have to have something disruptive to be noteworthy."

But for grid energy storage applications, a system that can keep its efficiencies across multiple and changing use cases could well represent a disruptive technology. Ideal Power’s converters could work with storage devices ranging from high-power, short-duration systems like ultracapacitors and flywheels, through mid-range lithium-ion batteries and up to multi-hour, low-power and high-energy flow batteries and advanced battery chemistries. “Our view is, we’re working with all those guys," said Bundschuh.

So far, it has landed one publicly announced partner: Eos Energy Storage, a startup working on a zinc-based long-duration battery chemistry set to be grid-connected by New York utility Consolidated Edison this year. While Bundschuh declined to comment on further partnerships, Greentech Media has been told that Ideal Power’s converter is being used by another battery startup, Aquion, in one of its off-grid, solar and generator-connected test projects. Energy software startup Growing Energy Labs Inc. (GELI) is also working on that project.

Distributed energy storage is set for rapid growth, as GTM Research has laid out in great detail in its recent report, Distributed Energy Storage 2014: Applications and Opportunities for Commercial Energy. While most of the focus on the economic competitiveness of grid storage has focused on the batteries, the power electronics that allow them to interact with the grid is an important part of the equation as well. Keep a close eye on how Ideal Power, and the rest of the inverter world, tackles the challenge of delivering products that can do the things the grid and customers need from grid-scale batteries.