Sam Jaffe of Cairn Energy Research Advisors made the argument that it's not software, but "batteries that will eat the world," when he presented at last week's Bay Area Battery Summit 2016 at the Stanford Linear Accelerator Center. He contended that batteries are "the key technology in changing our world for the better."

"Once you [pair] a powerful enough battery with a powerful enough semiconductor, you change that thing. It is no longer just a phone. It does something very different. It's used differently. The market for it is different," he said.

"I promise you, the cars in 10 years will look very different, and a lot of it will have to do with the electric drivetrain enabled by the batteries," he added.

Here are some of the other key excerpts from Jaffe's presentation.

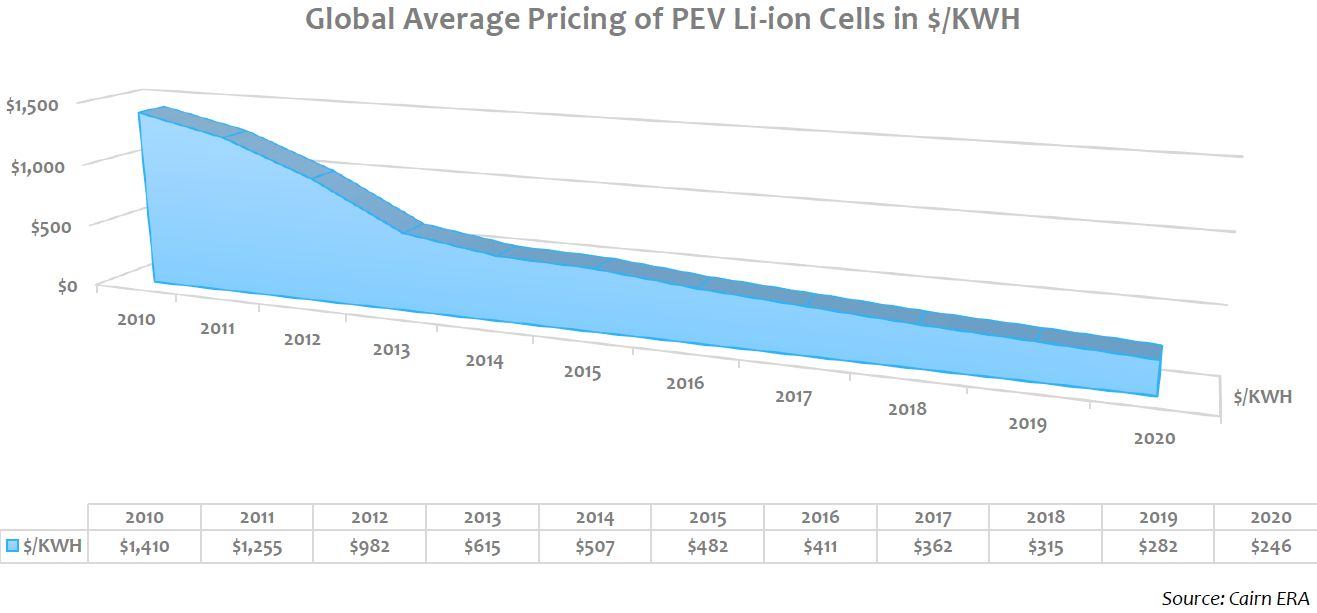

Revising the pricing forecast for plug-in electric vehicle cells

Today, "we're essentially saying that, on the average, pricing [in dollars per kilowatt-hour], is somewhere around $400, although...Tesla, of course, is probably somewhere around $120 for the cells that they buy from Panasonic. We know that GM is spending $140 for the LG Chem cells, and those are two of the biggest models. We think that it will get to $250 by 2020. That could be dramatically lower, and we're going to be revising these numbers soon based on a lot of new information happening in the market today."

How do you factor in the price of gasoline?

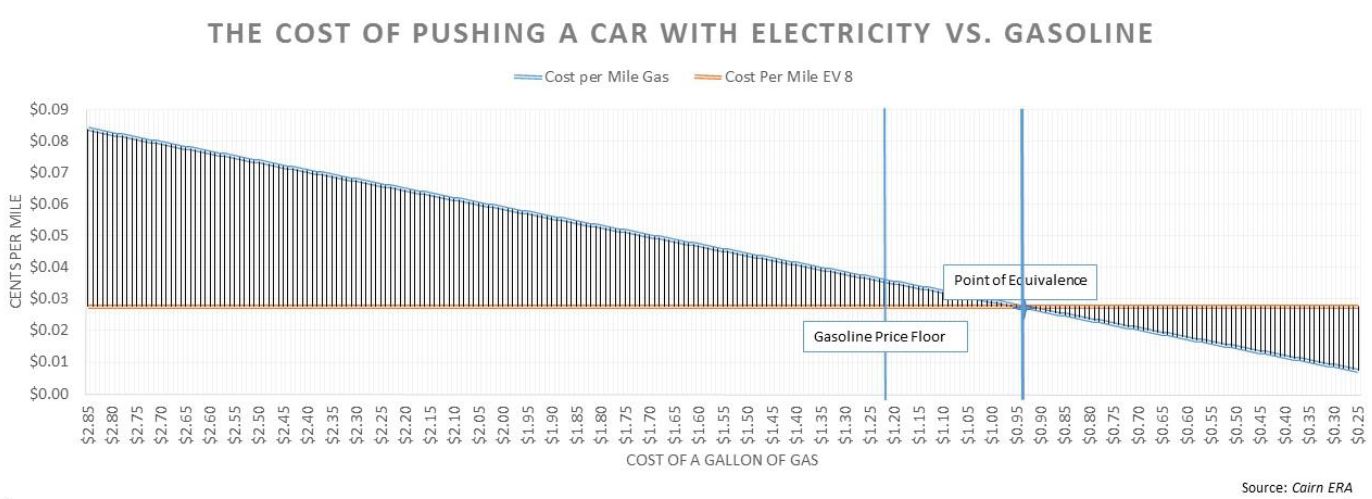

"I'm always asked, 'How do you factor in the price of gasoline?' I don't, and the reason why is that it is already cheaper to push a car with electricity than with gasoline, and it always will be, because you would have to get to a price point of about 80 cents for the gallon of gas to make it cheaper to push with gasoline, and we cannot do that."

"The refiners would lose money refining gasoline at 80 cents a gallon, not to mention here in the U.S., you've got an 18-cent federal gas tax. Boom. Automatically your floor is 98 cents. It will always be cheaper to push the car with electricity than with gasoline. Of course, I'm not factoring in here the price of the car."

Market driver: Pollution reduction in China

"I travel to China a lot. I spend a lot of time with Chinese companies and with the battery people in China, and they understand this better than anybody does. There are 1.2 billion people there. Most of them do not want their children living there, because the air is poisoned. I'm not talking about carbon, I'm talking about NOx and SOx. It is a horrible situation that they've put themselves in, and they want to solve it as a society. [...] It's important to understand that whenever we have policy discussions about carbon reduction, it goes hand in hand with air pollution reduction. China, now, is focusing on that. That's what's going to change things, in our view."

"We're saying that we're going to grow from about 705,000 vehicles in 2015 to 13 million by 2025, globally, and that represents about a 12 percent market share by 2025. These will be almost all battery electric vehicles, not plug-in hybrids with range extenders."

The bus came by and I got on. That's when it all began.

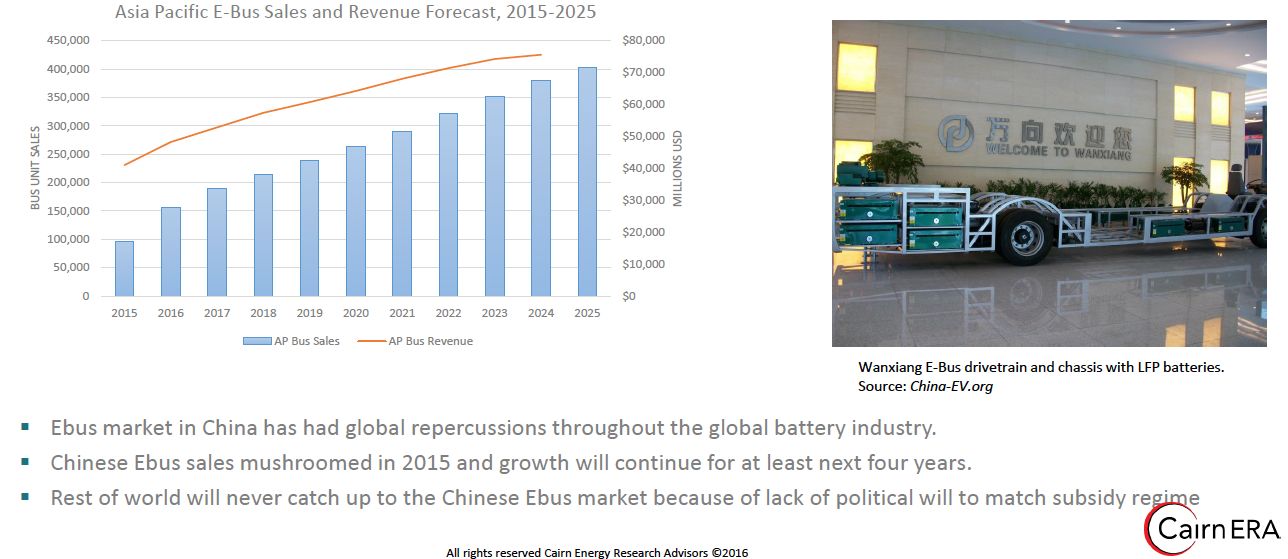

"The Chinese [electric vehicle] market has gone through a big bang in the last two years, and it's been all about buses, and to a lesser degree, passenger vehicles. When people write the history of batteries, I think it will go back to what happened in 2015 in China. If we had a 2014 bar here [on the chart], it would be barely recognizable -- it went up an order of magnitude to over 100,000 buses, which represented over 10 gigawatt-hours of batteries sold. It was all because of subsidies. It's had an enormous impact on the overall battery industry, especially in China. It's starting to happen now with the passenger vehicles. This is it. This is where the acceleration starts."

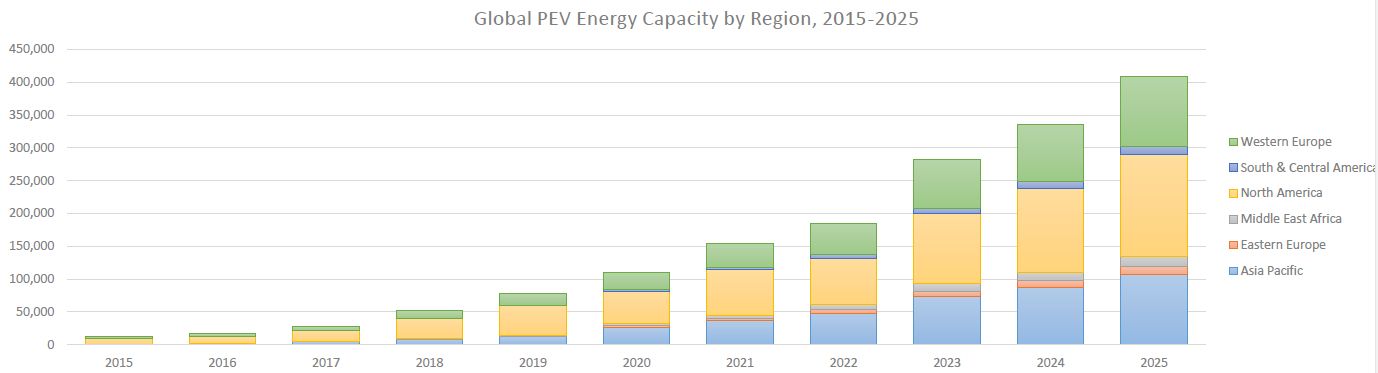

"In terms of overall capacity, we're saying that the number of gigawatt-hours going into vehicles will grow from around 11 gigawatt-hours in 2015 to over 500 gigawatt-hours in 2025. That's a huge change. By revenue, it will become close to a $60 billion industry just for the battery cells."

(Y-axis is megawatt-hours)

The big one: Combine batteries with combined cycle plants

"This is the big one: combine batteries with natural gas combined cycle plants to, essentially, balance the grid as renewable penetration grows higher. In this particular hypothetical example, we modeled out 1,600 megawatt-hours of batteries combined with a 1.2-gigawatt gas plant. The reason why it saves money has nothing to do with subsidies. It's all about burning the gas more efficiently so you use less gas, but you're able to use it as a very flexible tool to balance the grid. That's where most of the batteries on the grid, we think, will be going. It's going to start here in California. The natural gas peaker replacement market is about to kick off, and I know of several projects that are being planned that will probably get approval soon, where this is going to be not just a hypothetical but a very real use case."