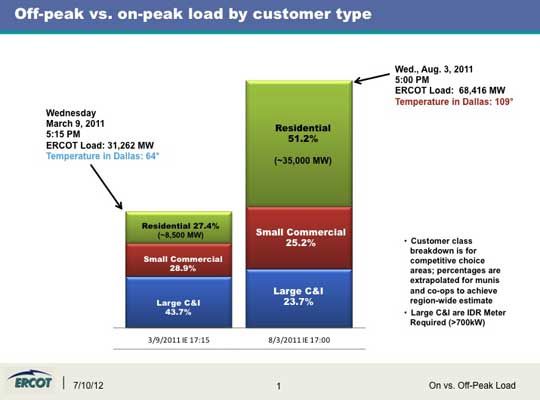

Last summer hit record temperatures in Texas, which led to record electricity use.

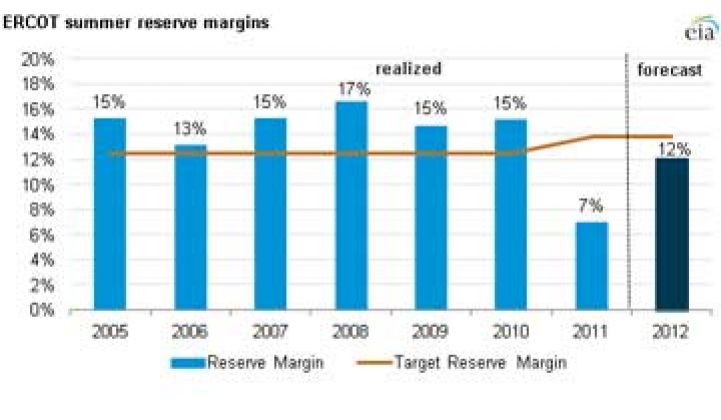

This year is not expected to be quite as hot, but there is a chance that the Electricity Reliability Council of Texas, or ERCOT, will fall below its target reserve margin as it did in the summer of 2011, according to data from the U.S. Energy Information Administration.

The capacity issues at ERCOT do not mean that the lights will necessarily go out, but rather that the reserve margin is shrinking and will continue to do so in the future without new capacity and expanded demand response.

In the summer of 2011, Texas’ power grid set record level power use for three consecutive days. The high demand topped off at 68,294 megawatts in early August. The forecast for 2012 is slightly lower: 66,195. However, the forecast that was released in December has been updated with a rosier outlook, according to Robbie Searcy, spokesperson for ERCOT.

Searcy said ERCOT has margins closer to 14 percent, but the grid in Texas has already set a new record for June -- 66,583 megawatts -- which is higher than the record for any day in July.

Texans are aware of the constraints, and the state’s public utility commission and ERCOT are looking for ways to increase capacity. The first move was to increase the system-wide offer cap, which was moved from $2,500 in 2011 to $4,500 starting in August. Ken Anderson, commissioner of the public utility commission of Texas, has said that might just be a starting point, and the SWOC could triple from its 2011 rates.

A report from ERCOT in May shows that the problem of not having the target reserve margin of 13.75 percent is not due just to a few hot years, but could be the norm in coming years. The margin, which was at about 7 percent for 2011, could dip below that starting in 2015 and continue to plummet until there is no reserve margin at all by 2022.

Not only will ERCOT need new baseline capacity, but it will also need sophisticated demand response that can shed load at various speeds, from 30 minutes to milliseconds. An OpenADR standard could help give certainty to grid operators to use more demand response, but there will also need to be sufficient market mechanisms in place for demand response to be allowed into various energy markets and fairly compensated.

ERCOT’s real-time energy dispatching service can’t even currently handle offers from demand response providers. In order for that to happen, DR would have to be fully automated, rather than relying on messages to building operators to manually turn down systems. For now, that’s futuristic stuff that hasn’t quite been worked out in Texas, or on an extensive scale in any region of the grid. There is automated demand response happening, but it is not standardized, and it is not the norm.

The grid operator in Texas has already updated its system to better handle wind integration, although the wind isn’t always blowing during the hottest hours of summer.

Like other system operators, ERCOT is planning for a future where EPA rules could shut down some of the oldest, dirtiest coal plants. Even with the retirements, ERCOT expects to have more than 80,000 megawatts of capacity starting in 2016.

While new capacity will relieve some of the pressure during the dog days of summer, many feel the real solution comes when the majority of customers see some connection between their pricing and the price of the market. Although consumer might not pay $4.50 per kilowatt-hour, a peak pricing program that stretches across large and small commercial down to residential customers could relieve peaking for far less money than building new capacity. Texas would not be the first state to try price signals to relieve peak. Oklahoma Gas & Electric plans to have 150,000 residents on voluntary peak pricing to delay new generation until at least 2020.

A pilot in ERCOT that starts next week will try to bring more electricity customers into the demand response fold. Instead of responding within 10 minutes, ERCOT will try to tap 150 megawatts that only need to respond within 30 minutes, hoping that it might be more attractive to more commercial, small commercial and residential customers. “We’re looking at demand response as one of the key pieces to our load concerns in coming years,” said Paul Wattles, Supervisor of Demand Response for ERCOT.

The pilot will run twice this year, and maybe once more next winter, but by next summer, the 30-minute response product should be part of ERCOT’s regular demand response offerings. Currently, megawatts in the emergency response service are up 20 percent from last year, and Wattles expects that to keep rising in coming years.

ERCOT didn’t get public utility commission approval to do a pilot until May, so at the moment there are only about 20 megawatts installed, but for the first time in ERCOT history, some are residential customers, according to Wattles. In Texas, the grid operator is also officially coordinating with utility demand response programs to coordinate when load is shed. It will take years, but the goal is to create the right market incentives where all customers could have the option to respond to price signals.

“We have more than five million automated meters in ERCOT,” said Searcy. “Finding ways to make those sorts of tools really work for demand response and within the competitive markets is being heavily discussed in a variety of committees.”

ERCOT is also working on consumer education campaigns and recently launched a mobile app with which users can see current and projected load along with tips on how to conserve energy. Searcy said when the temperature hit triple digits, thousands of Texans downloaded the app.

There is still a lot of summer left, with plenty of sweltering days ahead, which could impact how many changes happen in ERCOT in the coming years. And of course, Texas isn’t the only region with problems this summer. Deadly storms ripped through the mid-Atlantic region, raising questions about utilities’ ability to respond after unforeseen storms. Southern California Edison also is taking the San Onofre Nuclear Generating Station offline for summer.

Although this may not be the summer where smart grid comes to the rescue, it might be the one where millions of Americans realize they need a power infrastructure for the 21st century.