Elon Musk’s Master Plan, Part Deux envisioned a future where Teslas are used for each type of terrestrial transport, from passenger vehicles to buses and trucks, supplemented by a seamless suite of solar-and-storage products.

This vision was probably best captured in Tesla’s announcement of its offer to acquire SolarCity: “We would be the world’s only vertically integrated energy company offering end-to-end clean energy products to our customers.”

In fact, Tesla would be the second such company. China’s BYD (short for “Build Your Dreams”) has already built Elon’s dream -- and has done so profitably.

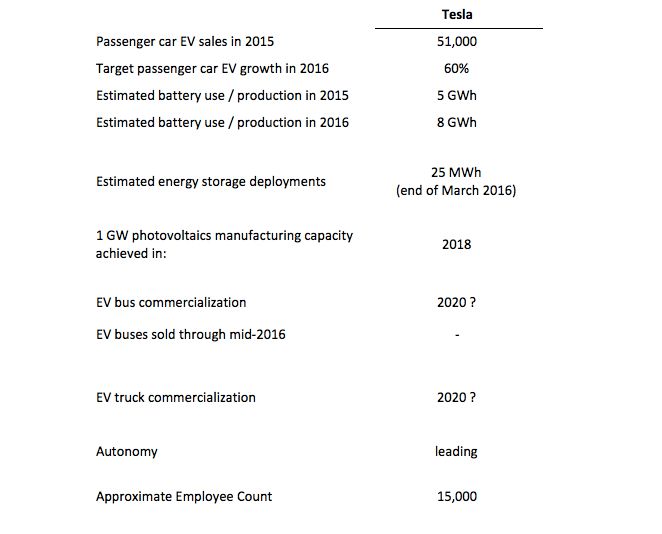

Tesla's numbers today

Tesla already enjoys advantages of scale over its rivals. It expects EV sales to rise from 50,000 last year to 80,000 this year, for a 60 percent annual growth rate. At 100 kilowatt-hours per vehicle -- a slight overestimate -- Tesla will have consumed 5 gigawatt-hours of batteries in 2015 and 8 gigawatt-hours in 2016. These volumes dwarf those of its well-known competition.

Though Tesla did not break out its energy storage sales in Q2, it deployed 25 megawatt-hours across four continents in Q1.

As for solar panels, SolarCity expects its Gigafactory to continue installing equipment through Q3 2017. If commissioning proceeds smoothly, it could clear 1 gigawatt of production in 2018.

Tesla likely won’t commercialize its bus or long-haul trucks before 2020, as it will want to focus on the Model 3 and Model Y. Cars are a far larger market than buses and transport trucks, so it would be ludicrous to go for the latter first.

It’s hard to put a timeline on Tesla’s autonomy efforts, given Mobileye’s termination of the two companies’ relationship, but at least the company can spread the effort across its approximately 15,000 employees. SolarCity would also bring a further 13,000 employees into the fold.

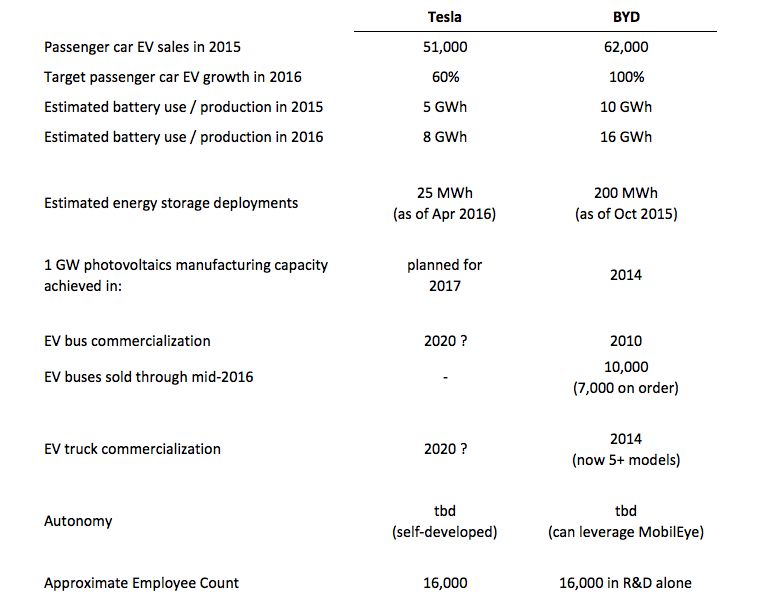

BYD versus Tesla

When comparing the two companies head to head, the data shows that in almost every relevant dimension, BYD has gone further and is growing faster.

Passenger vehicle EVs: BYD not only outsold Tesla last year, but its planned growth this year is higher. (It’s on track to meet those projections, too, with BYD China having sold 47,000 electric passenger cars through Q2.)

The Model 3 could help Tesla catch up to BYD in 2018/2019 if it executes to plan. Unfortunately, doubts linger about Tesla’s ability to do so, given its struggles with even modest levels of mass production. BYD already offers 10 automotive models, so ramping up future EV programs should entail relatively low levels of risk.

Battery use: BYD produced 10 gigawatt-hours of lithium-iron phosphate (LFP) batteries last year in its 10-gigawatt-hour factory, and it is now building a second manufacturing facility. It expects to produce 16 gigawatt-hours in 2016, keeping pace with Tesla’s growth rate.

Despite Tesla having half the battery scale as compared to BYD, it probably has a lower cost per kilowatt-hour, because iron phosphate has perhaps two-thirds the energy density of Tesla’s NCA (lithium nickel cobalt aluminum oxide) battery chemistry. And though BYD has improved its batteries’ energy density 30 percent in the past few years (likely by adding manganese), other chemistries have advanced as well.

LFP does have substantial advantages, the biggest being its dimensional stability when charged or discharged, heated or cooled. This allows BYD to recharge its buses at 300 kilowatts without a battery cooling system. (It also relegates Tesla’s superchargers to being the world’s second-fastest charging stations.)

The advantages carry over to durability; BYD buses come with a 12-year battery warranty, and many of the earliest generations of BYD e6 taxis -- still in use -- have surpassed 500,000 miles per unit on their original battery packs.

Energy storage: BYD claims to dominate the North American energy storage market and had deployed more than 295 megawatts/295 megawatt-hours across 66 countries at the end of Q2.

PV: BYD’s photovoltaics division reached 1 gigawatt of annual production in 2014. While its panels aren’t particularly high-efficiency (18 percent compared to SolarCity’s target of 22 percent and SunPower’s current 22.8 percent), its use of dual-sided glass encasing around panels lengthens operating life and reduces the risk of electrical fires. The panels presumably primarily serve to allow seamless solar-and-storage shopping for the utility-scale installations on which the company is focused.

EV buses: BYD has four electric-bus manufacturing facilities and shipped its 10,000th unit this year, with a further 7,000 units on order. Recently, its winter trial for EV buses successfully concluded in Edmonton, Canada (average daily January high: 17º F). A multi-bus/solar panel/1-megawatt energy storage project (geared toward limiting demand charges) with another city even farther north may soon emerge.

EV trucks: BYD has offered electric delivery vans since 2014 and has expanded into short-haul trucks; it has also entered the construction market with its first electric cement mixer. Though less of a head start than with buses, the lead is large and growing with each purchase and product line extension.

Autonomy/employee count: It goes without saying that Tesla has an autonomy advantage over the rest of the auto industry. That said, BYD has 16,000 R&D staff members -- greater than Tesla’s total headcount -- which demonstrates the bandwidth that can be brought to bear on key technologies. It would be remarkable if the company wasn't working feverishly on its own autonomy efforts.

Final thoughts

BYD is ahead -- and in some cases far ahead -- of Tesla in every dimension of Elon Musk’s grand vision. Autonomy is the only category where BYD is not winning. As such, every one of Musk's incisive insights about the transformative power of electric vehicles, solar photovoltaics and battery storage, and the cost advantages enjoyed by the biggest giga-scale producers, now work more in BYD’s favor than in Tesla’s.

Musk is playing catch-up in a game he thought he had just invented.

In a nod of acknowledgement to BYD’s 180,000 worldwide employees -- and to correct our overly Silicon Valley-centric perspective here in North America -- we would be well served to give BYD's CEO Wang Chuanfu his due. He clearly won round one.

Of course, the fight has only just begun.