Solar financier Sunrun just publicly filed its S-1 IPO registration with the SEC, and, much to the delight of our data-hungry solar analysts, it is chock-full of details on the operator of the "second-largest fleet of residential solar energy systems in the United States."

Here are some vital stats and comparisons to the No.1 financier, SolarCity:

- Sunrun has approximately 79,000 solar customers across 13 states (SolarCity has approximately 218,000 customers)

- Sunrun has deployed an aggregate of 430 megawatts as of March 31, 2015 (SolarCity installed 153 megawatts in Q1 2015)

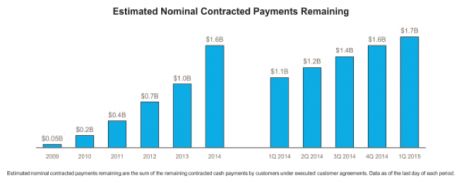

- Sunrun has estimated nominal contracted payments remaining of approximately $1.7 billion and an estimated retained value of $1.1 billion as of March 31

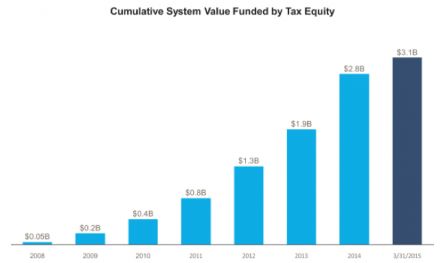

- The company has raised 20 tax equity investment funds with an estimated value of $3.1 billion

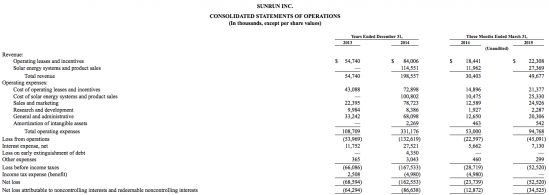

- The firm still loses money and has an accumulated deficit of $76.8 million as of March 31

- R&D expenses were $10.0 million in 2013 and $8.4 million in 2014

- The company has over 1,700 employees

Sunrun's main suppliers are REC Group for solar panels and ABB Group for inverters. Racking hardware comes from the acquired MEC and its racking product, SnapNrack.

Sunrun's estimated retained value per watt was $2.41 as of of March 31, 2015. SolarCity has a retained value of $2.27 per watt, according to its most recent analyst letter.

Reporting on SolarCity, the Wall Street Journal defines "estimated retained value" as an "estimate of the value of future income from the electricity that customers buy far into the future, net of costs. A discount rate is applied to those cash flows to take into account the risks involved and effect of inflation to calculate a value in today's money." WSJ adds, "That fairly straightforward premise is actually a black box of assumptions."

The VC investors with significant ownership of Sunrun are:

- Foundation Capital (19.7 percent prior to offering)

- Accel Partners (13.2 percent prior to offering)

- Canyon Partners (9.1 percent prior to offering)

- Sequoia Capital (9.0 percent prior to offering)

- Madrone Partners (7.5 percent prior to offering)

We'll publish more details and analyst viewpoints once we spend a few more hours with the S-1. In the meantime, here are a few tables from the document.