It was another strong quarter for vertically integrated solar company SunPower. The module manufacturer and EPC firm beat estimates across the board and held its 2014 guidance steady, while continuing to amass its now 8-gigawatt pipeline and its holdco projects. SunPower's’ pipeline has grown by more than 500 megawatts since the first quarter, according to the firm. This quarter did see a GAAP decline in gross margin to 18.5 percent, related to the timing of financial recognition of an older, "legacy" project.

According to SunPower's CFO Chuck Boynton:

- The company "beat plan" in all regions and markets

- SunPower factories are running at full utilization

- Inventory is at a two-year low.

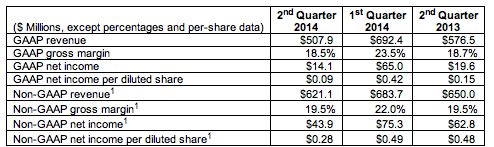

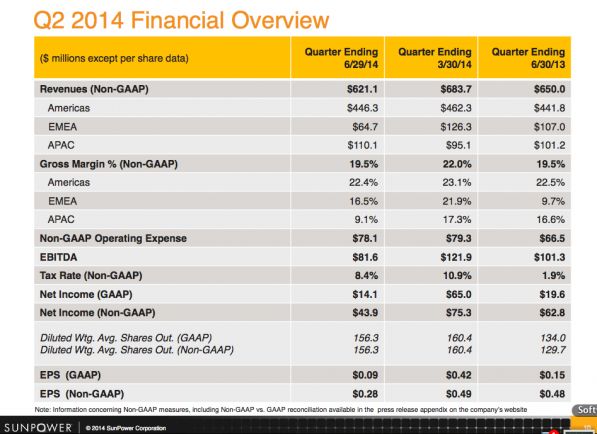

"We met our revenue and profit goals for the quarter as we saw strong demand in all of our key markets," said Boynton, after posting Q2 2014 GAAP revenue of $508 million and inome of $14.1 million. Here are the numbers:

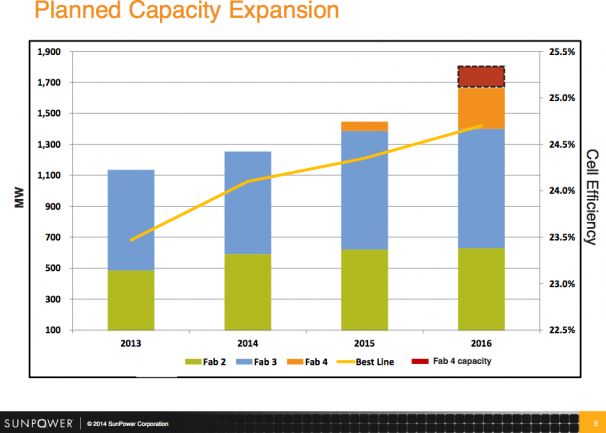

Capacity Expansion

SunPower has been capacity constrained since late 2013 and is essentially allocating its production. The company's construction of a new 350 megawatt fab in the Philippines, Fab 4, remains on schedule while Fab 5 is in the works. Tom Werner notes that the firm is still improving efficiency -- with a 24.5 percent efficiency anticipated for 2016.

The 350-megawatt Fab 4 solar cell factory is "on track" to produce up to 100 megawatts next year, according to CEO Tom Werner.

Solar Star Project

The 579-megawatt Solar Star project from MidAmerican Solar currently holds the title of world's largest PV plant. SunPower recently installed the one-millionth PV panel at the 5-mile square mega-project and has already connected 228 megawatts to the grid. Werner notes that the panels are being cleaned three-times faster by SunPower's acquisition of Greenbotics panel-cleaning technology while cutting water usage by 90 percent.

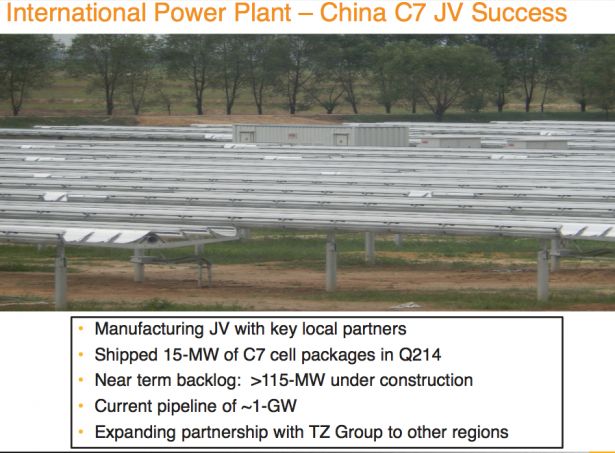

Joint Venture with China on C7 solar tracker

Werner noted that SunPower is seeing "further traction" with the C7 tracker joint venture in China. Baird suggests that SunPower's "C7 technology is not fully appreciated."

Werner said the China is showing "accelerating demand" above the 15 megawatts of C7 cell receiver packages shipped in Q2 and the more than 115 megawatts of construction backlog -- along with an alleged pipeline of approximately a gigawatt.

In a conversation after the quarterly update, CEO Werner pointed out the suitability of the C7 tracker product to China. Werner noted that while SunPower maintains its IP and ships the high-efficiency silicon receiver assembly, the balance of system (steel, trackers, concrete etc.) gets sourced and supplied cheaply and appropriately in China -- providing some hope for the embattled concentrator technology.

C7 SunPower low-concentration tracker project under construction in China.

Financial overview

SunPower now has $1 billion in cash on its balance sheet, giving the firm "the financial flexibility to support our holdco strategy and build Fab 4," according to a release. The company's closing of a second financing with Hannon Armstrong continues to allow SunPower to "monetize [its] assets to drive cash flow."

The company claimed strength in all regions and markets and described a pipeline of more than 8 gigawatts.

International presence

SunPower, with help from its record-efficiency and its French shareholder Total, has truly emerged as a global firm. The firm is developing and constructing projects in South Africa, Chile, France, Australia and a second project at Nellis Air Force Base in the U.S. Japan accounted for more than 26 percent of SunPower's shipments in the second quarter.

Q3 guidance and new finance strategies

For Q3, SPWR expects revenue of $625 millionat an 18 percent gross margin.

Expectations for the upcoming November analyst day include info on its holdco strategy, expansion efforts in the U.S residential market, C7 and Chinese demand, and progress on new financing mechanisms.

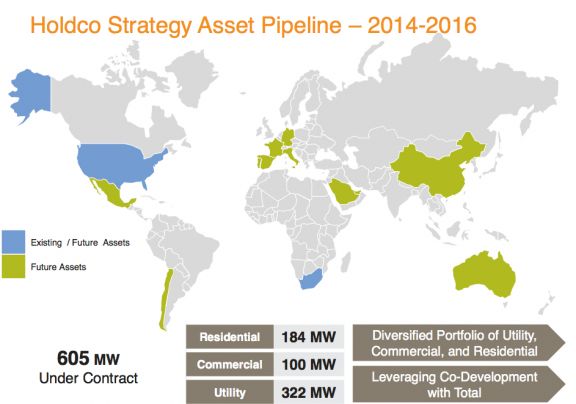

Last quarter, SunPower's CFO Chuck Boynton, explained that the company's new holdco strategy drives NPV and retained value and allows SunPower to capture the increased power-producing performance of its panels. With more than 500 megawatts under contract, "We can hold assets and sell strategically." The CEO said that asset-backed securities are under consideration "as we expand our portfolio."

Fiscal year 2014 guidance

For fiscal year 2014, the company's guidance remains unchanged -- with GAAP revenue expectations of $2.55 billion to $2.70 billion, gross margin of 20 percent to 22 percent and net income per diluted share of $0.75 to $1.05.