SolarCity's stock is up more than 12 percent after the vertically integrated solar financier and installer hit a record 136 megawatts for the quarter, upped its 2014 guidance and set a 2015 guidance of 900 megawatts to 1,000 megawatts deployed.

Q1 Takeaways

-

Record 136 megawatts in bookings in Q1, up 34 percent over the previous quarter, led by residential at 80 percent

-

SolarCity gained 17,664 new customers in the quarter, finishing Q1 2014 with more than 110,000 customers in total

-

Landed on the high end of guidance with 82 megawatts deployed

-

Total cumulative megawatts deployed is 649 megawatts as of March 31

-

Loss from operations in Q1 2014 was $67 million as compared to $26.7 million in Q1 2013.

Guidance bumped up and analysts weigh in

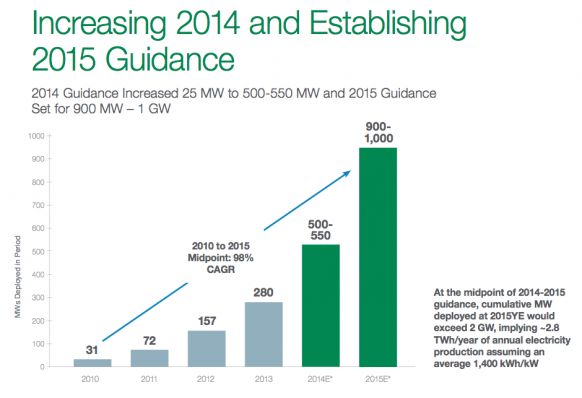

The leading solar installer increased 2014 guidance to 500 to 550 megawatts deployed and set initial guidance for 2015 with megawatts deployed of between 900 megawatts and 1 gigawatt. The CEO notes, "At the midpoint of guidance, we estimate we would exit next year with more than 2 gigawatts cumulatively deployed and annualized electricity production of ~ 2.8 terawatt-hours. This would put us on a path to fulfill our goal to become one of the largest suppliers of electricity in the United States."

Guidance for Q2 2014 is 105 megawatts to 110 megawatts deployed.

The company continues "to expect to generate positive cash flow for the full year 2014."

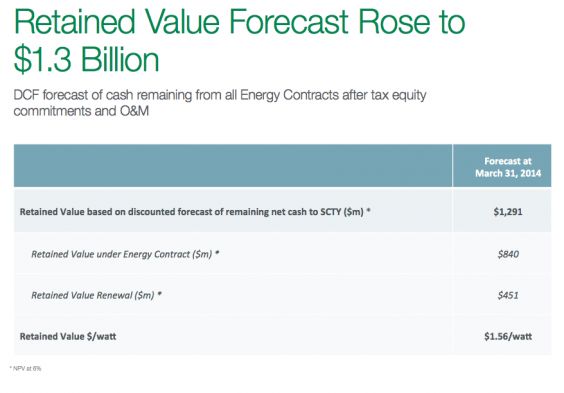

Deutsche Bank's Vishal Shah writes in an analyst note that SolarCity's "2015 outlook reinforces our view that growth in the U.S. residential market should accelerate into the 2016 timeframe, driving significant operating leverage in the model." He called the results a "big beat/raise" with a 2015 guidance "well above consensus." Shah also noted a number of other metrics that beat consensus. He comments, "Residential retained value is still above $2/W and considering the stable PPA outlook, as well as decreasing systems/financing costs, we expect retained value to either increase or at the very least remain at current levels during the remainder of 2014 timeframe."

Investment bank Baird reiterated its Outperform rating price target, writing, "We remain buyers of the stock." Baird noted that second-half deployments "should benefit from Nevada, where SCTY is expanding from 400 to 800 employees."

Choice excerpts from Q1 earnings call

Lyndon Rive, Chief Executive Officer

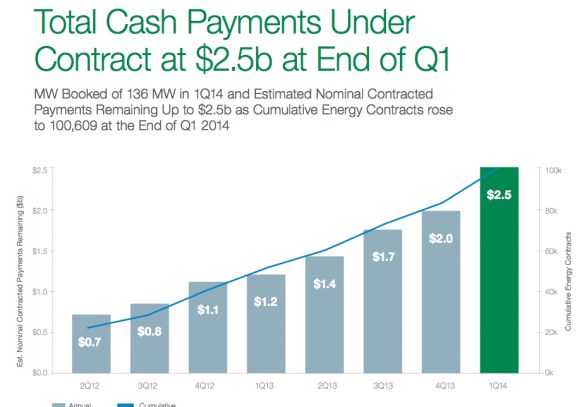

"Our contracted cash flow is now $2.5 billion. The amazing part is that we added $500 million in one quarter. These are starting to become big numbers. We also note [a cumulative total of] 100,000 energy contracts [as] we added over 17,000 customer contracts this quarter. We are well on our way to 1 million customers."

"Now, we are not going to slow down; we are going to continue to invest in sales and marketing. Based on these investments, we are now forecasting 2015. The forecast for 2015 is going to be 900 megawatts to 1 gigawatt. The reason for giving you 2015 guidance this early is that we’ve got to make those investments now, and you will see this in the opex numbers. If we meet this forecast by the end of 2015, we will have over 2 gigawatts of deployed solar and a historic growth rate of 98% for the last five years. That will be an amazing achievement."

Tanguy Serra, Chief Operating Officer

"Residential deployments continued doubling year-on-year from 30 megawatts in Q1 2013 to 67 megawatts in Q1 2014. We also had a strong 50 megawatts of commercial deployments. Commercial deployments are somewhat lumpy and depend on inspection dates of larger contracts. As a reminder, it takes, on average, one day to install a residential solar system, and we inspect shortly thereafter, which means that residential deployment is more like a finely tuned conveyor belt, predictably delivering megawatts on a daily basis."

Bob Kelly, Chief Financial Officer

"There are four main pieces of capital in the financial model. A construction revolver (which is $200 million today), tax equity funds, aggregation facilities and long-term securitizations. We optimized the cost of capital considering our investment activity in concert with the cash generated from operations which are predominantly our long-term contracts and the required financing.

"Since the beginning of this year, in a little over four months, we have completed in excess of $750 million in financings. We upsized an existing aggregation facility to $158 million early in the year and entered into a new $250 million facility led by Bank of America Merrill Lynch. On the tax equity front, we closed three new or upsized funds, including a first-time investor, a Fortune 500 financial services company."

Lyndon Rive, Chief Executive Officer

Discussing the Arizona market: "Yes, the state itself has seen a decline in solar adoption. The state has had many negative things happening to it which have increased the cost to the customer. Unless you have significant economies of scale, it’s really hard to offer a customer value proposition that make sense, so it is a challenging state. Now, we do have economies of scale and our value proposition is still very attractive to customers. In fact, our bookings in Arizona have...never been higher. [Even] with all these difficulties, the only way to push through with extra fees and costs is to get more volume and to get more scale. We’re actually going to continue to invest in Arizona."

Tanguy Serra, Chief Operating Officer

"At our scale, purchasing has not been a problem. We have not seen any increase in module costs. Again, we have a scale, which makes a big, big difference to buyers. We have got a number of very active conversations with Chinese and non-Chinese suppliers for long-term volume [commitments] in the low $0.70 per watt for modules."

[Transcription of earnings call courtesy of SeekingAlpha.]

Here are a few relevant slides from the Q1 investor presentation: