Ouch.

For many solar firms (SunPower, First Solar, Trina Solar, JA Solar, etc.) and their investors, the second quarter and first half of 2011 could not have ended soon enough. The common refrain was that high inventories, and a lack of transparency in German and Italian policy impacted share price, ASPs, profit, and revenue.

And despite the current, um, market correction and the moral and fiscal spinelessness of the American political class, another common refrain has been that the second half of 2011 will show a marked improvement. An additional theme was that North American utility deployments and small-scale systems in Europe were going to be the star of the second half of 2011 and the savior of the industry this year.

SunPower (NASDAQ: SPWRA, SPWRB) provided its quarterly numbers on Tuesday.

Revenue was up more than 30 percent to $592.3 million (63 percent from North America) from $451.4 million in the previous quarter, but margins plunged to 3.3 percent compared to last quarter's 19.6 percent, resulting in a GAAP net loss of $147.9 million.

Key Q2 milestones and call highlights included:

- $771 million letter of credit from majority shareholder Total

- Shipping world-record 20-percent-efficient solar panels

- A finding of no significant impact for the 250 megawatt-AC California Valley Solar Ranch power plant and a completed settlement agreement with national environmental groups means that CVSR will start construction in the third quarter.

- A credit facility with Citi to fund a $105 million U.S. residential solar lease program

- SunPower has a multi-gigawatt pipeline in North America.

SunPower's guidance for the third quarter is $700 million to $750 million with margins in the 12 percent to 14 percent range and shipments between 225 megawatts and 250 megawatts. Guidance for fiscal 2011 is $2.80 billion to $2.95 billion with margins in the 14 percent to 16 percent range and shipments between 900 megawatts and 950 megawatts.

Despite these less-than-rosy figures, Sanjay Shrestha of Lazard Capital Markets said, "We expect SunPower to be one of the long-term winners in an ongoing sector bifurcation as the overall industry evolves into an oligopoly, and creates distinct leaders with 10 or so players controlling 80 percent of the market." Baird Equity Research reiterated its Neutral rating and lowered their price target to $16.

Chart from Google Finance

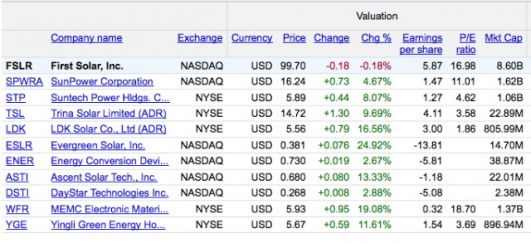

The markets did not like First Solar's second quarter earnings news one bit. Despite many solar stocks being up in the last day or two, First Solar is down, below $100 for the first time in three years, with a loss of billions in market capitalization. First Solar (Nasdaq: FSLR) is still the largest solar company in the world by market capitalization.

Chart from Google Finance

First Solar's net sales for the quarter were $533 million, down from $567 million last quarter (with the Street expecting about $583 million). First Solar attributed the lower sale figures to lower ASPs and "policy uncertainty" in Italy, Germany, and France.

First Solar also lowered its 2011 guidance. Guidance last quarter was for net sales in 2011 of $3.7 billion to $3.8 billion (trimmed from an upper bound of $3.9 billion). That number has been taken down even further for a guidance of $3.6 billion to $3.7 billion.

However, there is some optimism for the second half of this year. Rob Gillette, the CEO of First Solar, said in the earnings statement: “We expect stronger performance in the second half of 2011 as we build projects from our systems pipeline, develop promising new markets, execute our cost reduction roadmaps and continue to improve module efficiencies.”

First Solar’s updated 2011 guidance is:

• Net sales of $3.6 billion to $3.7 billion

• Operating income of $900 million to $960 million

Module efficiency goals are for 13.5 percent in 2014. The firm recently reached 17.3 percent in the lab. Module manufacturing cost remained in the $0.75-per-watt range.

Trina Solar (NYSE:TSL), operating in another technology (c-Si) and another country (China), revised its second-quarter guidance downward: Trina expects second-quarter shipments to range from 395 to 397 megawatts and predicts gross margins of 17.0 percent to 17.5 percent. Prior guidance was for 430 megawatts to 450 megawatts in shipments and low-20-percent overall gross margin. Shipment guidance for full-year 2011 was maintained at 1.75 gigawatts to 1.80 gigawatts, according to a release from the firm.

On the other hand, Yingli (NYSE: YGE) expects its solar module shipments for the second quarter of 2011 to increase by the range of 35 percent to 37 percent quarter-over-quarter, compared to its previously provided guidance of a more than 30 percent.

JA Solar Holdings (Nasdaq: JASO) anticipates its gross margins in Q2 to be lower than expected on plunging ASPs and high inventories. JA Solar also said that it expects its margins to improve in the second half of the year.

Suntech, (NYSE:STP) the world's largest producer of solar panels, will be announcing its second quarter results on August 22.