Dave Epstein, a former VC at Crosslink Capital, moved to Sweden to helm startup Sol Voltaics, a company developing a new solar technology.

"We're making an active ink to put on top of solar panels," said the CEO.

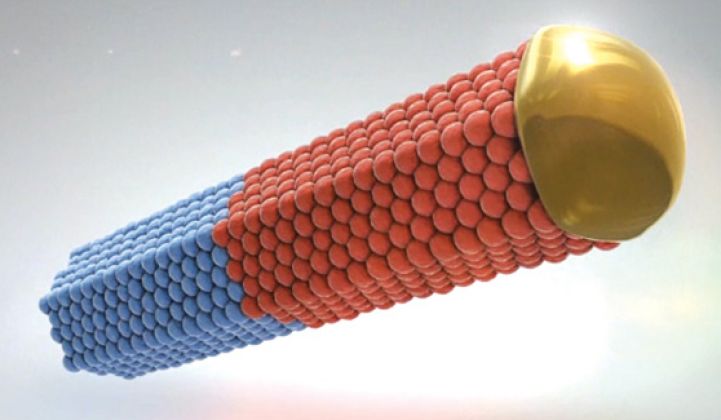

Sol Voltaics plans to use gallium arsenide (GaAs) nanowires to create another absorber layer on top of existing solar cells to extract more light and raise efficiency by 25 percent -- an enormous stride, as far as solar efficiency numbers go.

This suggests that a 17-percent-efficient crystalline silicon panel has the potential to reach 22 percent efficiency with the addition of the nanowires.

The GaAs nanowires are tiny solar cells about one or two microns long and approximately 100 nanometers in diameter, and they're sold as an ink-like solution. The layer of nanowires acts like a second solar panel, according to the CEO, and can "capture light very effectively on top of panels using a phenomenon called wave-concentrated photovoltaics (WCPV)." He claims that "the method we use to make these products is cost-effective with silicon."

Epstein added, "The solar market is booming even though companies are struggling. They are struggling because [the industry is] at the bottom of the cost curve. We've mined all of the cost out of solar panels. The only place to improve the economics is in efficiency -- to produce more power per panel." According to the CEO, higher efficiency means revenues go up, margins move from negative to positive and levelized cost of energy (LCOE) goes down.

"Efficiency creates value," said the CEO, who went on to claim that PV module price per watt varies depending on efficiency -- higher efficiency panels sell at an average of $0.94 per watt, while projections of $0.42 per watt will happen only for low-end modules. Epstein added, "People already don't want these low efficiency modules -- the projections going down to 42 cents will happen for lower-end modules."

According to the firm, "Nanowires and nanotubes are typically produced through an epitaxial process, that is, they are slowly grown as crystals in low pressure/high temperature environments on silicon or sapphire substrates. Because of the inherent physical limits of the epitaxial process, nanoparticles often need to be grown in place or harvested and sorted in batch processes that can be both time-consuming and expensive. Aerotaxy creates nanomaterials by suspending active materials in gases intermingled in precisely controlled environment."

The potentially higher-volume, lower-cost method used by Sol Voltaics to grow the nanowires was invented by company founder and CSO Lars Samuelson and was published in Nature in December 2012. The firm's aerotaxy process was described in Nature as the "continuous gas-phase synthesis of nanowires with tunable properties."

Less than a gram of solution of nanotubes is poured or printed on an existing solar cell (the ink needs to cover only 12 percent of the solar cell), then the nanotubes are aligned and fixed with a polymer, upon which a transparent conductive oxide (TCO) is then layered.

Nanowires in suspension are provided to the c-Si solar manufacturer and require three new tools to be added to the production process.

The company has raised $11M from investors, including Foundation Asset Management, Industrifonden, Teknoinvest and Alf Bjorseth of Scatec, and looks to raise another $10 million to $20 million this year, claiming the ability to get to full production for less than $50 million. A modestly sized lab can crank out megawatts of wires, according to Epstein. The firm is a sister company to LED nanowire firm Glo.

Innovalight also designed PV inks, but that company, which was acquired by DuPont, uses silicon inks that raise efficiency by only one to two percentage points. Epstein notes that Sol Voltaics sells the material and doesn't license it like Innovalight. "We will sell it on a cost-competitive basis with silicon," said the CEO -- despite the nanowires containing minute amounts of gold.

When asked about reliability issues, the CEO noted that GaAs has proven its reliability over the 30 years that it has been the high-efficiency material of choice -- and a material which degrades less than silicon over time in terms of efficiency.

Once you have this magic sauce, you have to sell it -- and that leaves the challenging task of selling to Chinese panel manufacturers such as Suntech or LDK which are struggling to remain alive. Additionally, most solar manufacturers have had to cut back on R&D -- and the Sol Voltaics process requires integration into gigawatt-scale production sites, as well as capex investment in more equipment to apply and set the nanowires. The necessity of improved efficiency seems obvious, but this remains a challenging customer base.

Still, if the benefits of III-V material can be had on the cheap -- there's some potential for disruption.

The 22-person company looks to have commercial product from a pilot line in 2015 and full production in 2016.