Late last month, Silevo, an advanced silicon solar-cell startup, announced that it was building a 200-megawatt solar cell factory in Buffalo, New York.

According to the Buffalo News, the Empire State will be investing $225 million into the facilities of Silevo and LED firm Soraa, with the aim of employing 475 people at the Riverbend site. Full production is anticipated in 2015. Silevo has also agreed to spend $750 million in the region. These are the aspirational promises typically made at state-funded energy hub unveilings across the nation.

Silevo had $16 million in revenue last year and is not yet profitable, according to reports. Founded in 2007 by a team from Applied Materials, Silevo has raised $75 million in funding. The firm has a $33 million, 32-megawatt production facility in China and production facilities in Fremont, California.

Silevo Technology

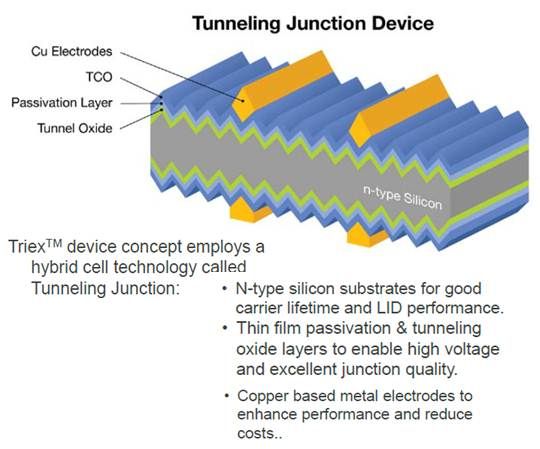

As we've reported, Silevo claims its tunneling junction device uses elements of standard crystalline silicon solar cells and elements of thin-film solar cells. The silicon-based PV cell combines n-type substrates, thin-film passivation layers and a tunneling oxide layer that yields high conversion efficiencies.

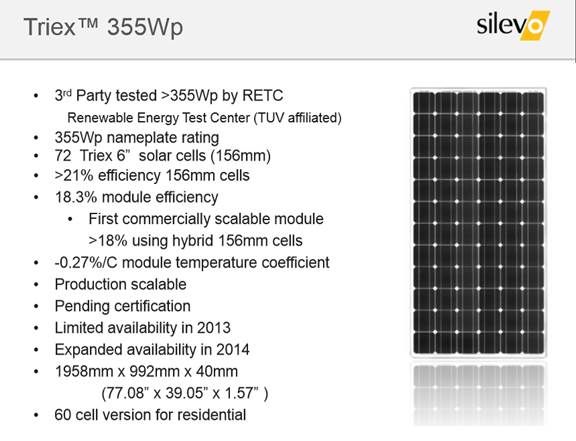

The Silevo cells’ high voltage-to-current ratio, CEO Zheng Xu has stated, make them capable of “greater than 21 percent conversion efficiency.” The hybrid concept’s use of oxide as the middle layer evolved from experimental work with metal insulated semiconductor cells carried out by solar energy pioneer Martin Green in Australia in the late 1970s. Company representatives have claimed that an 18.3-percent-efficient module with costs below $1 per watt will soon be in volume production. Silevo competes with high-efficiency panels from SunPower, Panasonic, Sanyo, and Suniva. Most vendors aim high-efficiency panels toward area-constrained applications (like Japan's rooftops), or, as in the case of vertically integrated SunPower, utility applications.

Raffi Garabedian, the CTO of First Solar, has said, "At the utility scale, efficiency is really hard to pay for," adding, "You end up paying too much for the module, and that doesn't offset your balance-of-system costs."

Solar Analyst Viewpoint

Shyam Mehta, Senior Solar Analyst at GTM Research, notes that the "highly competitive global landscape...is currently dominated by large, low-cost Chinese manufacturers." However, Silevo's "much higher efficiency of light-to-electricity conversion than most of the market can help lower overall system costs. Also, Silevo's technology produces more actual energy pound-for-pound than your average solar panel. Both of these are important, differentiated value propositions."

Mehta sees the company "focused on the rooftop solar market, since that is where the technology has the best value proposition. At the moment, the plan has to be to scale production. Currently, production volume is limited, which has made sense since the technology is very nascent and Silevo has been optimizing it for large-volume production over the last two years. However, the small scale means that the company's costs are also higher than Chinese competitors, although from what Silevo has told GTM, the costs are surprisingly low given the small scale. That's where the Buffalo facility comes into the picture."

As to whether Silevo is a good bet for the state of New York, Mehta said, "It is impossible to deny that there is meaningful risk in investing anywhere in the solar space in general. The industry is still young, very volatile and extremely competitive. Continuing dependence on subsidies also creates risk."

He added, "Going from small to high volume as Silevo is doing is a difficult process -- many solar firms have experienced delays and technical snags when scaling up." Still, Mehta called Silevo a "smart, savvy company with very promising technology, and importantly, the firm is aware of the dual importance of technology and cost-competitiveness."

Mehta also suggests that although Silevo currently manufactures cells in China, "It is not subject to either the China import tariff in the U.S. or the negotiated settlement in the EU, because both of those only apply to cells with a P-N junction, while Silevo's cells have P-i-N junction."

This is good news for Silevo and for Silevo's investors. But we've seen too many recent examples of states and localities bending over backwards to provide grants and tax breaks to untested technologies that have yielded little in return.

For now, New York's cleantech strategy includes manufacturing a startup's solar cells in Buffalo.

***

Herman Trabish contributed to this article.