With solar prices dropping in the U.S. and around the world, John Farrell noticed that the German solar boom was not flagging despite the slow, steady reduction in its subsidy.

“The trajectory looked very good for solar to be something that would work, not only from a distributed energy and ownership standpoint, but it could actually be economical,” said Farrell, the Senior Researcher and Director of Democratic Energy at the Institute for Local Self-Reliance (ILSR).

Farrell is the author of two reports: Rooftop Revolution: Changing Everything with Cost-Effective Local Solar and Commercial Rooftop Revolution. He concluded that by 2022, over 38 million homes and businesses could get solar power from their own rooftops, and pay less for electricity, without any subsidies for solar. “Together, unsubsidized residential and commercial solar at price parity could provide 9 percent of total U.S. electricity by 2022.”

Another equally important result of the reports, Farrell stressed, is the forecast that “as the economic barrier shatters, other barriers to rooftop solar emerge.”

Farrell assimilated data from the rooftop revolution reports into an interactive map that traces the progress of solar grid parity across the United States.

Farrell said utility-scale renewable generation will also be needed to achieve the necessary climate solutions and renewables goals. But, he said, “We have a regulatory system set up to favor utility-scale development, because that's how utility companies make their money; it's an uphill battle for distributed renewable energy. I don’t like to see it cast as an either-or, and with policy that levels the playing field for distributed generation, the two can work together."

He was surprised, Farrell said, “by how soon we are going to get to grid parity in various places in the country where there is this convergence of very high electricity prices and a good solar resource or, in some cases, one or the other.”

But, he said, that means “the problem we are going to have is not how to keep solar growing with subsidies, but how to deal with the fact that when it is economical, everybody is going to want to do it.”

Farrell expects third-party-ownership financing to play a complicated role. “It helps overcome major roadblocks,” he noted, “but it can also make the delivered cost of solar higher because of the middleman.” In the end, “We need it to help overcome the balkanized nature of our renewable energy markets and complex rules for incentives and interconnection, but I'd prefer if we simply made solar easier to buy and finance directly by the end user.”

As all the economic drivers come together, Farrell said, there will be “a surge in interest that is going to lead to a political and regulatory clash over the policies that would limit solar penetration.”

Demand will not outstrip supply, he said, because “more and more players will enter the market.”

The problem will be policy barriers, Farrell said. Things like permitting costs and interconnection issues will become important because of “all the people who want to cut their utility bill by generating their own electricity.”

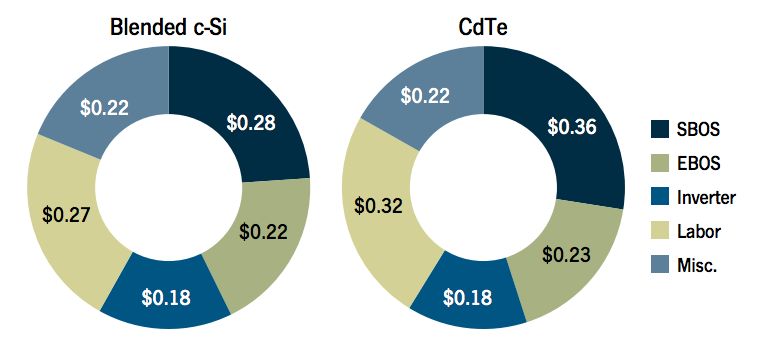

Source: Solar PV BOS Markets: Technologies, Costs and Leading Companies, 2013-2016

Implicit in the data used to create the interactive map, Farrell said, is the assumption “that we figure out what the Germans have done to cut soft costs. That is a huge part of their savings over the past four or five years.”

The main thing Farrell wants people to realize from the map is that “the solar rush is coming because of the economics, and we need to prepare ourselves -- utilities, regulators, policymakers and advocates -- in terms of better policy to embrace it.”