In First Solar’s recent defense of Arizona Public Service, it echoed the utility’s claim that utility-scale solar is the least-cost solar option.

But is utility-scale solar really cheaper than distributed rooftop solar?

In a June op-ed, First Solar CEO James Hughes contended that APS is “right to seek the highest volume of solar power at the lowest cost to rate-paying customers,” adding that “the cost per installed watt of utility-scale systems is as little as one-third that of rooftop systems.”

The two points -- that utilities should seek the least-cost option for ratepayers and that utility-scale solar costs less to build -- should be considered separately, according to Meghan Nutting, SolarCity Policy/Electricity Markets Director. The Arizona Corporation Commission staff last year concluded that distributed solar and not utility-scale solar is the least-cost renewable resource for utility customers, Nutting observed.

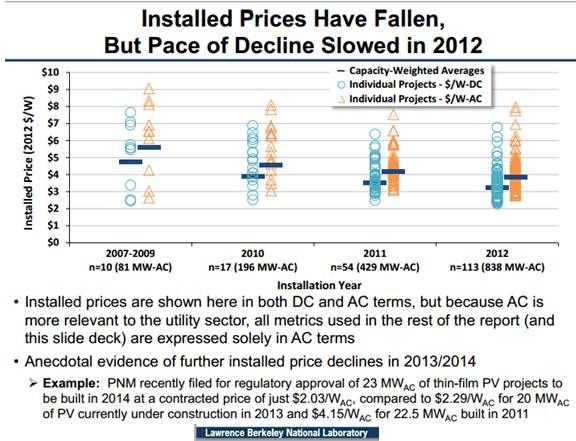

Nutting also pointed out that in Q2 2013, the national average installed cost of utility-scale PV solar was $2.10 per watt, according to the GTM Research U.S. Solar Market Insight report.

Furthermore, the installed price for utility-scale thin-film solar projects could be as low as $2.03 per watt next year, according to the just-released Utility-Scale Solar 2012 report from Lawrence Berkeley National Labs.

GTM Research put the Q2 2013 installed price for residential solar in Arizona at $4.59 per watt. But, Nutting said, most of that is covered by the system owner and tax incentives. The only cost to the utility, and therefore to ratepayers, is in utility-provided incentives. In Arizona, that is $0.10 per watt. And, Nutting added, the APS incentives fund is 95 percent expended, so ratepayers' cost for distributed solar will soon be zero.

As a regulated utility, APS must bring its plans to the Corporation Commission in a public rate case proceeding. During the last rate case, the commission staff evaluated APS proposals to support the distributed solar generation that companies like SolarCity (SCTY), Sunrun, and SunEdison (SUNE) sell and its proposals to obtain utility-scale solar projects built by companies like First Solar (FSLR), SunPower (SPWR), and Abengoa.

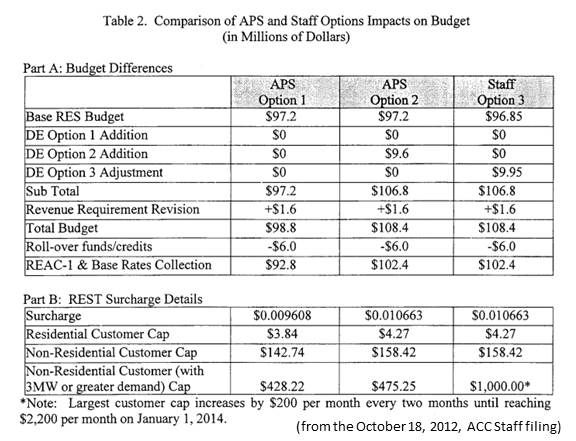

“For the largest utilities, including APS, the focus of the budget allocation should shift to placing the emphasis on obtaining the least-cost renewable kilowatt-hours,” wrote the ACC staff in an October 18, 2012 filing. That is “one of the fundamental elements of Staff’s proposed paradigm shift.”

The filing also suggested that APS should allocate 50 percent of its available renewables funds to residential PV upfront incentives, 16 percent to upfront non-residential PV incentives, 14 percent to non-residential performance-based incentives, 10 percent to residential non-PV performance-based incentives, and 10 percent for schools and government.

It recommended no funds be set aside specifically for utility-scale solar.

“Staff further recommends that this re-allocation schedule be used, starting in 2013,” the filing said. “It is time to let competition and the least-cost kilowatt-hour criteria drive the successful accomplishment of Arizona’s Renewable Energy Standard & Tariff goals.”

According to APS Renewables Policy Manager Greg Bernosky, the staff filing errs by failing to consider the cost of net metering in rooftop solar. He claims that that adds about $1,000 per solar system owner per year to the cost of distributed solar.

APS Manager of Pricing Chuck Meissner adds that the cost of the incentives discussed in the ACC staff filing are collected by the utility through surcharges that are applied equally to all customers. The $1,000 net metering cost is shifted to non-solar-owning ratepayers.

Bernosky and Meissner referenced APS data and a 2012 Navigant Research study as the basis for the $1,000 figure. This year’s estimated 19,000 solar-owning APS customers will therefore cost the other ratepayers roughly $19 million, Meissner said.

For the utility’s 1.1 million customers, that pencils out to less than $19.00 per capita, Meissner agreed. But if the net metering incentive is not altered before the next rate implementation in 2016, he noted, that could equate to $30 million, or $30.00 per customer.

Those $19 and $30 per-customer costs, based on the $140 per month average APS customer bill cited by Meissner and a lowball estimated electricity price of $0.04 per kilowatt-hour, pencil out to less than an additional $0.001 per kilowatt-hour, a figure that is too small to affect the cost comparison Nutting identified.

“The Commissioners have to realize distributed solar is the least-cost resource for APS ratepayers,” Nutting said. “APS and other utilities should build as much rooftop solar as possible before the 30 percent federal investment tax credit expires in 2016. That would get their customers the most megawatts of solar for the [lowest] expenditure of ratepayer money.”