First Solar, a vertically integrated solar power plant developer, missed Q2 revenue estimates by $201.3 million while posting revenues of $519.8 million, as announced in this afternoon's earnings call.

The company lowered its 2013 guidance and also announced that it has acquired the IP of what was once PrimeStar Solar, the cadmium telluride solar panel manufacturer acquired by General Electric in 2011.

GE (NYSE: GE), with 34 gigawatts of renewable power projects around the globe, is now one of First Solar's top ten investors, having received 1.75 million shares of First Solar common stock as part of this deal. GE will be buying GE-branded First Solar modules for potential deployment in hybrid wind and solar installations. GE and First Solar also aim to partner on inverters and basic research in addition to cadmium telluride module development.

GE held the CdTe efficiency record for a brief period of time -- until First Solar reclaimed the title. GE uses a close space sublimation (CSS) process for its CdTe, while First Solar uses a vapor transport deposition (VTD) process.

GE's last comment to Greentech Media on this topic, about a year ago, insisted on its commitment to solar and manufacturing in its Aurora, Colorado facility.

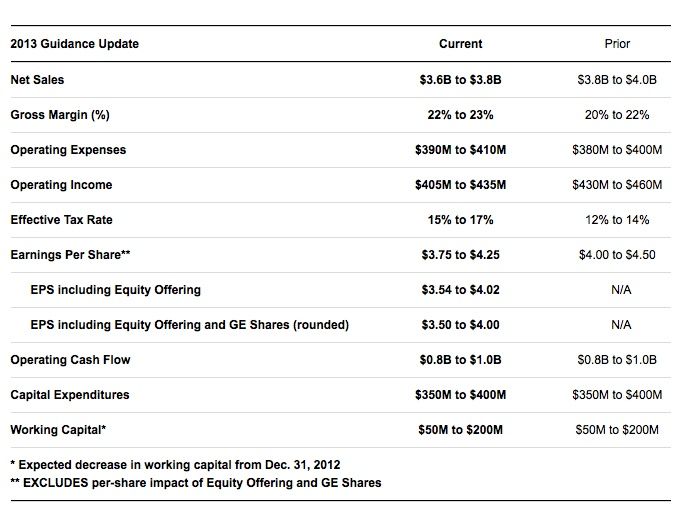

Here are the revised guidance numbers:

Some of this softening in guidance is about the timing and fashion in which revenue is recognized for solar projects and the extent to which projects are held to completion.

First Solar also announced the acquisition of Element Power's 1.5-gigawatt pipeline of U.S. and Mexico development projects.

First Solar noted that a new back-contact technology increased efficiency and lowered long-term degradation. Current module cost is $0.67 per watt.

First Solar's stock is currently trading down 8 percent in after-hours trading.