The suspense continues as microinverter and energy storage firm Enphase races to grow market share, cut costs and enter new markets. The company just announced financial results for its third quarter.

Here are the takeaways.

The good

-

Enphase reported total quarterly revenue of $88.7 million, up 12 percent compared to the previous quarter

-

It was Enphase's second-largest quarter ever by megawatts shipped

-

Gross margins held relatively steady at 18 percent, as did revenue-per-watt at $0.43 per watt (AC) -- although both are down year-over-year

-

Q4 guidance implies modest growth by revenue and megawatts

-

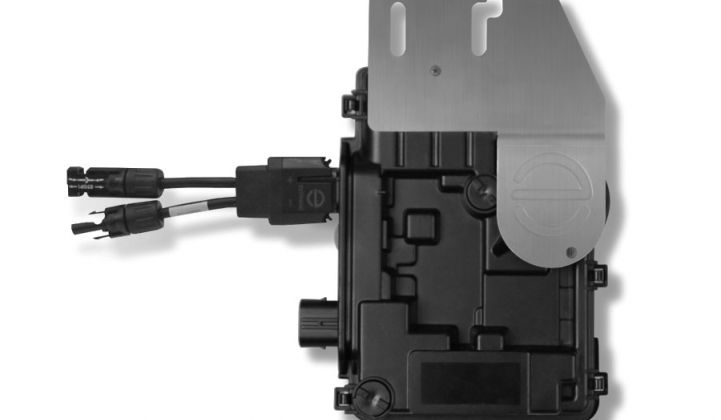

During the third quarter of 2016, Enphase sold 204 megawatts (AC) or 869,000 microinverters, all fourth- and fifth-generation designs

The bad

-

GAAP net loss for the third quarter of 2016 was $18.8 million

-

Earnings per share of -$0.28; missed consensus by $0.04

-

Revenue of $88.7 million (down 13.8 percent year-on-year); missed consensus by $1 million

-

Last month, the company announced a "restructuring," along with an 11 percent reduction in its 500-employee workforce

-

Earlier this year, Enphase entered into a $25 million loan agreement with a lender specializing in "rescue financing"

And the ugly

-

GAAP gross margin for the third quarter of 2016 was 17.9 percent

-

The company exited the quarter with a total cash balance of $24.1 million

-

Enphase raised approximately $16.2 million in net proceeds from an equity offering

Growth in residential solar has started to tail off

- GAAP net loss for the third quarter of 2016 was $18.8 million

- Earnings per share of -$0.28; missed consensus by $0.04

- Revenue of $88.7 million (down 13.8 percent year-on-year); missed consensus by $1 million

- Last month, the company announced a "restructuring," along with an 11 percent reduction in its 500-employee workforce

- Earlier this year, Enphase entered into a $25 million loan agreement with a lender specializing in "rescue financing"

And the ugly

-

GAAP gross margin for the third quarter of 2016 was 17.9 percent

-

The company exited the quarter with a total cash balance of $24.1 million

-

Enphase raised approximately $16.2 million in net proceeds from an equity offering

Growth in residential solar has started to tail off

Enphase is confronted by a cooling residential solar market.

This year, residential solar in the U.S. is going to grow 20 percent to 23 percent. "Many industries would kill for 20 or 21 percent year-over-year growth," said Shayle Kann, vice president of GTM Research, in a keynote address at the recent Solar Market Insight conference, adding, "But when you've grown accustomed to a market in which, in the last four years, the slowest growth year is 59 percent -- that does feel like a big slowdown."

Kann added, "The market isn't slowing down [at] the same [pace] for everyone. There are lots of local, sometimes regional, residential solar installers who probably would tell me that they're having a great year and expect to do the same next year."

Enphase CEO Paul Nahi said he saw a lot of upside in solar and energy storage from those same "Tier 2s, Tier 3s and the long tail [installers]." Enphase is also putting a lot of faith in the rapid growth of the Australian energy storage market.

Energy storage bookings?

When asked for actual energy storage booking figures during the earnings call, Nahi spoke of "a tremendous amount of optimism" but didn't provide figures.

Nahi did have some insight into what drives storage adoption: "So the primary driver, and when I say primary -- 99 percent of the reason that people are putting in storage in Australia right now -- is effectively rate arbitrage. That requires a storage device that can cycle multiple times a day. It means that at any given time of the day, you're either powering up or powering down your battery, and because of that and because of the cost of storage, backup we feel doesn't make a lot of sense for our battery. Chemistry as a backup is still very expensive, and it is fundamentally at odds with the use case that most people are buying it for. If you're buying it for rate optimization, you don't actually have a full battery for very long. You basically fill it up and then drain it, fill it up and drain it, multiple times a day, which means that it's not necessarily going to be there for backup when you need it. So I understand that it’s a clever marketing message to give, but unfortunately it is not a practical message for the consumer."

Despite helping to forge an industry for module-level power electronics, Enphase has found itself undercut on price by string inverters and SolarEdge's optimizer architecture. Battered by continuing quarterly losses as it fights to maintain market share, Enphase is betting it all on the short-term growth of the energy storage market -- and its own ability to develop a next-generation microinverter that's markedly smaller, cheaper and more profitable.

SolarEdge is still the U.S. residential market leader, although Enphase gained a bit in Q2. Enphase has guided revenue for the fourth quarter of 2016 to be within a range of $90 million to $100 million, and GAAP gross margin to be within a range of 16 percent to 20 percent

Scott Moskowitz, GTM Research's PV inverter analyst, sums it up: "The U.S. residential market, particularly California, has struggled to meet expectations over the past few quarters, and Enphase has had its share of financial difficulties over this time. Even so, Enphase has grown its volume of shipments by megawatts for each of the last three quarters. While questions remain regarding the company's financial health, Enphase is full steam ahead in reaching its cost-reduction goals, pursuing market share growth, and bringing its next-generation products to market."

***

Thanks to Seeking Alpha for the call transcript.