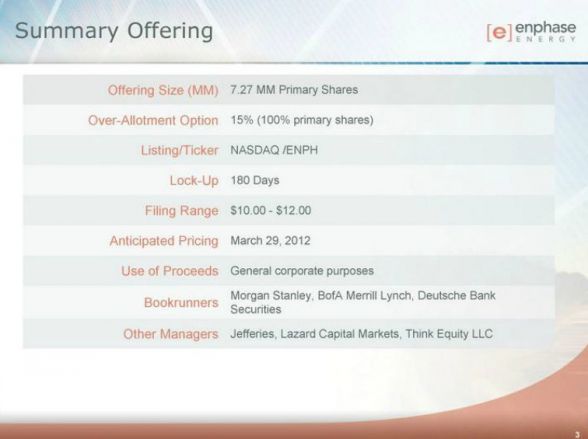

Enphase has lowered its IPO price range to between $6.00 and $7.00 -- down from the $10.00 to $12.00 per share range set earlier this month.

Enphase is the Petaluma, Calif.-based microinverter startup that has been long been viewed as an obvious candidate for IPO - expecting to trade with stock symbol ENPH.

The current pricing comes nine months after the IPO was registered with the SEC. The offer now looks to raise approximately $50 million to $58 million. Enphase looks to price Thursday for trading on Friday.

Regarding the pricing, a VC acquaintance offers this interpretation: This is simply about "supply and demand. The underwriters have to fill a book and investors have to commit to buy shares at a certain price. They weren't buying at $12."

"I've heard the book may not be filled at $6, but that will become clear soon enough."

As for why? It's a "low-margin business that has a market squeezing down on every bit of the value chain. And it's a product aimed at a relatively small -- albeit growing -- slice of the solar install market." The investor also suggested that smaller microinverter or distributed electronics firms such as SolarBridge or SolarEdge are "sweating bullets right about now."

MJ Shiao, GTM Research inverter expert, wrote an article on this topic last year posing the question, "Is Enphase a Worthy IPO Candidate?"

VC investors in Enphase include Rockport Capital, Kleiner Perkins, Applied Ventures, Madrone Capital, and Third Point Management.

Enphase has been planning its IPO with an SEC registration on file since June of 2011. The firm must periodically update that document. Here are some of the new stats:

- The firm has shipped more than 1.55 million microinverters since its founding, 1 million in 2011 alone.

- Enphase estimates that that represents about 40,000 installations.

- Canada accounted for 12 percent of revenue in 2011.

- Net revenues were $20.2 million, $61.7 million and $149.5 million for the years ended December 31, 2009, 2010, and 2011, respectively.

- Net losses were $16.9 million, $21.8 million and $32.3 million for the years ended December 31, 2009, 2010 and 2011, respectively.

- The firm expects to incur a net loss in 2012.

- At the end of 2011, the firm had 298 employees.

- Enphase market share of the PV inverter market in California for residential installations was 34.4 percent at the end of 2011, based on total wattage, with data from the CSI.

- Enphase market share of the PV inverter market in California in the 10-kilowatt to 100-kilowatt small commercial sector was 16.5 percent at the end of 2011, based on total wattage, with data from the CSI.

Late last year, Enphase announced that it was invading Europe via France, Belgium and the Netherlands, where its devices have passed Continental standards and are ready to be installed.

Inverters in Germany have their own set of rules and must come with several key grid-balancing capabilities built in. New rules require all inverters introduced to the market to come with power quality, reactive power control and power phase balancing capabilities (it’s all in the new VDE AR-N 4105 rules for generators connected to low-voltage grids, for those interested). The main point is to make sure lots of rooftop solar panels don’t cause imbalance on the grid, a problem that solar-rich German cities may be the first, but certainly won't be the last, to experience.

Other microinverter firms include Enecsys, a British startup with about one-hundredth the number of microinverters deployed as Enphase, Germany’s SMA and Power-One’s microinverter, as well as DC optimizers and other architectures from Direct Grid, SolarEdge, Tigo, eIQ, etc.

Microinverters, DC optimizers and other PV distributed optimization technologies still represented only about 2 percent of the solar inverter market in 2010, according to GTM Research. In other words, the microinverter battle is a small part of the war, and has yet to prove it has staying power.

GTM Research inverter expert Shiao also had these observations:

- Estimated costs for the quarter are $0.57 per watt (AC) versus $0.63 per watt (AC), indicating that scale and the shift to the new product are having an effect. ASPs dropped from $0.78 per watt to $0.74 per watt.

- At this point, Enphase has the microinverter market in North America cornered, and its expansion into Europe is quickly cutting off prospects for newer microinverter companies.

- Over $500 million of venture capital has poured into the space, with our estimate for the total market value for microinverters and DC optimizers to reach only $1.2 billion by 2015. The leading suppliers (Enphase and SolarEdge) combine to account for 40 percent of that VC.

- A note about consolidation: it's unlikely that many of those companies will be bought out. Centralized inverter companies have been far from enthusiastic about microinverters or producing their own DC optimization. The move into the space by Power-One and SMA seems more of an afterthought than a focus. As the U.S. and other emerging markets move toward utility-scale projects, central inverter companies may be content to cede the share of residential projects stolen from string inverters by microinverters.

The big challenges for Enphase are to keep this meteoric sales growth going amidst increasing competition, to find a path to profitability in a still difficult market, and to make it through the IPO window while the U.S. solar market grows and the EU market still exists.

***

Jeff St. John contributed to this article.

_603_237_80.jpg)