In the U.S., behind-the-meter energy storage is mostly sold to offset commercial peak demand charges. The business case works today in states such as California and New York, but it also leaves most of the battery’s value on the table, according to a new report from Rocky Mountain Institute.

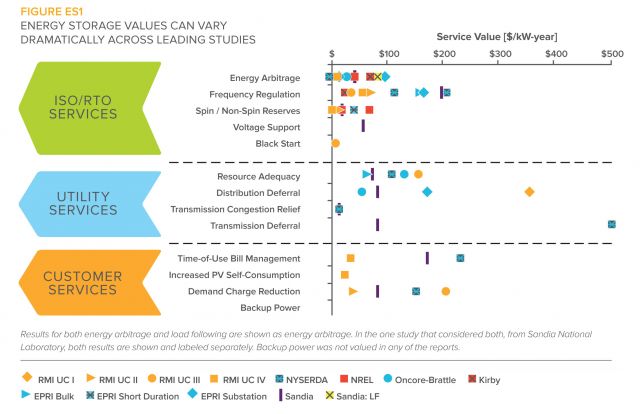

RMI’s meta review of the value of energy storage, pulling from many previous studies, found that batteries dispatched solely for demand reduction are only used for about 5 percent to 20 percent of their useful life. RMI identified 13 distinct services for customers and grid operators, but when it comes to stacking those, there is immense variation in the final cost-benefit depending on assumptions and inputs such as local utility regulations and wholesale market mechanisms.

The report was written not just to validate what progressive states like New York, California and Hawaii are doing, but also to show what’s possible in other states.

“Valuing batteries is not as simple as looking at just [the levelized cost of] solar or looking at retail or wholesale grid costs,” said Jesse Morris, manager of the electricity practice at RMI. “A lot of regulatory changes need to happen.”

To better capture the complexity, the RMI study modeled four primary use cases for batteries: commercial demand-charge management in San Francisco; distribution upgrade deferral in New York; residential bill management in Phoenix; and solar self-consumption in San Francisco.

Three of those use cases, which were paired with secondary services such as ancillary services, resource adequacy or time-of-use optimization, were revenue-positive by a small margin. The New York use case was the exception.

The study found that in the case of New York, it might be more economically feasible to use grid-scale batteries or other technologies to defer the cost of a substation. Also in the New York use case, the battery had no customer benefit, such as peak-demand reduction, which could have changed the economics.

Even though there were more cost-effective ways to meet the upgrade deferral in the modeled scenario, transmission and distribution deferral have some of the highest potential value for battery use cases if the right regulation is in place.

“It’s surprising how underutilized the battery is for any primary application,” said study co-author Garrett Fitzgerald, senior associate in the electricity practice at RMI. “Usually less than one-third of its life.”

In New York, regulatory changes are being tested. Batteries are a small part of Con Edison's $1 billion substation deferral project, the Brooklyn-Queens Demand Management (BQDM) program. But most projects like BQDM are still one-off examples of using batteries in this way.

In most wholesale markets, utilities cannot stack a fleet of batteries to sell into the market and use them for upgrade deferral at the same time. Oncor, for example, is looking for an overhaul in the deregulated ERCOT market to allow for a more than $5 billion investment in distributed batteries.

Other forward-looking states are testing new business models and allowing utilities to get creative about stacking the value of batteries. San Diego Gas & Electric, for example, has proposed a tariff for behind-the-meter batteries that would incentivize customers to let their energy storage devices be used for grid services.

Vertically integrated utilities in regulated markets provide another layer of complexity for battery vendors, as they are not required to disclose the value of grid services that are provided. However, with regulatory shifts in how utilities evaluate and pay for transmission and distribution upgrades, the picture could change.

Despite the lack of transparency, vertically integrated utilities can stack the business case themselves, argued Fitzgerald.

“They have more insight that allows them to more easily integrate a battery do six different things,” he said. “But the regulators have to push them to say, ‘You have to look at the least-cost solution.'”

RMI did not tease out the barriers to better utilization, but rather argued for the value of distributed storage in states that are just now considering the technology.

“The models we show cannot happen today,” said Morris. “We know that in electricity, the future is based on flexibility behind the meter, solar and smart controls -- and that future is a lower-cost future.”