The Renewable Auction Mechanism has been California’s preferred procurement mechanism for renewable energy in the midsize utility market of 3- to 20-megawatt projects. These solar, wind or biomass projects can provide enough power for anywhere from about 750 homes up to 20,000 homes for the biggest projects. This size is a "sweet spot” in many ways, because these types of projects can realize much of the economies of scale of significantly larger projects but can still interconnect on the distribution grid much closer to load.

The California Public Utilities Commission created the Renewable Auction Mechanism (RAM) program in 2011, with an initial 1,000-megawatt allocation to the big three investor-owned utilities (PG&E, Southern California Edison and San Diego Gas & Electric). There have been five RAM auctions in the last few years, but only a few projects have been constructed so far, because it can take up to three years after a contract is awarded for projects to come on-line.

Policymakers have been happy with the RAM program due to its streamlined approval process and standardized contracts. The California Public Utilities Commission (CPUC) has been considering an expansion or revision of the program for about a year and issued a final decision, D.14-11-042, in late November. The final decision makes major changes to the program and essentially ensures that there will be opportunities for new contracts for many years to come, albeit probably at a smaller scale than in the initial program.

The CPUC approved in the new decision a sixth RAM auction for June 2015, which will be at least 75 megawatts across all three utilities. The CPUC also approved another 200 megawatts of RAM capacity for PG&E, which is a shift of capacity from PG&E’s Solar PV Program (a similar but distinct program) into RAM. PG&E’s new RAM auctions will take place between 2015 and 2017. As such, at least 275 megawatts of new RAM contracts will be available between 2015 and 2017, and possibly more. Most of this capacity will be for peaking as-available projects (solar), but some contracts will be available for wind and biomass projects.

The CPUC approved RAM 6 as a “transitional process” between the original RAM and the new revised RAM, which I’ll describe further below. The same decision approves RAM as a streamlined procurement tool indefinitely, what I’m calling here the “revised RAM,” with the decision as to when it will be used left to each utility’s discretion. This is a big shift from the current RAM process, in which the commission defines when and how each auction is to be conducted, and for how many megawatts. Procurement choices are now, under the revised RAM, mostly discretionary for each utility, but with the standard contract and procurement process from the current RAM largely retained.

I’m going to provide a little more detail on the historical and revised RAM in the following sections.

A history of RAM and the new program details

The RAM program was approved in 2011 at an initial program capacity of 1,000 megawatts. This has since been expanded to 1.34 gigawatts due to the addition of capacity from each utility’s Solar PV Program (SPVP), and with the new decision approved in November, it was expanded up to approximately 1.5 gigawatts.

The RAM 5 auctions were held this past June, and SCE, SDG&E and PG&E attempted to contract for all of their remaining RAM capacity in those auctions. However, each IOU will hold one or two more auctions under the current program capacity in order to contract for project capacity that has been added back to the pool due to withdrawn or terminated contracts and to allocate an additional small tranche (75 megawatts) that the CPUC approved in the November decision (D. 14-11-042).

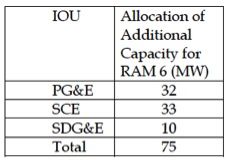

A total of 75 new megawatts was authorized for RAM 6, as follows:

The same decision granted PG&E’s request to transfer the remaining 200 megawatts from its SPVP into two additional RAM auctions to be held from 2015-2017. The most substantial new RAM opportunities will, accordingly, be in PG&E’s program, but SCE and SDG&E will have some additional opportunities beyond the new 75 megawatts authorized, particularly as additional projects from previous RAM auctions are withdrawn or terminated.

The total new total is 200 megawatts higher for PG&E (232 megawatts total), with the large majority allocated to solar (the “peaking as-available” category). PG&E will conduct auctions from 2015-2017 under this new allocation, whereas SCE and SDG&E are required only, at this point, to conduct RAM 6. Additional auctions will be discretionary and up to each utility.

RAM 6 will close by June 30, 2015. RAM 7 and 8 (perhaps for PG&E only) will very likely close on the same date in 2016 and 2017, respectively.

The decision expands the geographic eligibility for RAM projects to anywhere in the California Independent System Operator balancing area, which covers most of California and a small part of Nevada. This means that projects can be located anywhere in CAISO territory and bid to any of the three IOUs.

Projects can be interconnected to the distribution grid or transmission grid. However, a Phase II interconnection study or equivalent is now required to submit a RAM bid. The former requirement was a Phase I or equivalent study. Getting to a Phase II study for projects of more than 3 megawatts can take a couple of years, so this is not an easy requirement to meet. There are, however, many hundreds of megawatts of projects in the interconnection queues already, so we can expect, as with previous RAM auctions, many more bids than can possibly win contracts. Former auctions have seen ten to twenty times more bids than awarded contracts. RAM has always been a highly competitive program, and this is good for ratepayers if not for developers.

Projects must now come on-line within 36 months of contract award, but the timeline may be extended for up to an additional six months due to delays outside of the developer’s control. The recent decision extended this timeline by a year (up from 24 months previously), in recognition of the fact that it can take some time to overcome interconnection, permitting and financing hurdles.

The big picture

Developers in California learn one thing quickly: development is not easy, and there are hundreds of potential problems that can and often will crop up. California is, however, continuing with its fairly aggressive renewable energy programs, including this new revision and expansion of RAM.

My hope is that the utilities will use their new discretionary power to issue RAM RFPs in the next few years that go far beyond the couple of hundred of new megawatts now authorized by the CPUC, recognizing the value of these midsize projects. For this to happen, however, it is likely that we’ll need to see a new higher RPS mandate come into effect. The current mandate is for 33 percent renewables by 2020, and the utilities are on track to meet this mandate without substantial new RAM procurement.

Governor Brown recently promised that he would enact a new climate-change mitigation initiative for 2030 in order to keep California on the forefront of such efforts. There has been discussion for years of a 40 percent by 2025 and a ~50 percent by 2030 RPS, and my view is that we’ll probably see these new mandates come into force in the next year or so, if not earlier, as a key part of any 2030 climate mitigation mandate.

***

Tam Hunt is the owner of Community Renewable Solutions LLC, a renewable energy project development and policy advocacy firm based in Santa Barbara, California and Hilo, Hawaii.