In anticipation of its Phoenix Solar Summit, May 1-2, GTM continues its look at the Arizona solar industry.

Arizona’s solar energy advocates are watching their state's legislature for a possible move to undercut policies of deploying and harvesting perhaps the finest U.S. solar resource.

With traditional tax credit incentives under assault at the federal level, the states’ Renewable Energy Standard (RES) is the key policy driving growth in renewables. At current levels, the National Renewable Energy Lab estimated RES-driven generation could be more than 150 million megawatt-hours by 2015, according to an industry report.

Arizonans haggled over their RES from 2001 to 2007 before finalizing it, but certain political factions are still assaulting it, recounted Arizona Solar Energy Industry Association (AriSEIA) Executive Director Michael Neary in discussing his group’s efforts. Groups like his have to be vigilant, Neary said, because “in Arizona, there’s no telling what might happen when the local legislature goes into session.”

Arizona is not alone. In pursuit of more affordable or achievable standards, Missouri, Montana, Maine, Washington, Michigan, Iowa, Maryland, Oregon and other states have considered reducing or suspending their laws or expanding their definitions of 'renewable.' The Clean Energy Standard Act of 2012, proposed by Senator Jeff Bingaman (D-NM), replaced the congressional effort for a federal RES with a standard that added biomass, natural gas, hydro, nuclear and "clean" coal to wind, solar, and geothermal. It is given very little chance of passage.

Neary said Arizona solar advocates are on the verge of turning back the latest effort to compromise the state RES, if maneuvering to limit the power of the Arizona Corporation Commission (ACC) by Republican leaders does not prevent it.

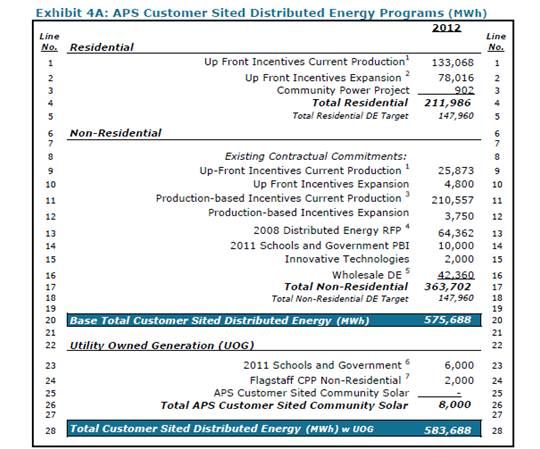

The ACC is “a constitutionally mandated fourth branch of government, in a sense,” Neary noted, adding, “The ACC created our Renewable Energy Standard and Tariff.” The RES mandates that ACC-regulated utilities, including Arizona Public Service and Tucson Electric Power, the state’s first and third largest power providers, obtain fifteen percent of their electricity from renewables by 2025. “And 30 percent of that is a distributed generation set-aside,” Neary added.

“HB 2789 started out as a bill that said any rule passed by our Corporation Commission would then have to be passed by the legislature,” he explained. Differences between the Commission and lawmakers “would go to the court, which to me is a cockamamie idea.” An amendment to HB 2789 would, Neary said, allow the legislature to block ACC rulings on renewables.

The amendment passed the legislature’s lower house because its sponsor promised supporters that its unconstitutionality, which was established in at least two separate state court decisions, Neary said, would be rectified in the Senate.

“The Goldwater Institute, which is a conservative/libertarian think tank,” Neary recalled, sued “to overturn our RES on a couple of occasions.” The state’s Supreme Court found that the most recent Goldwater Institute suit, Neary noted, didn’t even have the merit to be heard.

“Most people feel HB 2789 came from the Goldwater Institute and was an attempt to get another bite at the apple,” Neary said.

The amendment “pretty much capped our RES at fifteen percent,” Neary said. “We feel we have the votes to defeat it but we’re in the closing days of the session and the Senate President is holding the bill,” he said. “We would prefer to go to a final vote.”

Neary agreed the Senate’s Republican leadership is likely holding up the bill because the solar organization has the votes to beat it. “We are watching the calendar and trying our best to maintain the 'no' votes we have,” he said.

But “there was something good to come out of the Arizona legislature this session,” Neary noted. “We just passed SB 1229.”

Arizona’s Department of Revenue was, AriSEIA heard, considering making Renewable Energy Credits (RECs) subject to a sales tax of perhaps eight or nine percent. “It would be a windfall to the state but it would also be disastrous to some of these solar projects that were built on tight margins,” Neary said.

One way utilities get renewables “credit” toward their RES obligations is by paying homeowners a per-kilowatt-hour remuneration on solar water heating and rooftop photovoltaic (PV) systems, Neary explained. “If a homeowner got a few thousand dollars for a PV system, there would be a tax on that,” he said. “More importantly, the commercial systems that go on a production-based incentive, you could be selling a million RECs quarterly for a large system. That would wind up being a lot of money over the years, money that you didn’t build into the financials of the system.”

AriSEIA worked with the national Solar Industries Association (SEIA) and the state’s Department of Revenue to craft language that would exempt RECs from a sales tax. “We were able to pass this bill,” Neary said. “It’s on its way to the governor now.”

The triumph was, Neary added, the first successful collaboration on public policy at the state level between the national SEIA and AriSEIA since an affiliate agreement put a formal end to a split between them. “I think our legislative successes will help us make the case that companies should join AriSEIA, and SEIA, as well, because they should care about public policy.”

And, Neary made it clear, the more people in Arizona keeping an eye on the legislature, the better.