Marco Mangelsdorf is president of Hawaiian PV installer ProVision Solar and a director of the Hawaii Island Energy Cooperative. He spoke at a recent EUCI event on getting Hawaii to 100 percent renewables and other topics.

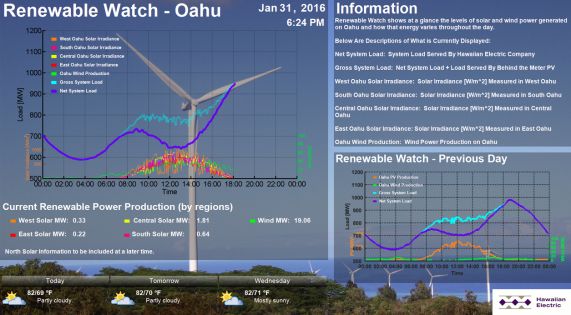

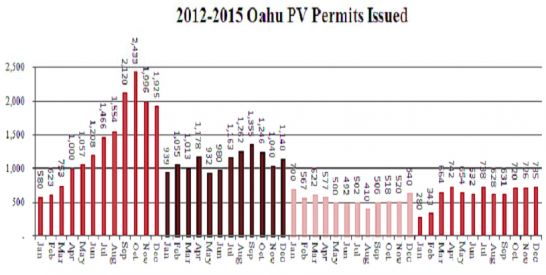

"Oahu is the biggest market in the state, and it's very interesting to see the ups and downs on what's been known as the 'solar coaster.' We've hit our peak already, as you can see, in 2012, went down in 2013, went down again in 2014 and went back up last year by approximately 15 percent, so there's been one heck of ride for people in my business."

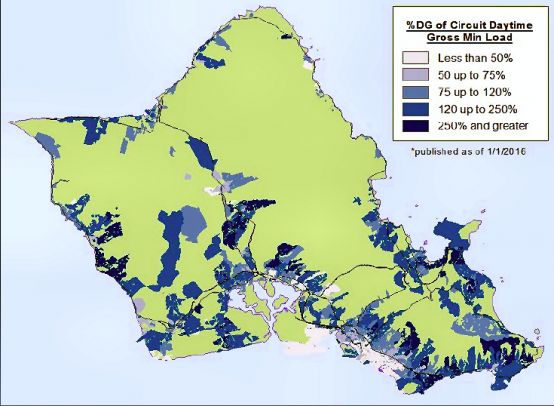

Maps of the island grid from HECO show "darker colors are representative of those circuits which have the highest penetration of rooftop solar," said Mangelsdorf, adding that Hawaii is "reaching levels of PV penetration that are unprecedented, and unprecedented for any other part of the United States."

But it's not the island of Oahu that is the harbinger of the solar industry to come, according to this installer.

"Molokai may be the future for us and the rest of the state," said Mangelsdorf, "because Molokai has reached a level of distributed generation [and] DER penetration where for all intents and purposes, Maui Electric, since the beginning of last year...has allowed very, very few new distributed-generation PV systems to be approved."

He continued, "My concern is...how much longer do we have in the rest of the state...until we reach levels seen on Molokai in terms of the door coming down and [being] closed to more distributed generation allowed to be exporting power to the grid?"

What comes next?

The veteran installer explained the new tariff system, in which the Customer Grid Supply (CGS) option credits surplus power provided to the utility at "something roughly half of [the] retail" rate.

"What effect is it having on people like me and businesses like mine?" asked Mangelsdorf. "It's not having any effect quite yet. Why? Because PV contractors did a fantastic job last year in scaring the bejesus out of a lot of homeowners after Hawaiian Electric [proposed the new tariff]. They literally went door-to-door to sign people up, trying to sign up homeowners who had not done NEM -- 'No money down, you don't pay anything, just sign the form, let us get you in the program.'"

He noted that the new tariff increases simple payback for grid-connected PV systems by 50 percent to 100 percent. He said, "Depending on one's consumption, it can push it out to maybe six to nine years, so that's clearly not in the best interest of the homeowner."

"There's also the question of how long the caps are going to last. The caps under CGS are 25 megawatts for [Oahu], 5 megawatts for the Big Island, 5 megawatts on the big islands of Maui," he said, adding that "the big question" is what happens after the caps have been reached.

Mangelsdorf also suggested that the three of the biggest installers on the islands -- Sunrun, SolarCity and Vivint -- have seen their value propositions "extremely diminished" under the CGS and CSS interconnect agreements. He said, "These three companies don't have much, if anything, in terms of a product offering today to replace the killing they were making under the NEM program."

The storage gold rush?

"There's so much buzz about [energy storage]. It will be wonderful and glorious when it does happen, but when that's going to happen, no one really knows. As far as I can tell, looking at the data, it's not happening now...and it's not going to happen in the near term."

He challenged the audience: "Anybody want to take a guess at how many customer self-supply applications HECO, MECO and HELCO have received as of today? 500? 250? 100?" According to Mangelsdorf, the total is one. "That's one customer self-supply application for all three companies."

"That to me does not indicate a gold rush or a rush of any kind for homeowners going for battery-based systems," he said.

According to a company spokesperson, SolarCity hasn’t begun offering the self-supply products yet, but will begin this spring.

Ravi Manghani, GTM's senior storage analyst, confirms that a payback period of five to seven years is about right for the grid supply tariff. He notes, "Self-supply using solar-plus-storage only marginally improves economics for certain segment of residential customers that have large evening loads. Adding storage can add another level of complexity that very few customers will be comfortable with, so it's part of natural adoption behavior." He added, "The self-supply tariff went into place only in October. It will take a few months for vendors and installers to set up the necessary infrastructure to start actively deploying."

The gospel according to Marco

"The gospel according to Marco is that utility companies will always, always, always be criticized for not doing more when it comes to renewable energy. Unless and until they were to open up the grid to everybody with little or no restrictions, and that simply can never happen, because the utility is a public good that must be maintained properly for the benefit of everybody who [relies on] the utility company. Just like you can't have everybody [who wants to] go on a freeway with their bicycle, their skateboard, their horse and buggy, on horseback -- that is simply not practical," he said.

As for the threat of grid defection, he said, "Defecting from the grid is a hell of lot more hype than it is reality. I've lived off-grid, and it's a vastly different lifestyle. I'm absolutely convinced that there is only a...[very] small minority of people who would be willing to put the energy and effort into living off-grid. Grid defection -- it's not going to happen in the near term"

Mangelsdorf remains rooted in reality. "I'm a lot more concerned as a business owner about near-term revenue, about paying my bills, paying my employees in the months and the years to come than about whether the state is reaching 100 percent renewables...29 years from now."

"In the near term, I think there's going to be a substantial drop-off in the number of new system sales this year based on a number of factors, not least of which is that we're now in the post-NEM world. I think...a number of these finance companies will all be leaving our shores...in the weeks and months to come," Mangelsdorf said.

He added, "SolarCity lost several hundred million dollars in one quarter last year. I can't afford to lose $300 million in a quarter. I can't afford to lose $300,000 in a year, so I'm competing against companies that can afford to lose hundreds of millions of dollars a quarter. On the flip side of that, how long can a business model last where these companies are losing such sums of money?"

He stressed that "battery storage on either side of the meter will not make much of a difference in the near term," adding, "the reduced post-NEM value proposition will cause a significant drop in new system sales in 2016 compared to the 2015 uptick."

He concluded, "You can't just talk the talk about renewable energy being a great and wonderful thing. It has to be good for everybody, it has to be cost-effective -- and even though my business is suffering from a drop in sales, it's still the right thing to do."