"We're back to growth," proclaimed SunPower CEO Tom Werner at the solar company's annual analyst day.

Analyst days at any company tend to be optimistic affairs -- and last week's SunPower briefing was no exception. But this episode was actually chock full of news. (Here's the presentation [PDF] and a link to an audio archive.)

"We are a technology company," said the CEO, with "new technologies across the supply chain." He cited 30 years of holding the title of the world's highest-efficiency solar cell.

Werner said that the company looks to ramp its panel capacity to 4 gigawatts by 2019, utilizing technology from its recent acquisition of Cogenra.

SunPower announced the acquisition of solar carport specialist Solaire Generation last week, as well. GTM Research's MJ Shiao notes that although "the overall commercial market has been relatively flat, the carport market has seen modest growth over the past few years. Despite higher build costs, carports can lower the overall cost of a project portfolio by amortizing fixed costs over a larger system. Solaire has been a leading supplier of solar carports and its focus on aesthetics and quality is a strong match for SunPower."

Here are six key takeaways from SunPower's presentation.

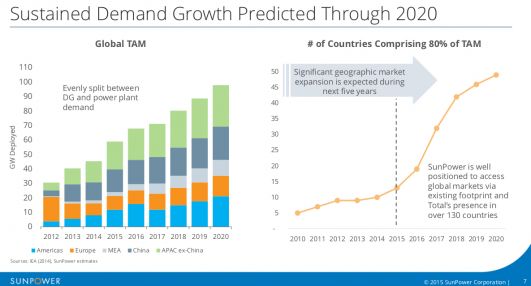

Solar will be a $200 billion market by 2020

"It's time to grow again," said the CEO. "Solar is a $200 billion market by 2020" with 50 percent of the demand coming from Asia and China. He added, "The size of the opportunity going forward is a multi-trillion[-dollar] opportunity. There aren't many markets with multi-trillion opportunities."

Werner acknowledged that the North American market is going to get "a breather" in 2017 following the loss of the ITC. He suggested that an increasingly international market is going to require the ability to "scale channels."

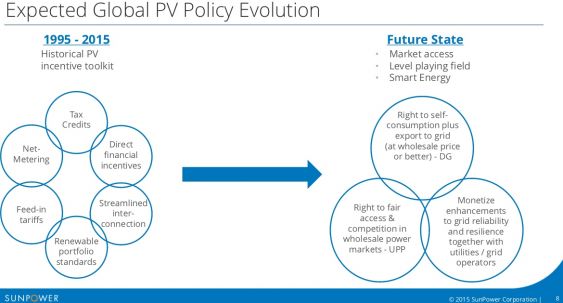

Policy moving to market economics

Werner said that the policy environment over the last 20 years has been driven by incentives and feed-in tariffs "which create supercharged markets" that "come and go." What Werner sees going forward is a market orientation that is "more about access to the grid" and is increasingly subject to "market economics."

He said SunPower believes that "businesses win in transition," and noted that the Investment Tax Credit in the U.S. was likely to change in 2017 at the same time as policy changes are imposed in Japan.

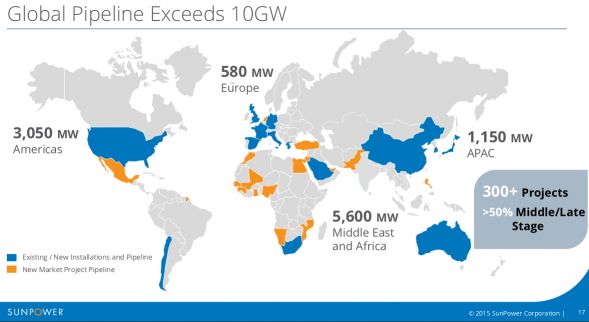

International business leverages Total relationship

With help from its parent company, Total (the largest company in France), SunPower looks to grow in South Africa and other parts of Africa, as well as in France and Turkey. The company is ramping its panel capacity to 4 gigawatts by 2019 including more than 2 gigawatts of low-cost panels for global markets. SunPower is pushing for a 20 percent to 30 percent reduction in installed system cost by 2018.

Cogenra acquisition provides lower-cost panel line

Those gigawatts of low-cost panels for global markets alluded to by Werner are going to be enabled by technology acquired from startup Cogenra. Funded by Khosla Ventures, Cogenra's original business plan targeted low-concentration PV technology. Cogenra's CEO and founder Gilad Almogy is a former senior VP at Applied Materials. Its COO, Ratson Morad, was a member of Solyndra's founding team and a former COO at Daystar.

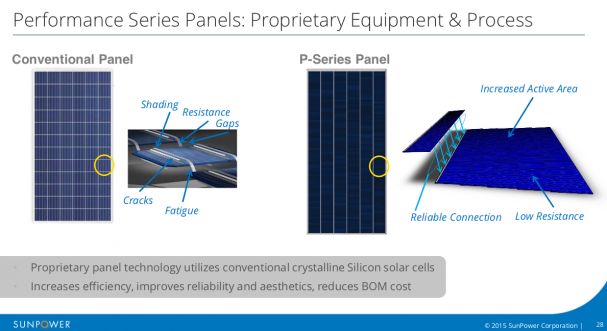

Although the low-concentration PV (LCPV) firm had some small commercial success, the startup pivoted to focus on its wafer assembly and module construction business instead -- a technology necessitated by the high temperatures faced in LCPV applications. The process involves "singulating" conventional solar cells and bonding them in a shingle-like fashion. The process gets rid of the ribbon, improves reliability and reduces non-active area. The Cogenra team has a background in process tools and is now back to designing capital equipment to scale this technology.

The larger 350-watt panel generates 15 percent more power than a conventional commercial panel, according to SunPower.

Werner said that its new lower-cost module line will produce panels with efficiencies of 17 percent to 19 percent while leveraging the "60 gigawatts of existing cell capacity." He called the Cogenra module technology "complementary" and "worthy of the SunPower brand."

SunPower still setting efficiency records

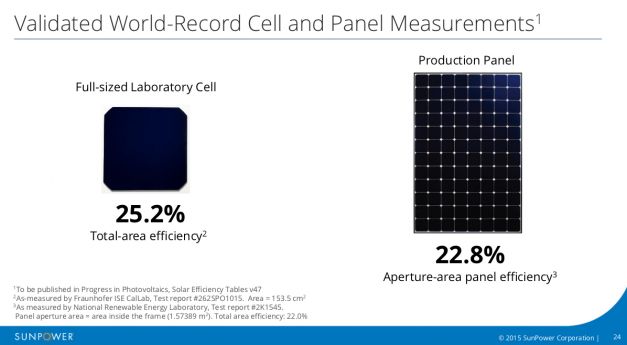

SunPower announced a new, soon-to-be-published solar cell record of 25.2 percent and an aperture-area panel efficiency of 22.8 percent, as measured by Fraunhofer ISE CalLab.

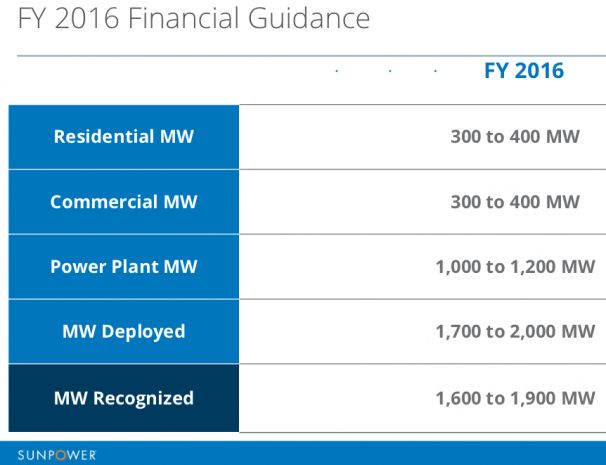

Strong beat on 2016 guidance consensus

SunPower issued its 2016 revenue guidance on the day of the analyst call -- a non-GAAP total of $3.3 billion to $3.5 billion, beating the $3.03 billion consensus. Deployments are to grow to 1.7 gigawatt to 2 gigawatts -- up from 1.15 gigawatts in 2014. Gross margin is expected to drop to 13 percent to 15 percent from last year's 23 percent to 24 percent.