A few weeks ago, we learned that Vivint Solar, the solar division of home security and automation provider Vivint Inc., had filed for an IPO that could happen as soon as this fall. The confidential filing leaves many questions unanswered, but we’ve rounded up the most important background information you should know about this residential solar powerhouse.

National market share

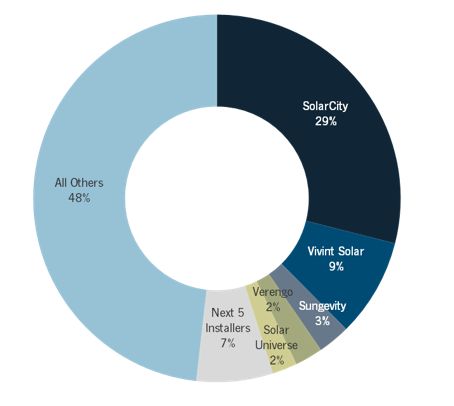

Vivint Solar is the youngest of the top ten residential solar installers, but has held the No. 2 spot since the beginning of 2013, making it one of the fastest-growing companies in the industry.

FIGURE: Leading U.S. Residential Installers, Q1 2014

Source: GTM Research U.S. PV Leaderboard

Despite being the No. 2 installer, Vivint still falls behind several companies, including SolarCity, in terms of the total capacity of financed solar (complete third-party financier rankings are available in the recently released report U.S. Residential Solar Financing, 2014-2018).

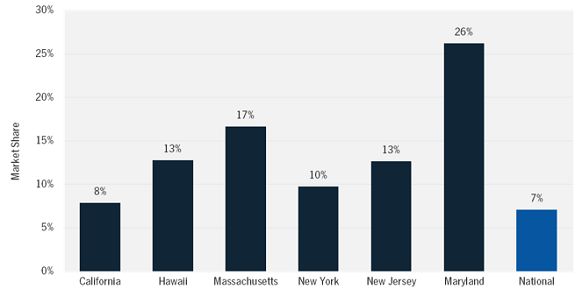

Regional presence

Surprisingly, Vivint is active in far fewer markets than other national installers such as SolarCity, Sungevity, and Solar Universe (which are active in a dozen or more states). Instead, Vivint has put all of its sales efforts into just six states, not including its recently announced expansion to Arizona. The large gap between SolarCity and Vivint is most drastic in California, but Vivint has beat the national leader in New York and Massachusetts for the past several quarters.

FIGURE: Vivint's State-by-State Market Share, 2013

Source: GTM Research U.S. PV Leaderboard

The installer’s expansion to the Phoenix, Arizona area, announced in June, is perhaps its biggest test yet. State property taxes on leased systems that came into effect at the beginning of the year will add more than $150 to the cost of an average system during the first year of production, negating the savings of many leases. A lawsuit filed by SolarCity and Sunrun against the Arizona Department of Revenue illustrates the severity of the threat to third-party-owned solar.

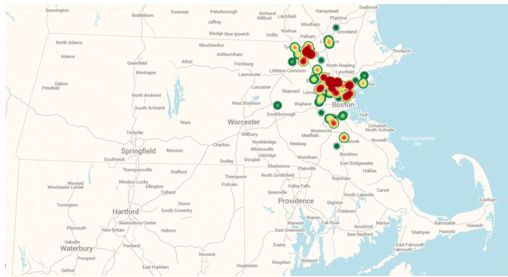

Sales strategy

Vivint Solar is well known for its sales model, which was adopted from its parent company Vivint Inc. and consists almost entirely of door-to-door soliciting (in addition to referrals). This strategy may explain the company’s slow expansion to new states, as it requires hiring a large sales team. The map below shows just how concentrated the door-to-door sales method must be, even when implemented in a small state like Massachusetts. Vivint’s acquisition of Solmetric was meant to further increase the efficiency of its door-to-door sales by allowing sales reps to take roof measurements, create a preliminary design, and potentially close the sale on the first visit. The installer even foregoes state incentives in some cases to speed up the installation process.

FIGURE: Vivint Solar Installations in Massachusetts, Jan. 2012-June 2013

Source: GTM Research report U.S. Residential Solar PV Customer Acquisition

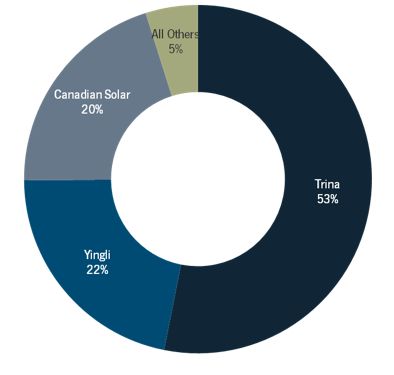

Suppliers

Vivint’s overall business model involves simplifying as many areas of its operations as possible, such as using one primary sales method. Another key area to which this applies is its suppliers. Vivint Solar’s top module suppliers in 2013 were Trina Solar (also the leading supplier to SolarCity) followed by Yingli Solar and Canadian Solar -- three of the top five suppliers to the U.S. residential solar market, according to the GTM Research U.S. PV Leaderboard. The installer also uses just one inverter supplier, Enphase Energy, partly due to the flexibility that microinverters offer for making last-minute changes during installation. Just last week, the two companies signed a three-year strategic agreement to continue this supply relationship. Vivint Solar used only Zep Solar mounting structures until that supplier was acquired by SolarCity.

FIGURE: Module Suppliers to Vivint Solar, 2013

Source: GTM Research U.S. PV Leaderboard

Financing strategy

Vivint Solar is one of the industry’s two completely vertically integrated financiers, meaning it both finances and installs systems. Its consumer financing options are limited, in line with the rest of its streamlined operations. Originally, the installer only offered power-purchase agreements, but it has recently added a lease option. Vivint Solar is the only leading financier that has shown no signs of intending to add a loan product.

The sources of Vivint’s solar project financing have been one of its biggest mysteries. Since 2011, the company has announced enough tax equity funds to support close to $1.1 billion of residential installations (and has possibly raised more undisclosed funds). However, only the first $75 million fund specified an investor, U.S. Bancorp. We also don’t know whether Vivint Solar has received any project funds from private equity firm Blackstone Group, which acquired Vivint Inc. for $2 billion in 2012.

Along with the imminent IPO, we’ll be watching Vivint for further expansion, both within its current state markets and into new states (Colorado, Connecticut, and Nevada are likely next moves), as well as its first securitized portfolio.

***

Nicole Litvak is a solar analyst at GTM Research covering the U.S. downstream market, including the U.S. PV Leaderboard.