The growth of distributed energy resources such as rooftop solar, behind-the-meter batteries, electric vehicle chargers and intelligent load controls is changing the world of building energy management and pushing the world’s biggest building technology and controls vendors to buy up software that can offer them greater control over these grid edge resources.

In the latest example, Emerson, one of the country’s biggest industrial, commercial and residential automation and HVAC systems providers, is acquiring OSI Inc. for $1.6 billion. The all-cash transaction is expected to close in early 2021 and will create a “complete electric utility solution from generation to metering,” according to Emerson’s press release.

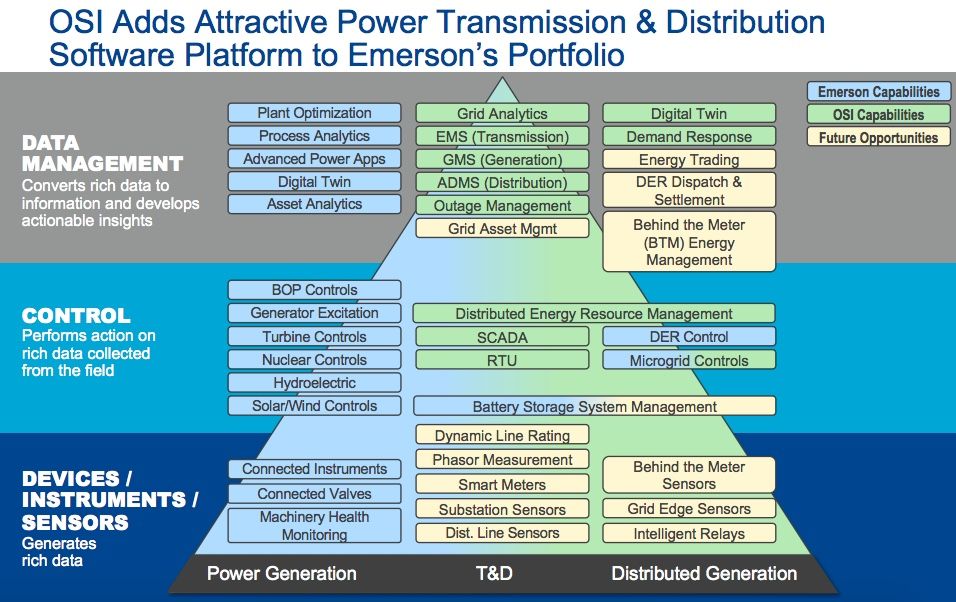

Emerson, beyond being one of the country’s biggest commercial and industrial HVAC systems vendors, is a provider of control systems for industrial facilities, including power plants. It’s also a long-time player in grid-enabled devices such as smart thermostats and remote-controllable water heaters.

OSI, which stands for Open Systems International, has a broad utility software portfolio, ranging from supervisory control and data acquisition systems and software for utilities to operate distribution and transmission grids, to the back-office IT systems supporting utility geographic information systems, outage management and data analytics.

OSI is also a player in the nascent field of distributed energy resources management systems, or DERMS, a term that applies to many different approaches to integrating DERs into grid operations and energy markets.

OSI’s DERMS is a utility-centric implementation, as opposed to systems built around fleets of DERs bidding their aggregated energy and flexibility into energy markets. More than a dozen U.S. utilities use it today, most of them also users of the company’s advanced distribution management system, according to Wood Mackenzie’s latest report on DERMS technology vendors.

OSI’s DERMS customers include California’s Sacramento Municipal Utility District (SMUD), New Jersey’s PSE&G and Oregon utility Portland General Electric. As with many other utility-centered DERMS, these partnerships are building on a scaled implementation of many other grid functionalities, such as volt/VAR optimization and fault location, isolation and service restoration, on the path toward integrating DERs.

Portland General Electric, for example, has worked with OSI Inc. since 2006 and has spent years working toward a recently launched, broad-reaching DERMS initiative seeking up to 200 megawatts of “distributed flexibility,” ranging from demand response to solar-battery virtual power plants. SMUD has also spent years building an integrated grid operations center and collecting and analyzing data on how DERs are affecting its system on its way to a DERMS rollout.

There are many competitors in the DERMS space, ranging from grid giants such as Siemens, General Electric and Hitachi ABB Power Grids to startups AutoGrid, Enbala, Opus One, Smarter Grid Solutions and Alarm.com’s EnergyHub.

Several DERMS providers have already been brought under the wing of global energy companies. Centrica bought REstore, and Engie has taken a majority stake in Tiko and invested in Kiwi Power. These DERMS are largely built around platforms that concentrate on aggregating and optimizing fleets of behind-the-meter DERs owned by residential, commercial and industrial customers.

OSI Inc. sits in a category of independent companies with wide-ranging utility software products. Another comparable software provider is Open Access Technology International, which works with utilities on applications ranging from volt/VAR optimization to intermittent renewables forecasting for grid operations, and is also working with utilities like Hawaiian Electric on DERMS.

Emerson’s press release on its OSI acquisition details how the two companies’ product lines and utility services complement each other and add up to a combined $5.4 billion market for their software offerings.

OSI has been a growing competitor in the North American utility advanced distribution management system market in recent years, competing largely with market leaders Schneider Electric, Hitachi ABB Power Grids and General Electric, according to Ben Kellison, WoodMac’s director of grid research.

This strength in transmission and distribution grid operations software, and its ability to manage a host of utility capabilities as modular additions to this integrated platform, is a good complement to Emerson’s strengths in power plant operations, asset management and analytics, Kellison said.