For a while, residential storage was talked about everywhere, but almost impossible to find.

The quarterly tally from GTM Research stood out more for how few batteries made it into homes, even as Powerwall mania raged. But times have changed.

With the final data in from 2017, it's clear that the megawatt-hours of storage deployed behind the meter increased by 79 percent year-over-year, setting records for the residential and commercial segments. The megawatt-hours deployed behind the meter in Q4 alone grew 362 percent compared to Q4 2016, according to GTM Research's latest Energy Storage Monitor, released last week.

Within that category, residential storage saw precipitous growth: 248 percent year-over-year growth in 2017, measured in megawatts.

Corporate consolidations have turbocharged small startups with multinational brand recognition and fat balance sheets. Regulatory changes have given birth to new markets and are incubating several more. And several leading companies have scaled up their storage business to substantial volume.

"2018 is the year that the groundwork laid in 2017 for behind-the-meter market players will bear fruit," said Brett Simon, energy storage analyst at GTM Research. "This year, we’ll see their discussions turn into actionable deployments."

Here are the key trends to watch as the flourishing begins.

Market momentum

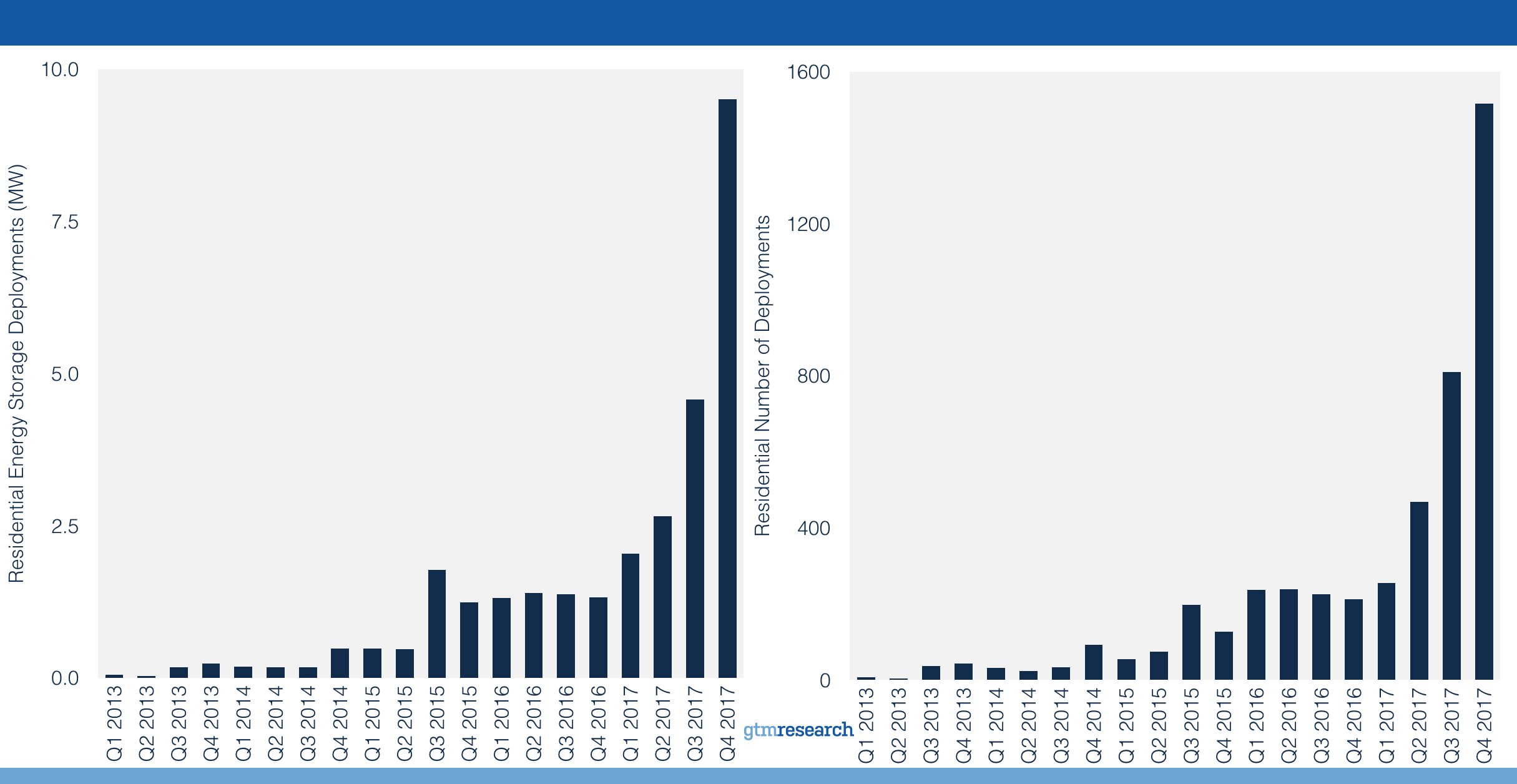

The U.S. residential storage market failed to exceed 240 deployments in any quarter of 2016, according to GTM Research's accounting of grid-connected systems. The total achievement for 2016: 914 systems.

Last year, the deployments chart went into full-on hockey stick mode.

Q1 laid down 255 systems, beating every previous quarter. But then Q2 posted 468, followed by 810 in Q3 and 1,516 in Q4.

That means Q4 alone outperformed all of 2016 by 1.7x, and 2017 as a whole tripled the number of systems deployed in 2016.

System count tells us about how many residential deals are happening and how many customers are entering the market, but it doesn't capture the scale of capacity. Measured on the basis of megawatts and megawatt-hours, though, the hockey stick persists.

2017 was the year residential storage deployments started to surge, whether measured in megawatts or number of systems. (Source: GTM Research)

Measured in megawatts, residential in Q4 grew 108 percent quarter-over-quarter and 619 percent year-over-year. In megawatt-hours, it grew 95 percent quarter-over-quarter and 917 percent year-over-year. Note that the growth in energy capacity outpaced growth in power capacity, mirroring the trend toward longer durations that we've seen in larger-scale battery systems.

Taken together, these graphs convey a natural suspense: When you see the trend line shooting skyward, you want to see how far it goes next.

Such continuous growth is by no means guaranteed, but several factors suggest it can happen. One is that system costs keep getting better and options for residential customers keep on growing. As the industry grows, so too does its lobbying efforts to create a more amenable policy and regulatory landscape.

The growth so far has come almost entirely from early success in California and Hawaii.

"Storage is still not economical everywhere -- it’s not like some magic switch has flipped," Simon noted. "But it is becoming more economical in more locales as we see changes to net metering rules and utility tariffs."

In the last year, other markets have started inching into the picture: New York, Massachusetts, Arizona, New Jersey -- even Texas.

GTM Research's analysts anticipate megawatts and megawatt-hours deployed will roughly quadruple in 2018 compared to 2017.

Sunrun's big play

For the residential industry to grow, major companies have to take it seriously, and that's starting to happen.

Tesla largely kicked off the home battery craze, and played a central role in the quiet early days of the market. Interestingly, Tesla dominated 100 percent of the residential projects interconnected in 2017 with funding from California's Self-Generation Incentive Program, and 82 percent of the funds reserved in 2017. Next up came LG Chem, with 15 percent of funding reserved.

SGIP market share does not translate directly into overall market share, but it does paint a picture of what's happening in California, the leading home storage market. The vendor landscape finally is becoming more democratized, which means more options for consumers and more competition.

Currently, the biggest challenger to Tesla is fellow rooftop solar specialist Sunrun. That company seized the rooftop solar market leader title from Tesla/SolarCity, and is gunning for share in the battery market with its LG Chem-powered BrightBox package.

"We're in the middle of a transition," Executive Chairman Ed Fenster told me. "As we move toward home solar and battery service, our offering becomes more compelling to customers; it's a better value proposition for us; it strengthens the grid and provides other ancillary service revenue opportunities with utilities; and over time, it insulates you from certain regulatory changes."

In quarterly earnings last week, Sunrun reported that 20 percent of its California solar customers now choose to add storage. In Hawaii, it's close to 100 percent, in response to the local utility's Customer Self-Supply tariff. The product recently expanded into Arizona, Nevada and New York, and, last week, to Massachusetts.

Those state-level expansions entail more than just putting up ads. As Fenster explained to me, before Sunrun moves into a market, it spends considerable effort examining all the relevant permitting rules and regulations governing interconnection of such systems. The company works with the relevant authorities until it believes the rules are sufficiently clear to allow business to begin.

After that work has been done, a whole ecosystem of storage vendors and installers can benefit from it.

Once the industry can standardize storage and solar-plus-storage offerings, and word of mouth starts to spread from early adopters, this industry will see compounding growth the way early rooftop solar did, Fenster said.

As such, he thinks 2018 will be when the attachment rate, which measures how many solar customers get storage too, starts to become a significant factor in the rooftop solar business.

Other vendors are growing as well. Sonnen has been chasing a more high-end clientele with its higher-cost system; its signature strategy will put a few thousand systems into an eco-chic housing development in Arizona. Mercedes-Benz entered the U.S. market with a partnership with Vivint, but hasn't made much noise since that time. A smattering of smaller players rounds out the bunch.

That leaves a long way to go until a mature competitive landscape develops and the full addressable market gets tapped.

Resilience now

The nonstop barrage of storms, earthquakes and fires last year made it impossible to ignore the fragility of a grid connection.

When a disaster comes along, it prompts a lot of generic statements about how people are finally realizing the value of resilience. In the immediate aftermath of storms, these assertions rely more on feeling than on hard evidence of changing consumer behavior.

The resilience bump has been largely nonexistent for microgrids, where even the ravages of Superstorm Sandy failed to spur more than a handful of deployments in the five years since. Those microgrids, though, had to navigate lengthy municipal planning processes and relied on grants from various levels of government to move forward.

Storage, on the other hand, only needs a homeowner to say yes.

Many projects require $10,000 or more in cold, hard cash, but several programs offer no-money-down "energy security as a service" programs. That means that a major event, like the nor'easter that knocked out power near GTM headquarters in Boston last week, can translate into home storage sales in a matter of weeks or months rather than years.

IRS drops hints on retrofits

The Internal Revenue Service released a private letter ruling in March granting the 30 percent Investment Tax Credit to a married couple that retrofitted a battery onto an existing rooftop solar system.

This decision can't be used as precedent for other customers' claims, but it lays out the IRS' thinking: If the ITC goes to solar projects, and to battery projects that charge from those solar projects, it follows that a battery solely charging from an existing solar array should qualify as well.

It's too early to know just how this will affect the market, but it's clearly a positive development for the industry. It's easier and more cost-effective to just add storage onto new-build solar, but there's still an ample population of solar customers who could be facing net metering rollbacks in the coming years and want some way to consume more of the power they produce. Or they're tired of continuing to lose power when the grid goes down.

If this private letter ruling crystallizes into a formal rule, those customers will have a much easier time saying yes to storage.

Tesla's power plant ambitions

The points listed above focused on the U.S. market, but I'll close with a mention of Tesla's plan for a 50,000-home distributed battery plant in South Australia.

The idea is to aggregate power from all those solar-paired Powerwall 2 units to provide 250 megawatts of flexible capacity for the grid by the summer of 2022. Those are simply mind-boggling numbers in the context of today's storage market. If Tesla can truly deliver on that, it will mean a new day has arrived for residential storage.

Let's wait to see that happen. First, Tesla needs to deliver systems to 1,100 public housing units as part of a trial phase. If that succeeds, South Australia will have to cobble together the $800 million it will need to buy the Powerwalls it wants to give away.

If this proves to be more than a splashy announcement conveniently timed before a quarterly earnings release, it will set a new standard for the scale and usefulness of home batteries. And it could challenge other companies to push the envelope on their ambitions, too.