The U.S. market for non-wires alternatives is still in its infancy.

Energy efficiency, demand response, distributed generation, batteries, EVs and other sources of grid edge flexibility are starting to take the place of improvements to a utility’s “wires” infrastructure. But NWA isn't so much a market. It's more of a collection of regulation-driven utility projects.

Not everyone calls them NWAs, either. That’s the preferred term in New York’s Reforming the Energy Vision initiative, which is driving the lion’s share of projects in the country, including Con Edison’s groundbreaking Brooklyn Queens Demand Management program.

But in California, they’re being called distribution deferral opportunities, and other states have their own descriptions for the same fundamental concept — as well as their own regulatory models for how utilities and NWA providers can share in the financial benefits.

This lack of common nomenclature is matched by a lack of commonly accepted standards for how to compare and contrast the values of wires versus non-wires opportunities, particularly down at the distribution grid level. That’s because NWAs are being rolled out amidst broader efforts by regulators and utilities to deploy the technology and integrate the data to make these kinds of measurements possible in the first place.

It’s important to remember this relative lack of data when assessing the findings of the latest GTM Research/Wood Mackenzie Power & Renewables research note on U.S. non-wires alternatives opportunities. “We’re trying to create metrics that provide answers to questions that people have been asking about for the last year, prior to having enough information to have definitive answers,” Ben Kellison, head of grid research, said. “This is an ongoing development, for projects that have such long timelines and such a small sample size," with fewer than 200 NWA projects nationwide, he said.

Still, what information is available supports several important insights about the NWA opportunities across the United States.

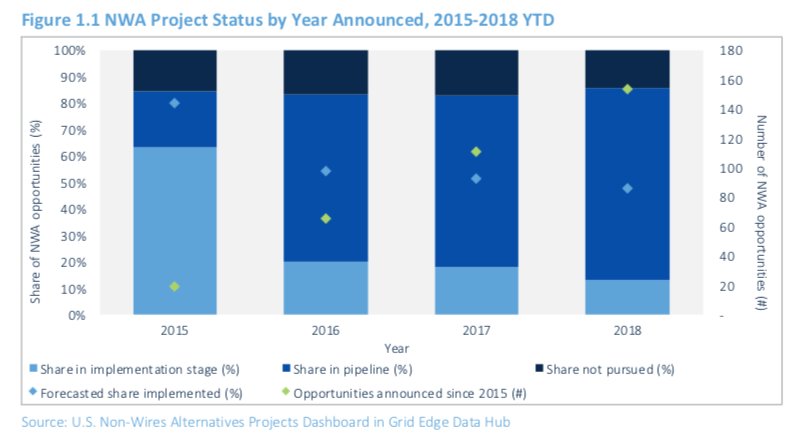

Take the first data point presented in the research note: Roughly 80 percent of the NWA opportunities identified at present can expect to reach completion eventually. Given that NWAs now take years to complete, project developers are eager for more data on how likely it is that they will emerge with something to show for their effort.

To get its 80 percent figure, the research note looks at the 19 NWA opportunities identified in 2015, Kellison said. Before that date, NWA projects were too rare to make meaningful comparisons. And projects identified after that date haven’t had enough time to go through the process to reach a terminal phase leading to implementation or cancellation.

But opportunities identified in 2015 have been around long enough to see 63 percent of them implemented and another 16 percent canceled, with the remaining 21 percent still undecided. Using a Bayesian inference approach, the analysis extrapolates an 80 percent implementation rate for the projects identified in that year — and a predictor of possible success rates for future years.

"The accuracy of this approach is directly tied to the quantity of available data in a particular timeframe,” according to analyst Daniel Munoz-Alvarez, the note's author. “As uncertainty clears out, we will have a clearer picture of the rate of successful NWA projects.”

"We could improve our predictions of success with a better understanding of the factors that lead to cancellation," Munoz-Alvarez said. Unfortunately, one of the key points of the research note is that “significant omissions and uncertainty remain” around the criteria that utilities are using to approve or reject NWA proposals.

“Transparency is important,” and today’s utility processes for forecasting load growth and DER supply, identifying grid deficiencies in need of investment, and finding those that could be subject to NWA solutions, “is not very transparent — it’s all up to the utility, and it’s not clear if it’s formalized or not.”

In California and New York, utilities are under regulatory mandate to shed light into the machinations of their distribution grid planning “to be sure they’re incorporating checks to ensure that alternatives to those projects are considered, and whether they make sense or not,” he said.

But at present, New York’s utilities do not report justifications for screening out T&D projects for NWA consideration, not even when the projects satisfy New York Public Service Commission-approved NWA suitability criteria, making it difficult to judge why projects were rejected. And in California, utilities have raised data privacy and security concerns in delaying or redacting reports detailing the methodologies behind their grid investment forecasts and identifying candidates for distribution deferral.

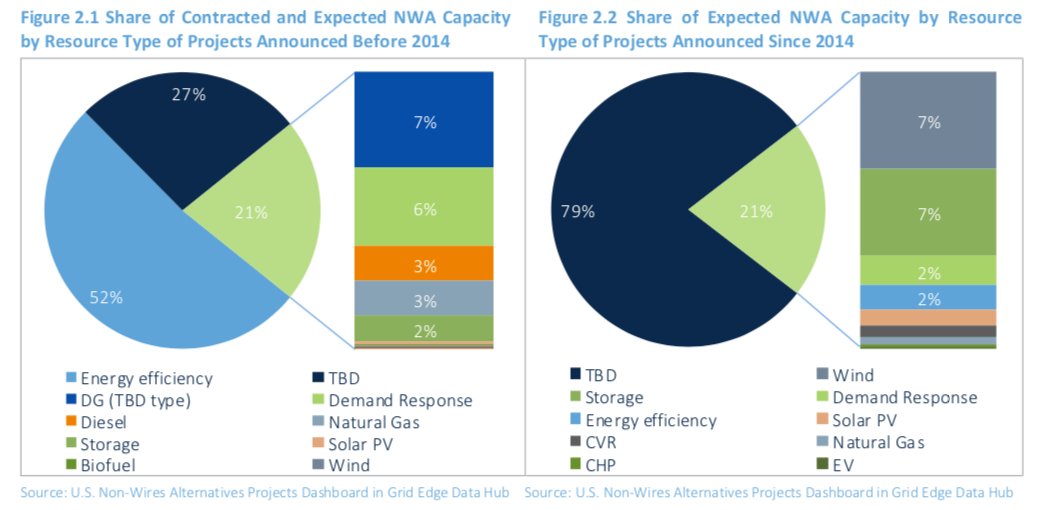

Finally, let’s look at the data behind another key finding — that energy efficiency, which makes up more than half of pre-2014 NWA deployments, will play a far less prominent role in the DER-focused NWAs being developed today.

The challenge with the data behind this finding is that, “from 2014 to today, the majority of the predicted capacity associated with identified projects remains ‘to be determined,’” Munoz-Alvarez said. Of all the NWA projects identified post-2014, no specific DER technology has been determined for 79 percent of the capacity in the pipeline, mainly because they’re too early in the process to have formally submitted plans that describe the mix of resources they’ll be putting to use.

Still, the 21 percent of post-2014 projects that have specified resource types show a clear shift away from energy efficiency, which now ranks fourth behind wind power, energy storage and demand response, he noted. Efficiency still outranks solar PV, electric vehicles, combined heat and power, natural gas, and conservation voltage reduction, and will doubtless continue to play a role in NWAs, as it has with Brooklyn-Queens Demand Management and other New York projects.

But it’s a big shift from energy efficiency’s preponderance in pre-2014 NWAs, which was based on large-scale programs in Vermont and New York that stretch back into the prior decade. That’s largely because utilities, regulators and NWA developers alike see the opportunity for flexible resources to earn multiple value streams beyond their core grid deferral use case, he said.

"With time, results of NWA procurements will reveal which types of resources are best suited to address infrastructure needs. In the end, there may not be necessarily a silver bullet that works in all cases, given how different the NWA opportunities can be," said Munoz-Alvarez.