Early this month, the country’s independent system operators and regional transmission organizations filed their official plans to comply with Federal Energy Regulatory Commission Order 841, the directive to integrate energy storage assets into their capacity, energy and ancillary services markets.

These plans are hugely important to the energy storage industry, given the size of the markets that could be unlocked by their implementation — about 7,000 megawatts, or more than 20,000 megawatt-hours, of cost-effective energy storage, according to The Brattle Group.

They’re also hugely complicated. Taken together, the filings from PJM, ISO New England, New York ISO, California ISO, Midcontinent ISO and Southwest Power Pool add up to more than 25,000 pages, covering everything from physical and operational characteristics of electric storage resources, to the tariff changes to integrate them into day-to-day operations at scale.

Or, sometimes, not covering these details, according to the Energy Storage Association.

On Tuesday, the ESA led a webinar discussion of the top-line findings from these Order 841 compliance plans, including where it feels grid operators have failed to meet FERC’s requirements — either through leaving out one or another part of the notably complicated set of tasks required to manage batteries as grid resources, or by actively setting up policies that could effectively bar storage from participating in a cost-effective way.

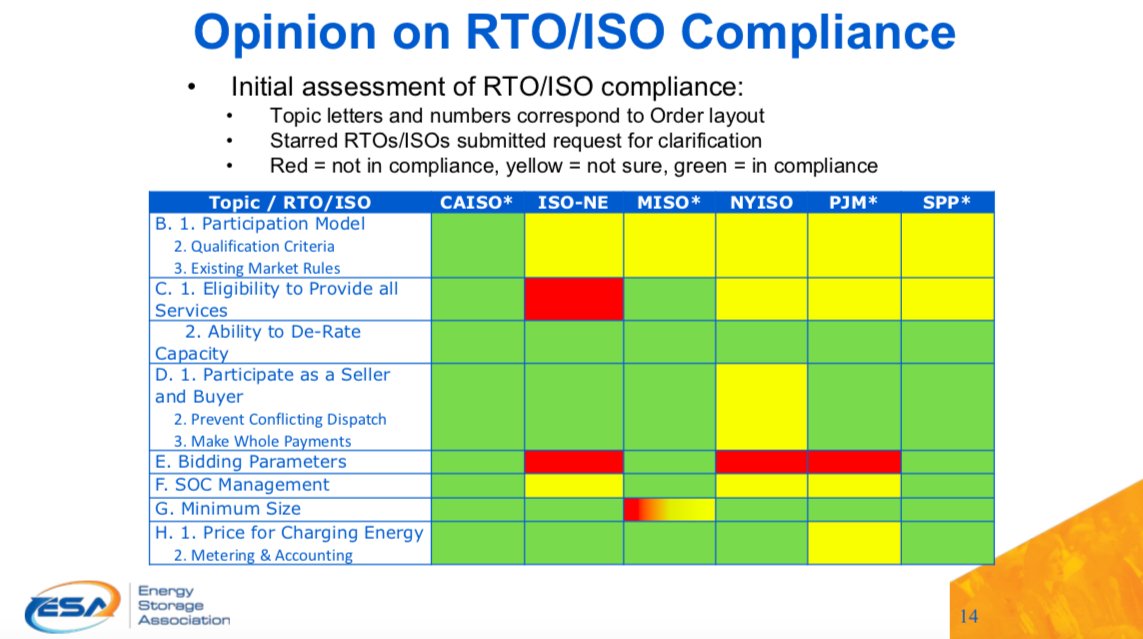

This chart from ESA and its consulting partner Customized Energy Solutions lists the different requirements FERC put into Order 841 and how well they believe each ISO/RTO has done in meeting them. Green means in compliance, yellow means “not sure” — either because the plan didn’t address the issue, or was unclear in some fashion — and red means out of compliance, at least in these groups’ estimation.

But out of this long list of issues, ESA and its allied industry members have picked out a few that they feel could really undermine Order 841’s directive to allow energy storage’s value to come to bear on the grid. The biggest, in terms of its potential market impact, is mid-Atlantic grid operator PJM’s10-hour duration requirement for participation in capacity markets — a requirement that could undermine the economics of today’s 2- to 4-hour duration lithium-ion batteries.

Energy storage industry advocates are also concerned about ISO-NE’s automatic derating of storage as it approaches a 1-hour duration threshold and its insistence that batteries register as both generators and load, to name two key issues. And they have a host of issues with NYISO’s approach to managing batteries’ state of charge, its restrictions on wholesale and utility program “dual participation,” and dealing with projects less than 2 megawatts in size, among others.

These three independent system operators (ISOs) make up the vast majority of the energy storage market potential in the country, outside California and Texas, making it critical that their policy roadmaps are clear of any foreseeable obstacles that run counter to FERC’s goal of creating a level playing field for energy storage, said Kelly Speakes-Backman, CEO of ESA, in a Tuesday announcement.

They’re also the home of states that have instituted large-scale energy storage mandates and incentive programs, including New Jersey’s goal of 600 megawatts of storage by 2021 and 2 gigawatts by 2030; Massachusetts’ target of 200 megawatt-hours by 2020 and 1 gigawatt-hour by 2025; and New York’s goal of 1.5 gigawatts by 2025. In addition, she said, “we expect PJM, NYISO and ISO-NE to remove barriers and level the playing field, so as not to obstruct the policy objectives of the states they serve.”

Jason Burwen, ESA’s vice president of policy, laid out some of the key industry objections to each of these issues in a Thursday interview. Here’s an overview, focused on the issues that are likely to see the most debate over the next two weeks of public comments, and into 2019 as each ISO and RTO works toward their own compliance deadlines.

PJM

PJM’s plans for FERC Order 841 compliance have stood out since its earliest straw proposal. PJM's insistence on setting a 10-hour duration requirement for any energy storage resource seeking to serve in its lucrative capacity performance market has worried the storage industry. That’s much longer than ISO-NE’s proposed 2-hour duration requirement, or NYISO’s 4-hour duration requirement, for participation in their respective capacity markets.

No batteries that exist today can provide 10 hours of uninterrupted discharge, meaning that any battery vendors looking to participate in PJM’s capacity market under these rules would have to derate their capacity to stretch over 10 hours. “So, your 10-megawatt, 1-hour battery could qualify as capacity as a 1-megawatt resource that can participate,” Burwen said by way of example.

But this would mean that this hypothetical battery would only be worth one-fifth the capacity value it would receive under a 2-hour duration requirement, or 40 percent of its capacity value under a 4-hour duration requirement. And because it would be on call during PJM’s noon-to-10 p.m. window, it would face restrictions on using it 10 megawatts of capacity for other economically productive activity during that time — a calculation that’s unlikely to excite energy storage developers.

The New York School of Law’s Institute for Policy Integrity said in an analysis of the filings that PJM’s “onerous” 10-hour requirement is only possible for most resources “through significant derating of capacity, and even then may not facilitate cost-effective participation in the capacity market.”

This move seems to fly in the face of PJM’s stated goal of avoiding overly prescriptive performance requirements for its capacity market, in favor of beefing up the penalties for non-compliance to weed out non-performing assets, Burwen said. For example, it doesn’t seem to match PJM’s approach to determining the duration requirements for intermittent wind and solar power, or energy efficiency and demand response, participating in its capacity markets — “those peak hour periods are not longer than four hours for intermittent resources,” he noted.

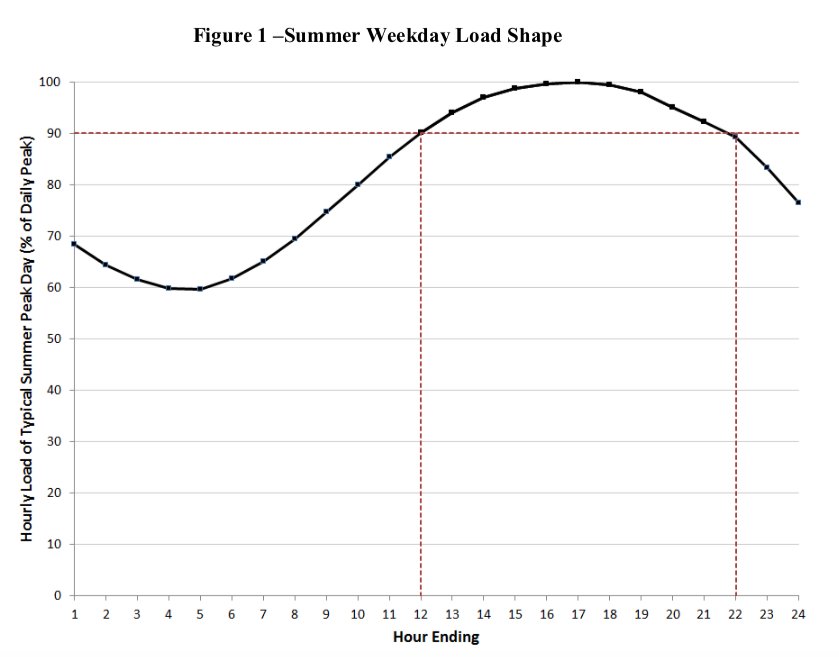

PJM filed an affidavit from Jeffrey Bastian, its manager of capacity market operations, supporting its 10-hour duration requirement for energy storage as being “commensurate with PJM load requirements” for typical summer peak days, and noting that shorter periods such as six hours have only shifted loads into later during the peak, not reduced it completely.

Bastian also wrote that PJM’s use of four-hour periods to measure capacity value of wind and solar power “should in no way be misconstrued to mean that the capacity value of a resource capable of providing a MW level of output or load curtailment on a sustained basis” — that is, energy storage — “should be measured by its capability over only this same four-hour period.” That’s because this four-hour measurement is meant only for resources whose output is outside of their direct control, but still “varies in a predictable manner by hour of day and by season of the year.”

Instead, “PJM has long used the output level that can be sustained for at least 10 hours to determine the maximum capacity level provided by pumped-storage hydro projects,” he wrote. It’s also followed the 10-hour rule for the relatively few battery storage resources in its interconnection queue for capacity, rather than for frequency regulation, such as a multi-megawatt solar-plus-storage project in Minster, Ohio, and is “following the same approach for a dozen additional battery storage projects with active interconnection requests.”

Even so, PJM has conceded from the get-go that there are “concerns” from the energy storage industry about its 10-hour rule. “I can certainly tell you that they’ve gotten the attention of the entire industry on this point,” Burwen said. ESA will be planning to address the subject in its comments to be filed with FERC, “as it seems to be very limiting to the value that can be recognized for energy storage.”

PJM’s filing received ESA criticism for its lack of state-of-charge parameters for the market structures it’s putting in place for energy storage assets. This is not an uncommon failing in ESA’s estimation, with PJM, NYISO and ISO-NE, or half of the country’s six grid operators, getting a “no compliance” grade.

ISO New England

ISO New England’s filings, and ESA’s criticisms of them, are complicated because the ISO has already laid out many of its FERC Order 841 compliance efforts in its Enhanced Storage Participation filing in September. This month’s filings have filled in a few remaining issues, such as meeting FERC’s 100-kilowatt minimum size requirement and exemption of battery charging energy from transmission charges.

But “several crucial items are lacking” from ISO-NE’s plans, according to ESA, such as state-of-charge parameters and “a clear explanation of the mechanism by which storage will be eligible to provide all services in the New England market.”

For example, in an odd divergence from every other ISO and RTO, ISO-NE has declined to create a new “registration” for energy storage as a standalone asset that can both charge and discharge, instead opting to force batteries to register as both generators and loads, as well as a third “add-on” service designation for providing energy-neutral frequency regulation. “Without a dedicated energy storage resource type and the need to register as a combination, we’re trying to understand how that might lead to inadvertent barriers to market participation,” Burwen said.

But the biggest problem in ISO-NE’s filing is its proposal to automatically derate the value of energy storage in order to “keep 60 minutes of energy in the tank,” as ESA put it. This is a complicated issue, tied to ISO-NE’s use of a “co-optimized real-time energy and reserve market,” in which any resource bidding into energy markets must also meet Northeast Power Coordinating Council (NPCC) rules that “[s]ynchronized reserve, 10-minute reserve, and 30-minute reserve...shall be sustainable for at least one hour from the time of activation.” In other words, if a generator, battery or any other resource is in the energy market, it has to simultaneously be able to be called on for those reserves for at least an hour.

But because batteries, unlike generators, have limits on how long they can run, ISO-NE has decided that:

- “In order to comply with the NPCC standard, the ISO will automatically reduce the Economic Maximum Limit of a Continuous Storage Facility’s Generator Asset when the facility has less than one hour of available energy remaining. In other words, if the battery, generating at its Economic Maximum Limit, would run out of energy in under an hour (calculated based on the one-hour available energy value the Continuous Storage Facility telemeters to the ISO), the software will automatically adjust the unit’s Economic Maximum Limit to an output level that the battery can sustain for an hour. For example, a 20 MWh Continuous Storage Facility with an offered maximum limit of 10 MW that has 7 MWh of storage remaining will be limited to an Economic Maximum Limit of 7 MW. It is not necessary to do this on the consumption side, because when a load is dispatched down, it can operate at the lower consumption level indefinitely.”

To the energy storage industry, this derating rule appears to artificially limit the value of storage assets that have less than an hour of energy duration left, but still plenty of energy to provide to the market. “The whole point is that if you’re in the energy market as a storage asset, as you start to get to a lower state of charge, the ISO is saying, you can’t sell all the energy you’d like to sell,” Burwen said. “You would like to sell all the energy you have stored, but this will set an inherent floor on how much you can sell.”

He also pointed out that NYISO, which has the same NPCC requirements, “has found a way to comply with NPCC rules that does not” limit energy storage in the same way that ISO-NE has. “We have filed a protest on this point.”

New York ISO

The criticisms that ESA has for New York ISO’s FERC Order 841 compliance filing are multifaceted. In broad terms, ESA’s analysis finds it “non-compliant with Order 841 in that the NY ISO filing would prohibit storage from participating in both wholesale markets and utility programs. The filing also includes measures that run counter to the intent of Order 841, including a proposed market mitigation scheme that will serve as a barrier to entry for resources smaller than two megawatts.”

The barrier to “dual participation” in wholesale and utility programs is a sin of omission, not commission, Burwen noted. “New York ISO in its 841 filing does not appear to be letting storage resources participating in a utility or other program to be market participants,” he said, even though “we believe that Order 841 makes explicitly clear” that this is a requirement.

As NYISO pointed out in its filing, it’s working on this dual-participation issue in a separate proceeding as part of the state’s broader Reforming the Energy Vision initiative. But as ESA and other parties have pointed out, that process could take years to complete, meaning that it should be incorporated into the same proceeding guiding Order 841 compliance.

In other words, “it’s not because New York ISO does not have anything they’re doing on this — it’s because it’s not to the letter of Order 841,” Burwen said. Given the state’s massive energy storage mandate, it’s important that NYISO move toward integrating these efforts. NYISO is also running later than most other ISOs on its compliance schedule, asking FERC to push its implementation deadline to May 2020 as it undergoes a “significant upgrade” to its market software.

NYISO’s energy storage resource model also has some failings in ESA’s view, such as its lack of a model for “non-continuous” storage, or anything that can’t switch from charging to discharging, or vice versa, at a moment’s notice. NYISO is also suggesting that it will be in charge of managing the energy level of storage assets in its day-ahead market, which could be problematic to many asset managers, noted Burwen.

While the specific rules for how this would happen have yet to be laid out, “to be ISO-managed in the day-ahead market means that you as an asset manager don’t get a choice of how you’re going to manage your state of charge going forward,” Burwen said. “It limits your ability to manage that state of charge.”