Last April, New York launched its Reforming the Energy Vision (REV) initiative, the biggest, boldest effort yet to adapt a state’s entire energy infrastructure for a future of distributed, resilient, green energy. New York Governor Andrew Cuomo gave state energy and utility agencies a mandate to overhaul energy regulations and create open data-sharing between utilities and customers, distributed energy services marketplaces for third-party players, and market-based earnings for regulated utilities.

Some 16 months and dozens of white papers, regulatory filings, and pilot project proposals later, the REV concept is starting to cohere -- at least in silhouette. In February, the New York Public Service Commission issued its first-track orders on how to reform retail electric industry regulations. The commission, led by chairwoman and distributed energy entrepreneur Audrey Zibelman, followed it up in July with a staff white paper (PDF) on ratemaking and business models that can bring the value to distributed energy resources into play.

Also in July, the key Market Design and Platform Technology working group released a 100-page document (PDF) that laid out the “market-based earnings” and "earnings impact mechanisms" meant to replace today’s rate-based utility compensation. The same month, utilities including Consolidated Edison and National Grid unveiled pilot projects that will test solar, energy storage, demand response, energy efficiency, and communications and control systems in the form of microgrids, virtual power plants and other distributed energy resource configurations.

Richard Kauffman, the state’s finance and energy chairman and designated REV czar, described the state of play in an interview before Greentech Media’s REV4NY Exchange event in New York City last month. He also highlighted concurrent state initiatives that will help move REV forward, including the microgrid NY Prize competition, changes coming to New York’s large-scale renewables program, and the potential for New York’s Green Bank to step in to animate still-immature markets.

Even so, there’s still a lot to be laid out in New York’s REV. The core concept of a distributed systems platform provider to manage the interchange of energy data and services has yet to be fully fleshed out, for example -- although it’s pretty clear that the state’s big utilities will be setting them up, rather than an independent entity, as proposed by former FERC chairman Jon Wellinghoff. The distribution system implementation plans that will explain how utilities plan to do this are now due in early 2016, rather than by year’s end, under one of REV’s frequent deadline extensions.

All of this uncertainty has some people worried. While REV workshops and meetings have generally been pretty amicable, we’ve been hearing reports of increased confusion, and some concern, from people in the distributed energy business about how the process is unfolding. The confusion comes not just from the sheer volume and complexity of issues on the table with REV, but from what’s still missing. The concern is that utilities are trying to slow down the reform, and the data-sharing to enable it, to protect their core business models from competition.

The DER divide: Utilities vs. third parties

Some of the conflicts are out in the open -- namely, the question of how utilities should value rooftop solar and other clean, distributed energy alternatives. In July, REV released a white paper (PDF) on the benefit-cost analysis framework it would like to develop to tally up distributed energy's pros and cons. But the ideas coming from the state's utilities have drawn the fire of environmental groups such as the Natural Resources Defense Council (NRDC), as well as solar advocacy group The Alliance for Solar Choice.

TASC, which represents solar companies including SolarCity, Sunrun, and Verengo Solar, charged in its September filing (PDF) that “[t]he Joint Utilities’ proposals in combination essentially doom the REV process to achieving marginal change." Its list of complaints include utility proposals to exclude “externality values,” that is, greenhouse-gas emissions reductions, from the benefit side of the ledger, and ignore the effect that widespread DERs could have on reducing wholesale energy prices. NRDC’s filing (PDF) takes issue with the utility idea of a “Ratepayer Impact Measure” that would discount DER values based on a calculation of the additional costs they impose on customers, among other points.

Both groups also decry the utility idea of a “distribution provider test” for DERs that are seeking to replace traditional capital investments like poles, wires, transformers and all the rest. This four-step test would allow utilities to pick which distribution projects they want to open to competition from DERs, exempt utility projects that take less than three years, and pick their own “utility-specific percentage” limit on how much peak load reduction they’re seeking -- all of which “leaves the utilities enormous discretion that could be used to eliminate DER alternatives.”

This is important, because REV calls for utilities to consider DERs as an alterative to traditional investments, much as California has done with its distribution resource plan proceeding. But the policy coming out of REV so far hasn’t specified how utilities will replace their guaranteed rates of return on capital expenditures, beyond establishing the idea that market-based earnings should both encourage utilities to support valuable DERs, and offset the base revenues that could be lost to DERs' spread.

Given this uncertainty, it might make sense for utilities to seek to limit the growth of DERs able to compete against capital budgets. “There’s a critical tension here,” said Matt Mooren, energy and utility consultant at PA Consulting. “For the policymakers to have a successful outcome here, they need to lean on the utilities to ultimately help them achieve the outcomes.” At the same time, plenty of the ideas coming out of REV “could be to some degree in conflict with the utilities’ preferred outcomes,” he said.

“"I think the utilities will be looking at all different avenues to holding on to revenue streams. I wouldn’t want energy data, which ratepayers have already paid for, subject to that." ” Michael Murray, chief technology strategist, Mission:data

The benefit-cost analysis framework is supposed to inform utilities’ distribution system implementation plans due next year. As NRDC notes, that first unveiling will be “challenging, but very important” -- so important that it wants the PSC to pick one utility “to go first in, order to ensure that critical elements of the [benefit-cost analysis] are implemented correctly and to keep the process manageable.”

Closing off projects, closing off data

Third-party energy services companies are also concerned about the lack of open data to inform REV’s new energy marketplaces. Some of the earliest signs of resistance on this front emerged after New York utilities proposed their first REV pilot projects -- a combination of microgrid demonstrations, community energy and efficiency programs, and solar-battery enabled virtual power plants featuring companies like SunPower, Sunverge, Opower, Retroficiency, Simple Energy and Smarter Grid Solutions.

But Mission:data, a group representing consumer-facing, data-hungry energy companies such as SolarCity, Stem, Bidgely, PlotWatt, EcoFactor, BuildingIQ, EnerNOC and iControl, wrote in a July PSC filing (PDF) that the pilot projects haven’t worked out a key part of the REV mandate: opening their data to the broader world.

“Each of the investor-owned utility proposals include data-enabled products and services offered directly” from the utility, the group wrote. These are things that could be money-makers in future DER-rich environments, such as energy reports for energy efficiency and customer acquisition, market segmentation, subscriptions to enhanced data analytic services, product recommendations based on energy usage and real-time energy data. However, “none propose to establish a platform for direct access by the consumer or their designee,” that is, the group’s members and companies like them.

This same critique has popped up in California, regarding the pilot projects that investor-owned utilities have proposed as part of their distributed energy-grid integration plans. In both states, regulators have said that they see utility-controlled projects only as a first step in a process that will eventually open up third-party participation. As the Market Design and Platform Technology report notes (PDF), “Over time, some of the regulatory incentives proposed here may become unnecessary and will be supplanted by more valuable and efficient market-driven financial benefits.”

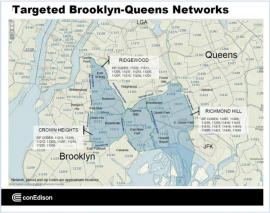

Right now, the single biggest DER project in New York is Con Ed's Brooklyn-Queens Demand Management Program, which is combining 11 megawatts of long-duration, utility-owned batteries with $200 million in customer-efficiency and demand-response program spending, meant to replace about $1 billion in infrastructure spending to support two big substations serving the two boroughs. But that project is being paid for through a so-far unique set of rate-based revenue constructs, and Con Ed hasn't yet provided much visibility into how it's valuing its combination of energy storage, efficiency and responsive customer load.

Michael Murray, chief technology strategist of Mission:data, said in an October interview that REV documents have started to address the open data issue. Specifically, the final Market Design & Platform Technology report released in July asks utilities to lay out a process by which they will share data in “scalable meter data interface solutions, such as Green Button Connect.” Green Button Connect is the emerging standard for sharing smart-meter data with customers, and utilities in California, Texas, Illinois and other states have been working on implementing it, albeit in different versions that may not be cross-compatible.

“This is progress, but not a lot of progress, because there are no other details provided, and the proposed demonstration projects still do not entertain enabling customers with access to their own data,” Murray noted. “The big thing for Mission:data is opening up the meters, to ensure a level playing field. My fear is that the meters will continue to be used to consolidate the market interest of the utilities. If you could imagine them getting cut down significantly in their role, the meters and the distribution assets are the last things they have to monetize -- that will be a thing to be fought over.”

This is a tension that PSC Chair Audrey Zibelman outlined in a speech at REV4NY last month. “The only way markets drive efficiency is with ubiquitous data that is available to everyone,” she said. “We need the price transparency to the grid, and then vendors can build from there. The other piece is on the consumer side -- how do we make it very easy for consumers to transact?”

At the same time, she said, regulators “can’t expect utilities to spend money and not have a mechanism to recover it.” This principle could lead to proposals that utilities monetize third-party data access -- and right now, Murray said, “there doesn’t seem to be a clear direction from the commission or from the Market Design and Platform Technology staff paper on data access.”

“Given the fact that this is sort of a fraught negotiation, my fear would be that the utilities would try to potentially charge money for something that should be just provided in the rate base,” he said. “I think the utilities will be looking at many different avenues to holding onto revenue streams. I wouldn’t want energy data, which ratepayers have already paid for, subject to that.”

Laying the groundwork for deep data-sharing: Is New York ready?

These aren’t critiques limited to New York, of course. Utility business models, as constituted today, have some fundamental conflicts with distributed energy, whether over kilowatt-hours sold or capital costs deferred. Nor do utilities have incentive to collect, verify and share expensive data with competitors.

But unlike states undergoing rooftop solar-driven regulatory reform like Hawaii and California, New York “doesn’t have that many DERs yet -- it’s not as high-penetration as California,” Murray said.

REV is also trying to jump-start a market ahead of the technology to support its vision, he added. Unlike California, New York utilities still haven’t deployed smart meters, a critical source of data on what’s happening at the customer-grid interface. Nor has New York conducted the circuit-by-circuit distribution grid data that would inform locational values for DERs, as California has done.

“I haven’t seen a detailed hosting capacity analysis out of New York,” he said. “I’m not sure how they’re thinking about locational benefits. And you need to have that stuff if you’re going to jump into this brave new world.”

This is the same problem laid out in a series of filings from the Northeast Clean Heat and Power Initiative (NECHPI), a group representing combined heat and power business interests. Take its response to PSC’s benefit-cost analysis white paper (PDF), which the group decried for having “no baselines or projections established through a statewide integrated energy resource analysis, about how changes in values will be measured and validated across a wide array of programs, projects, plans and the like down to the specific DERs...on individual feeders.”

In the case of the Market Design and Platform Technology working group’s July white paper, NECHPI wrote that "it is difficult to imagine how stakeholders and active parties will be able to begin to consider and support the development of new tariff structures and rate-setting approaches without having considerably more concrete, specific guidelines for utility activities, plans, and targeted initiatives for integrating substantially higher levels of DERs.”

Henrietta de Veer, a long-time energy consultant and author of the NECHPI filings, noted the contrast between California’s work on collecting and disseminating distribution grid data, and what she sees as New York’s lack of groundwork on this front. “Throughout every proceeding, compromises are being made, based on missing data and erroneous assumptions,” she said.

For example, to determine the locational values of DERs on the distribution grid, “You cannot even begin to discuss it, unless you know what you have down to the circuit level,” she said. But New York's utilities have asked the PSC for permission to avoid providing circuit-level data, preferring to provide the far simpler locational marginal price data from the state's grid operator, New York ISO.

“"TASC respectfully requests that the Commission and Staff reject the narrow and overly traditional approach that the Joint Utilities are attempting to enforce on the BCA framework, so as to prevent limiting the expansive and forward-thinking nature of the entire REV process."” The Alliance for Solar Choice, PSC filing, Sept. 2015

Utilities need to protect grid security and customer confidentiality, which leads them to be extremely cautious about what kind of data they offer to provide. But as PA Consulting's Mooren pointed out, "New York policymakers' preferred approach is for utilities to provide the required data to third parties. That's the intended leveler of the playing field that would allow anyone to step up and start participating." At the same time, "the data comes from what is a regulated system, and needs to be in a great degree a system that preserves privacy as it relates to all the customers."

But some REV participants see this as a dangerous line for utilities to take, because it could provide an excuse to retain control over various aspects of REV implementation, and exclude third parties that are seen as threats to that control. As de Veer wrote in another filing, “it would appear that the utilities believe that many, if not most, of the distributed system platform provider functionalities will remain with the regulated utility for the next five years at a minimum. This is certainly neither in the spirit of REV, nor is it how it is envisioned by the Commission.”

De Veer suggests that New York regulators mandate 10-year state and utility integrated resource plans, and require utilities to start work on circuit-level mapping of their distribution grids “as soon as possible to form the basis for all the other proceedings involved in REV.” Using the cost-benefit analysis framework developed by the Electric Power Research Institute would be a good start, she said -- as would be looking at what California has done so far.