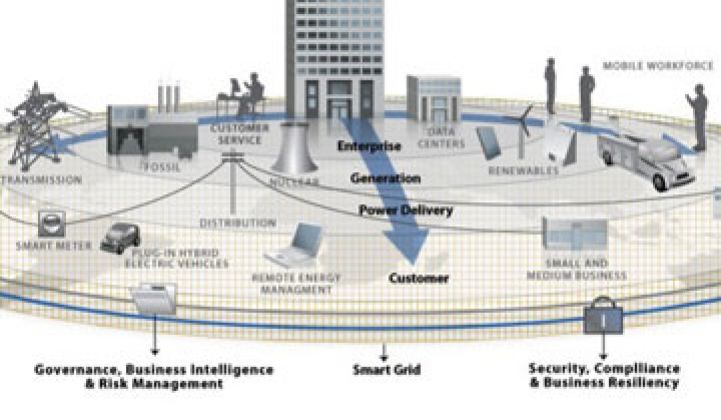

Verizon, and other cellular carriers, have long been in the utility business, primarily providing backhaul communications services for utility operations. With massive, secure networks and decades dealing closely with customers, carriers like Verizon are finding new revenue streams and business models in the energy space.

From building energy management that can be white-labeled by a utility to customer engagement platforms that can also be used for internal operations, Verizon is looking far beyond its current role as a communications provider for backhaul and metering services to its utility customers.

Building Energy Management, One Step at a Time

When it comes to energy use in buildings, Verizon found the market the same way many other companies do: it wanted to save money.

The communications giant has more than 30,000 facilities around the world and it has just started cutting energy use. In about 65 buildings in the U.S., Verizon has installed a buildings control system from Elutions.

For now, those buildings are only “focusing on the basics,” such as HVAC and large equipment, according to Kyle McNamara, managing principal in the global energy and utility practice at Verizon. Controlling those systems can drive about a 10 percent to 12 percent savings, he said. Overall, Verizon has a goal of making 250 of its buildings “smart” by 2015 and reducing its carbon intensity by 50 percent.

To bring the solution to its enterprise class customers, Verizon is now partnered with Elutions, which has been in building management for 25 years. Somewhere between the Johnson Controls and the startup dashboard companies, Elutions produces its own hardware and has a cloud-based solution, which were some of the reasons Verizon was interested in the partnership. “It’s a scalable solution,” said McNamara.

Cloud-based, hosted solutions were a hot topic at Greentech Media's recent Soft Grid conference. Verizon is seeing interest in bundling everything from meter data management (it works with eMeter) to customer service systems to demand response into one platform for utilities looking for flexible systems that can be deployed quickly.

Utility customers are interested in potentially white-labeling the energy management system to their large customers. Outside of the partnership with Verizon, Elutions already works with NStar. Although the system Verizon is offering is still fairly basic, the system could also link to a utility’s demand response program through the smart meter.

Beyond the Meter for Internal Applications

While the smart meter communications network, even if it is just backhaul, is still the nuts and bolts of Verizon’s offerings, there are also efforts to leverage Verizon’s customer communication systems in the utility space.

On the customer engagement side, Verizon has recently released a two-way engagement platform. One of the most obvious uses is to leverage it during outages, but it is far more flexible, said McNamara.

Verizon has been building the platform for over a year, but just recently started selling it into the utility space. Currently, the company is working with a hotel chain so that customers can provide real-time feedback.

With utilities, it could be a system for customers to be able to pick their medium for messaging, whether it’s a phone call for an older person or a text message for a customer who never leaves his smart phone. Messages could be for outages, but could also be helpful if a bill hits a certain level or to provide a variety of other alerts.

However, many utilities already have messaging systems, which makes it a hard sell. But the features go far deeper than just sending a customer a message.

McNamara said the system can work within the utility, allowing internal staff to coordinate during outages, by means such as sending alerts to field crews. Selling a system that cuts across organizational silos is a challenge not only for Verizon, but for any company that has a platform that can benefit everyone from grid operators to the customer service desk.

One of the bright spots is the municipal and cooperative market. “As you look at second-generation deployments [of smart meters and smart grid], we’re seeing more managed services for munis and co-ops that don’t have the staff or dollars to buy and support these things themselves,” said Ernie Lewis, also a managing principal in the global energy and utility practice at Verizon.

What Verizon feels it offers that some smaller players don’t is the scope of security compliance that utilities will require. Rather than just sitting within the general cloud, Lewis talked about having communities within the cloud that are designed, and protected, with certain industries in mind. “We can offer a cloud that meets all of the NERC CIP requirements,” he said. Whether it’s for security concerns or advanced communications, Verizon wants to give utilities solutions that are “move-in ready.”

Verizon is also in the other side of the energy management business, offering a connected home service to its individual customers. Like other telecoms and security companies with similar offerings, Verizon sees a market where it can help utilities figure out how to access those customers who have already bought a connected home package that probably has a wireless thermostat.

“There’s a logic to connect it back to the utility,” said Lewis, who also noted that the actual business model around that is still up in the air.

Advanced metering communications was just the beginning; there’s a whole lot more to come. Verizon is also looking at providing the underlying communications systems between distributed generation and the utility, and also considering how best to tackle the small commercial space. “Some of the chains -- like a Subway, for example -- don’t need the quickness of a Walmart,” McNamara said of providing a cost-effective building energy management solution for Verizon’s small enterprise customers. “That’s our next target,” he said. “Is there a bundle that’s a more reasonable solution?”

There is if Verizon decides to build one.