Software plays a number of key roles in today’s grid-scale energy storage systems. One role is figuring out what combination of batteries and power electronics best fit the purposes of the customer buying them -- a complicated task in and of itself. Then, of course, there’s the critical job of keeping them running at optimum efficiency and revenue-generating capacity over the course of their useful lives.

As battery-based energy storage systems move from the realm of pilot projects to widespread deployments, these disparate roles have started to converge. Startups like Greensmith, Geli, Younicos and 1Energy, as well as deep-pocketed players like AES Energy Storage and S&C Electric Company, are starting to build the same pre-planning capabilities that have formerly been done a project-by-project basis into the same software platforms that manage day-to-day operations.

But to make these features useful to the utilities and end customers that use them, these capabilities need to be translated and presented in ways that people other than energy storage experts can understand. That’s what Greensmith is hoping to accomplish with StorageModel and StorageView, the new applications for its core storage software platform it released this week.

“This is very much a packaged version of an internal set of tools we’ve been using for a long time,” Greensmith CEO John Jung said in a Monday interview. The Rockville, Md.-based startup has provided software for more than 40 projects to date, he said, ranging from a 20-megawatt system providing frequency regulation for mid-Atlantic grid operator PJM, to 30-kilowatt behind-the-meter batteries in California, along with newer projects balancing intermittent solar power in Hawaii and Puerto Rico.

It’s also incorporated a dozen different types of batteries, including multiple lithium-ion chemistries, Aquion Energy's sodium-ion battery and ViZn Energy’s zinc redox flow batteries, along with several different models of bidirectional inverters and power converters to convert their DC power to grid-ready AC.

Energy storage, from pre-planning to execution

In simple terms, Greensmith's first new application, StorageModel, provides the upfront planning capabilities gathered from this real-world experience, he said. “We see a...number of mistakes [continuing to be] made out there -- selecting the wrong batteries for the job, choosing the wrong inverter and power converter systems, getting the ratio between power and energy not quite right,” he said. “Like a wind tunnel for automobile designers, StorageModel lets storage developers and owners evaluate alternative designs before making investment decisions.”

Other energy storage planning platforms exist for similar tasks, of course, whether from competing startups like Geli and Younicos, grid giants like Siemens and ABB, or research organizations like the Electric Power Research Institute and energy consultancy DNV GL. “What’s important about StorageModel is not just the software functionality, but the fact that it takes advantage of multiple battery types, multiple inverters, multiple use cases, and multiple deployment scenarios,” Jung said.

Picking the right combination of technologies upfront can be critical for energy storage deployments that are being built today to take advantage of revenue streams that might not yet be available, he noted. California, which has mandated that its three biggest utilities procure 1.3 gigawatts of energy storage by the end of the decade, is an example of that situation. California lacks lucrative frequency regulation services markets, and today, it's only letting behind-the-meter batteries aggregate their capacity for demand response via limited pilot projects. But both those situations are expected to change in the coming years, making flexibility a critical part of initial planning.

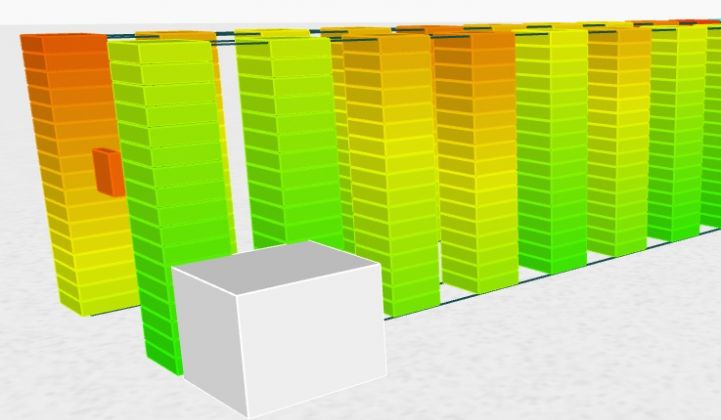

StorageView, in turn, takes on the ongoing operations side of the equation, to “proactively and dynamically monitor and manage the incredible amount of information coming from our system,” he said. In simple terms, the application creates three-dimensional models of battery system performance and safety characteristics out of the streams of data Greensmith’s software tracks across each deployment, he said.

“It can be temperature, or our own proprietary calculation of battery health, that not only monitors and manages it proactively, so that you never have an unanticipated event, but also brings additional resiliency,” he said. “If any single module has a bad day, the rest of the system can continue to participate in the market.”

Once again, these fundamental safety and performance management features are something that more or less every successful energy storage software provider will have to provide to get traction in the market, he said. But “the higher-order stuff is really about individuals who are presiding over a suite of systems and a strategy that is multi-year and multi-faceted,” he said.

“That deals a lot more with analytical capabilities that whittle all this data down to something very simple and visual to allow for pattern recognition” by users whose main job is not babysitting individual storage systems, but managing them as parts of a much bigger set of energy systems, he said.

A comprehensive view for a fast-growing energy storage sector

In some ways, Greensmith is trying to provide a similar level of integration and visualization help to its customers as do software platforms that help data center operators manage a fleet of virtualized servers in a cloud computing environment, he said. "The people we brought into the company early on, they didn’t just come from the power sector; they came from the telecom and cloud-computing sectors," he said. "We tend to solve problems a little big differently."

Utilities are addressing similar challenges in managing their new smart grid systems through “situational intelligence” platforms, and Greensmith has utility customers including San Diego Gas & Electric that have helped it gain expertise in how its energy storage systems are being put to use for broader grid management needs, he noted. “We’re talking layers of integration across fleets, into different grid assets that exist today, and a heavy amount of back-office integration we’re doing with the SCADA and control networks that power project developers and utilities have built,” he said.

Like every other player in the grid-scale energy storage field, Greensmith has taken on a lot of its early work in the role of a turnkey systems integrator and services provider, he noted. But the more it can shift these capabilities to its software platform, the more it can turn over these tasks to its end customers -- and the higher margins it can earn on its revenues as a result, he said.

Importantly, unlike big project developers like AES Energy Storage or behind-the-meter battery storage providers like Stem, Green Charge Networks, Coda Energy and Tesla, Greensmith isn’t seeking to aggregate or finance its own projects, according to Jung. Instead, it's seeking to become a preferred provider of an “operating system” for others building out the growing energy storage ecosystem.

Greensmith claims that its software is managing more than one-third of the 61.9 megawatts of energy storage projects deployed in the United States last year. That’s a significant share of a market that grew 40 percent from 2013, but it’s nothing compared to the 220 megawatts of storage projects that GTM Research predicts will come on-line in 2015. By 2019, GTM Research expects the U.S. energy storage market will reach 861 megawatts annually and be valued at $1.5 billion.

That means that software providers like Greensmith and its competitors are under pressure to bring as many capabilities as possible under their purview, and quickly, to capture their share of this enormous opportunity. So are the companies providing batteries and integrated systems under their own control, of course. Which model will prevail is hard to predict -- and there's plenty of opportunity for partnerships that create new hybrid models.