As the largest state-owned public utility in America, in one of the most progressive states in the country, the New York Power Authority doesn’t have the option of taking a “wait and see” approach on cleantech.

Plus, NYPA’s business model enables it to invest in and deploy new technologies in bold ways, according to President and CEO Gil Quiniones.

New York’s investor-owned utilities are also deploying innovative technologies. But NYPA can generally take more risks and move faster because it doesn't have to go through the Public Service Commission’s regulatory process.

“We tend to be able to be the first mover and the first tester of new initiatives,” Quiniones said.

GTM spoke with Quiniones last week for an update on NYPA’s 2020 strategic plan, ahead of his keynote interview with Shayle Kann, senior vice president at Energy Impact Partners, at the Grid Edge Innovation Summit taking place June 20-21 in San Francisco.

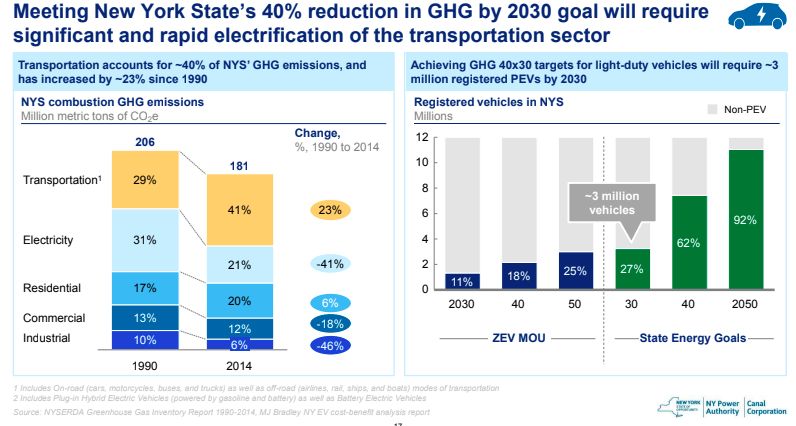

One of Quiniones’ top priorities is rolling out NYPA’s major new investment in EV infrastructure.

Last month, the public utility announced up to $250 million for EV-related investments over the next seven years. NYPA’s board of trustees has already approved $40 million for specific investments between now and the end of 2019, including around 200 DC fast chargers along major thoroughfares, the installation of EV chargers at New York’s JFK and LaGuardia airports, and the establishment of “model communities” to test various customer engagement programs.

“NYPA is interesting because we serve 47 municipal utilities and four cooperatives (these are small distribution utilities owned by cities or towns). So we will pick two or three to...test various customer engagement strategies to see what sticks in terms of promoting adoption for electric vehicles,” said Quiniones.

How NYPA will spend the remaining $210 million to be deployed by 2025 has yet to be determined. That decision will depend a lot on lessons learned from the first phase of the program, Quiniones said.

NYPA does not rely on state taxes or state credits to fund this program, he added. Rather, the budget for the latest EV initiative comes from NYPA’s operating reserves, which come from selling excess power the public utility doesn’t need into the wholesale market.

This isn’t NYPA's first foray into EV infrastructure. The public utility is in the process of installing 400 Level 2 charging stations, with around half deployed to date. NYPA is also installing 30 fast chargers along the New York State Thruway between New York City and Buffalo. Four have been installed so far, with 26 still to go.

All of these efforts are designed to support the state’s broader clean energy and climate goals.

While NYPA isn’t regulated by the NY Public Service Commission (it’s regulated by a separate board), the utility has petitioned the PSC to put fast charging on a special rate that does not include a demand charge. Removing the demand charge is crucial because the charge renders the fast-charger business model infeasible.

Several other state agencies signed on to the proposal. They also asked the PSC to direct the state’s investor-owned utilities to develop broad plans to encourage EV adoption. Quiniones said he expects a regulatory proceeding on EVs open in New York “shortly.”

The question of whether or not utilities should be allowed to own EV charging equipment and how much they can charge for related grid upgrades is expected to be a big part of the EV proceeding. “The good thing is that California has dealt with some of those issues and should inform our process in New York,” he said.

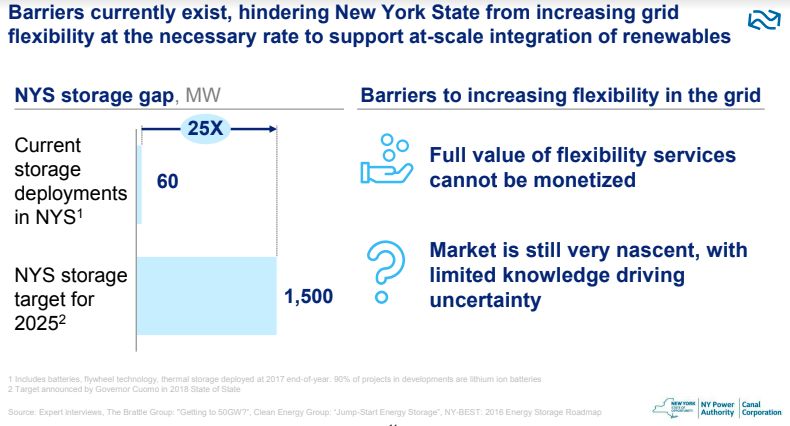

Another focus area for NYPA is “grid flexibility" — deploying technology that makes demand more flexible and controllable, primarily including energy storage and demand response.

NYPA has worked with both of these technologies in the past. But these efforts have now been “put on steroids,” Quiniones said. The public utility’s upcoming investments in grid flexibility will probably be on the order of the $250 million earmarked for EV infrastructure investments.

NYPA is taking a similar approach on energy storage as it is with EVs. It’s collaborating with New York state’s other large utilities, as well as NYPA’s own municipal and co-op systems, to deploy pilots and craft new rules.

Quiniones said NYPA will soon announce what he calls “test and learn” energy storage installations across its territory at the transmission level, the distribution level and behind-the-meter with certain customers. These efforts are designed to increase overall system efficiency, which is a major goal under New York’s Reforming the Energy Vision plan.

The state’s capacity utilization is currently about 54 percent, according to Quiniones. Energy storage could play a pivotal role in boosting grid utilization, which is expected to help keep system costs low.

“Our goal is for the [energy storage pilot] to inform the regulatory process, as well as the market rules in our New York ISO,” he said. “We also anticipate our PSC will be starting a proceeding on storage. And that's kind of what NYPA's role has always been — historically, we are the entity that will try things first.”

If NYPA’s pilots prove out well, then utility regulators can, along with the New York ISO, help to create the right regulatory landscape and market rules to foster a particular initiative or technology, Quiniones continued.

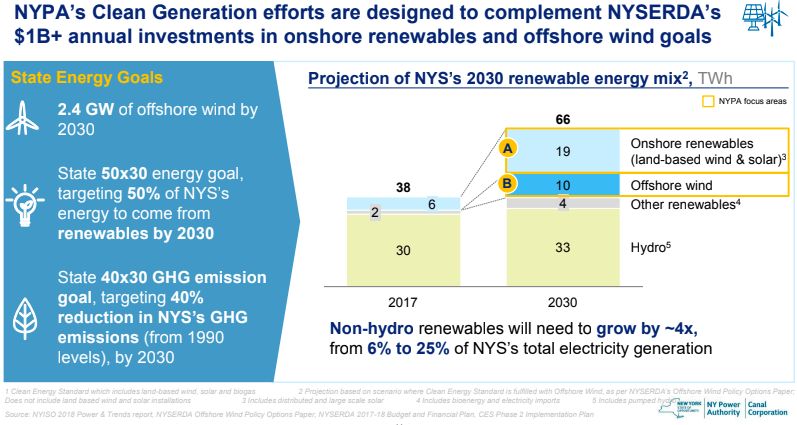

The third big clean energy focus area for NYPA is trying to figure out the proper role of the public utility in helping to support the state’s offshore wind goals. Last year, Governor Andrew Cuomo announced that he wants to have 2.4 gigawatts of offshore wind by 2030. Earlier this year, Cuomo released an offshore wind procurement plan.

“So what is the proper role of NYPA?” Quiniones asked. “NYPA [is] the owner of one-third of the transmission grid in New York state, [so] we're looking particularly at transmission. Is there a role for NYPA to build out the transmission network for offshore wind?”

The first step is to study other countries and stakeholders already involved in offshore wind. The next step is to study how NYPA could play an advantageous role in planning, developing, financing, designing, building and operating an offshore wind transmission network.

The digital grid is another area where NYPA has taken a proactive role.

The public utility has already created an integrated smart operation center that houses its monitoring and diagnostic center for NYPA’s power plants, transmission lines and substations. It also helps monitor the system for cyberthreats and physical security threats. NYPA’s telecommunication network operations center and strategic software and data centers are also in the same location.

“We're probably one of the [only] — if not the only — [utilities] that's declared we will digitize everything in our processes,” said Quiniones.

NYPA is also digitizing the energy systems of its large commercial and industrial customers, in a system called New York Energy Manager.

“We're creating digital replicas of their energy systems so we can help them optimize the way they use energy, but also to inject this concept of flexibility,” Quiniones said. “Over time, we really would like to aggregate flexible load and be able to schedule and bid that into the markets.”

NYPA’s third major digital grid initiative is a collaborative project among all New York utilities as well as the ISO, dubbed the Advanced Grid Innovation Lab for Energy, or AGILe. The consortium is digitizing the entire power grid of New York, starting with the transmission and generation systems, Quiniones explained. The state has invested in supercomputers that are built specifically to simulate and model the power grid, creating a “digital twin” of the system.

Everything is being digitized, he said — from HR systems, to supply chain management, to asset management, to drones, to wearable tech that helps keep workers safe.

Quiniones' general sentiment about all of these efforts: “We’re very excited.”

***

Grid Edge Innovation Summit is the leading future energy conference that will examine the energy customer of tomorrow and how new innovative business models are quickly emerging. Join us as we bring together the most forward thinking and prominent members of the energy ecosystem and as our research team explores the future of the market.