PV inverter manufacturers are at a crossroads. With a wave of oversupply driving at the heels of industry incumbents and new technology players alike, decision-makers are increasingly realizing that status quo strategies will not keep the industry's shakeout from their door.

As is the nature of a shakeout, a number of inverter companies will inevitably fall by the wayside. However, in our recent report on the global inverter market, we at GTM Research outline strategies for mitigating the pain and laying a groundwork toward survival (e.g., developing new technologies, improving cost structures, entering emerging markets, focusing on mergers and acquisitions).

Employing these strategies is no easy task, and determining exactly which path is best suited for each specific inverter company is even more stress-inducing, practically requiring of a coterie of qualified corporate analysts. Therefore, we pose this question: When faced with the realities of producing and selling inverters in today's modern PV age, how would you, the reader, guide a manufacturer?

Below we present a "choose your own adventure" of sorts for today's inverter professional, or for those looking to walk a few kilometers in his or her shoes. Here we aim to present the state of the inverter industry, after which the reader will be polled to choose between two paths, each of which would lead to a new scenario, new set of challenges to be faced, and new decisions to be made based on the result of the poll.

This so-called adventure is adapted from The Global PV Inverter Landscape 2013: Technologies, Markets, and Survivors. Good luck.

The State of the Industry

Over the past decade, the PV inverter industry has undergone tremendous change, evolving from a niche product provided by only a handful of specialized suppliers to a global landscape attracting the world’s largest industrial conglomerates and innovative startups. With a boom in global PV demand that shot PV installations up from 7.2 gigawatts in 2009 to 17.5 gigawatts in 2010, inverter suppliers suffered from component shortages that paved the way for new entrants to steal market share.

In 2011, despite initially bleak expectations resulting from major incentive cuts and confusion, global PV installations stormed forward to 26.8 gigawatts. Much of the surge came from traditional European markets in the fourth quarter of that year.

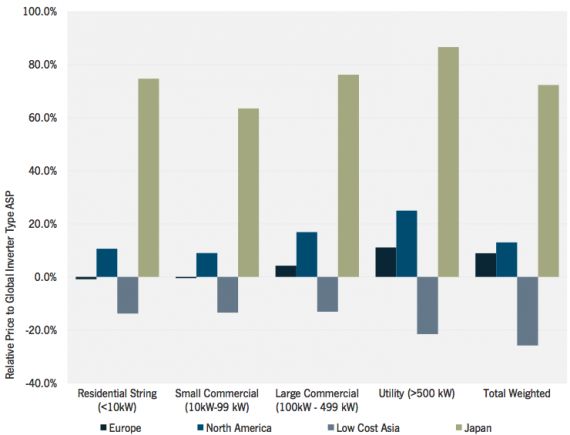

As of today, the inverter landscape has become overly crowded, especially for secondary markets like the U.S. With the expected stagnation of European demand, traditional players have slowly pursued new markets in emerging economies like China, India, Southeast Asia, South America and even regions of Africa. These markets have emphasized high-power products -- a contrast from the residential string and light commercial inverters historically favored in European feed-in tariff (FIT) markets. This shift in product mix, coupled with an emerging group of new low-cost suppliers, has pressed blended global inverter average selling prices (ASP) down by 15 percent from 2011 to 2012.

FIGURE: Inverter Pricing by Region Relative to Blended Average Market Segment ASP by Region of Sale, 2012

Source: The Global PV Inverter Landscape 2013

Inverter manufacturers have begun to emphasize new features and incorporate add-on products to combat dropping ASPs. System monitoring devices and electrical balance of systems are more aggressively packaged with inverters, especially at the low and high power segments. In free-field systems, especially those connected directly to medium voltage, balance of electrical systems are packaged with the inverter. While the total electrical package costs more than a standalone inverter and sometimes even more than the sum of separately sourced components, engineering, procurement and construction providers (EPCs) save on electrical installation costs.

Furthermore, lowered incentive rates are forcing developers and project owners to focus more on reliability and system uptime. The increasing prevalence of third-party ownership and PPA contracts, especially in North America, has also incentivized a heightened emphasis on maintaining system uptime and performance, especially in residential systems where monitoring systems were previously seen as an unnecessary cost-adder.

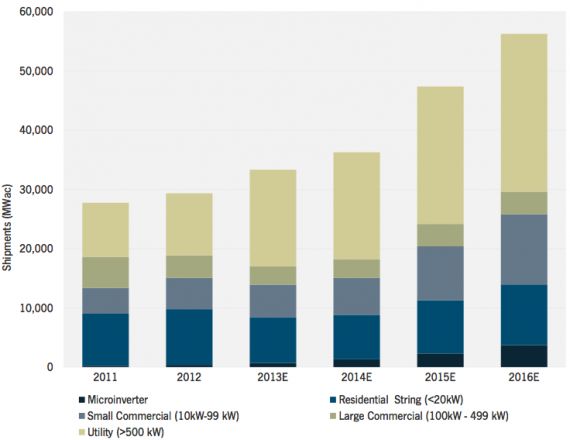

On the opposite end of the power spectrum, module-level optimization, including microinverters and direct current (DC) optimizers, has materialized as a true market force. After receiving over $107 million of venture capital, Enphase Energy went public, raising an additional $54 million. In fact, as of the end of 2012, over $550 million in private venture capital had been raised by companies seeking microinverter and distributed optimization solutions.

FIGURE: Global PV Inverter Shipments by Inverter Size, 2011-2016E

Source: The Global PV Inverter Landscape 2013

While the industry continues its bitter debate over whether the distributed optimization model is disruptive or niche, Enphase’s 2012 shipments surged to 1.5 million units. Though Enphase is certainly the most recognized name in the space, many other competitors have been building momentum in the still-nascent distributed optimization space.

The growth of new technologies will be held back, however, by industry uncertainty over the supplier landscape. While the current spotlight is on the viability of various incumbent module manufacturers, recent announcements by Siemens that it will roll back inverter production and Satcon’s forced liquidation throw added risk into the process of supplier selection. Supplier bankability will be increasingly scrutinized, and newer suppliers, or those with uncertain financial prospects, will be heavily disfavored. As market exits rise, we expect reliability and availability to come to the forefront of inverter selection.

FIGURE: Global PV Inverter Landscape in 2013

Source: The Global PV Inverter Landscape 2013

In addition, price will continue to play a major role in vendor selection. Chinese manufacturers are the primary suppliers that have capitalized on a market in search of low-cost supply, but they certainly are not alone. European suppliers, searching for increased demand, have also significantly dropped pricing, though this may be more a sign of desperation. In either case, the availability of low-price supply will force higher-cost suppliers to squeeze margins or exit altogether. While we see a likely increase of market exits in the inverter space, we see as many large industrial diversifieds or even pure-plays continuing to target and introduce new products into the inverter space, as well. In the near term, market shifts and supplier consolidation will create significant turmoil in the inverter market, similar to the current supplier woes in the module industry.

During this time, global shipments will actually continue to increase from 29.8 gigawatts in 2012 to 52.3 gigawatts in 2016. However, shifts in the end market, both in market segment and region, will cause temporary declines in the inverter market. The revival of European rooftop markets in 2015 and a relative stabilization of global inverter ASPs will help stabilize and return global revenues to growth.

What's a decision-marker to do? At this point, you may find it most productive to narrow your choices to three: pursue a supply strategy, pursue a demand strategy, or purchase GTM Research's The Global PV Inverter Landscape 2013 report, which presents a comprehensive outlook on this complicated decision process.

Will you stake your inverter company's hopes and resources on supply-side solutions such as new technologies or improving efficiency and cost, or might you find it better to attack demand by pushing into emerging markets globally and getting your hands dirty in the competitive scrum of mergers and acquisitions? Or will you satisfy both your company's needs by purchasing the report today at www.greentechmedia.com/research/report/the-global-pv-inverter-landscape-2013?