According to a new report by GTM Research, Utility AMI Analytics at the Grid Edge: Strategies, Markets and Forecasts, utilities around the globe are projected to spend USD $10.1 billion on AMI analytics solutions and integration services through 2021. By enhancing the value of new and existing automated metering infrastructure (AMI) investments, utilities are improving customer service and engagement, upgrading grid planning and management, and increasing energy efficiency.

While adoption has been moderate in the past, GTM Research believes regulatory mandates and the emergence of revenue opportunities associated with distributed energy resources (DERs) are coalescing to reinvigorate demand for AMI and AMI analytics. The development and implementation of new use cases beyond the initial meter-to-cash model will continue to be especially critical to the growth of AMI analytics markets.

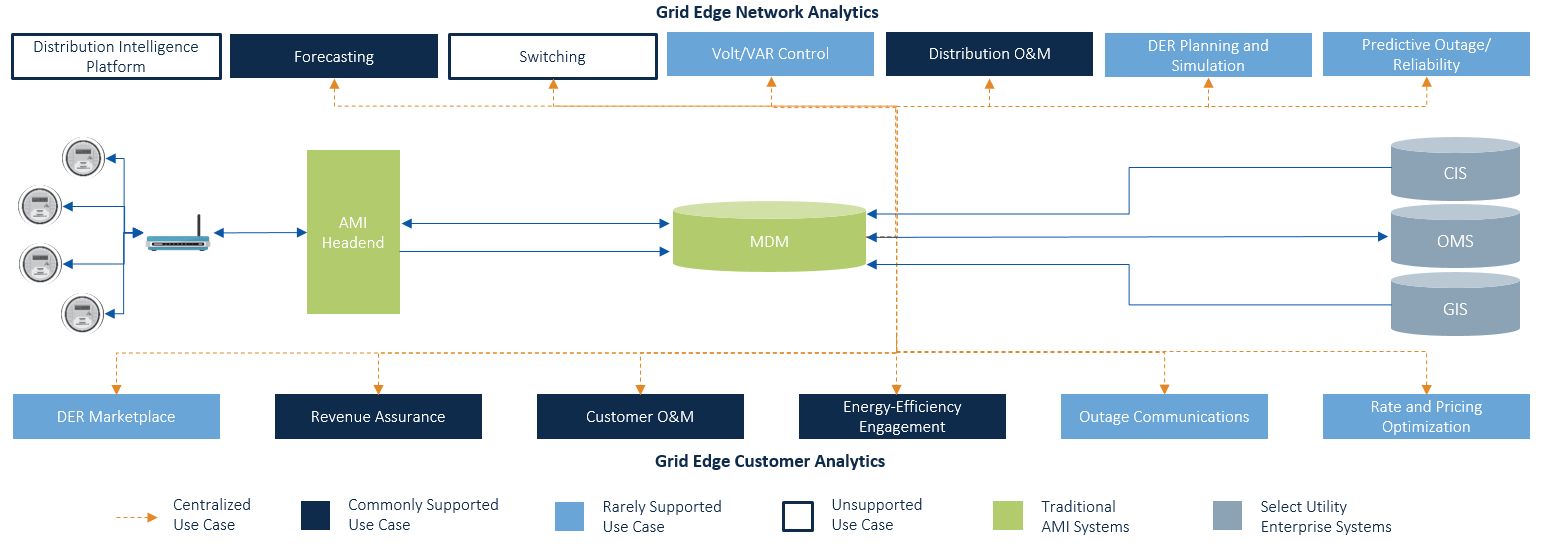

AMI-based grid-edge analytics use cases can be segmented into two markets: network and customer. On the network side, data can be leveraged to better operate and maintain a stable grid through greater voltage control, predictive outage analytics, and the operations and management of assets on the distribution grid. On the customer side, granular AMI data serves to increase the accuracy of algorithms to feed into revenue assurance applications, energy-efficiency programs and the maintenance of the meter at the customer site.

FIGURE: Common AMI Architectures: Headend -- Meter Data Management Integration

Source: Utility AMI Analytics at the Grid Edge: Strategies, Markets and Forecasts

While these use cases could be a major boon to utilities and are a strong incentive to adopt AMI analytics, “vendors still need to form the business case in larger markets,” said Aakriti Gupta, GTM Research grid analyst and the report’s author. “Today, the majority of utilities deploy standalone solutions with point-to-point integrations to serve niche use cases leveraging existing vendor engagements. The integration gap continues to widen over time as custom code is written for each point-to-point interface, increasing the total cost of ownership with each integration. We predict that the strongest demand in the analytics market will be for turnkey solutions that can be rapidly integrated with existing backend IT systems with limited customization.”

Since processing data to create actionable insights is one of the biggest barriers to optimizing infrastructure data, expenditures on software are expected to rise over other types of AMI-related spend. Subsequent infrastructural improvement and maintenance will only prove that appropriate software applications are essential for optimization.

Due to the complex nature of integrating infrastructure and software, vendors in AMI and AMI analytics generally seek partnerships to round out functional specialties and distribution capabilities. It is common to see AMI vendors collaborate with one vendor, with one providing metering and another providing the network, even if one vendor is itself capable of offering both components. “Since different environments are suited to different AMI network technologies, both meter and AMI network vendors benefit from the increased interoperability, creating increased distribution channels,” Gupta explained. “However, there are emerging data management vendors that are less well-known, so there is a great deal of potential in this market for both growth and partnerships.”

***

For more information, visit the report page here.