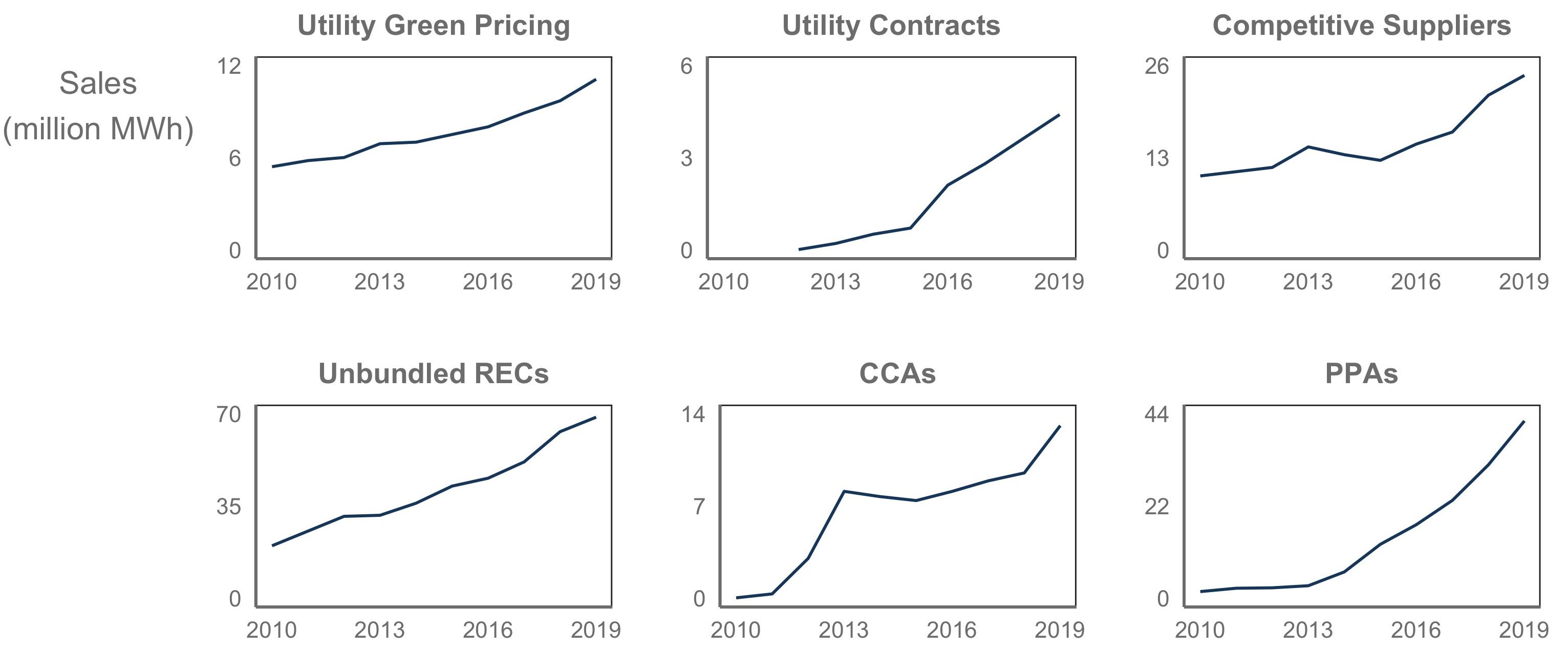

Millions of retail electricity customers in the United States buy voluntary clean power, meaning renewable energy beyond what load-serving entities such as utilities otherwise provide. These clean power sales have surged in the past decade: According to data collected and published annually by the National Renewable Energy Laboratory, they doubled from 2010 to 2014 and doubled again from 2014 to 2019.

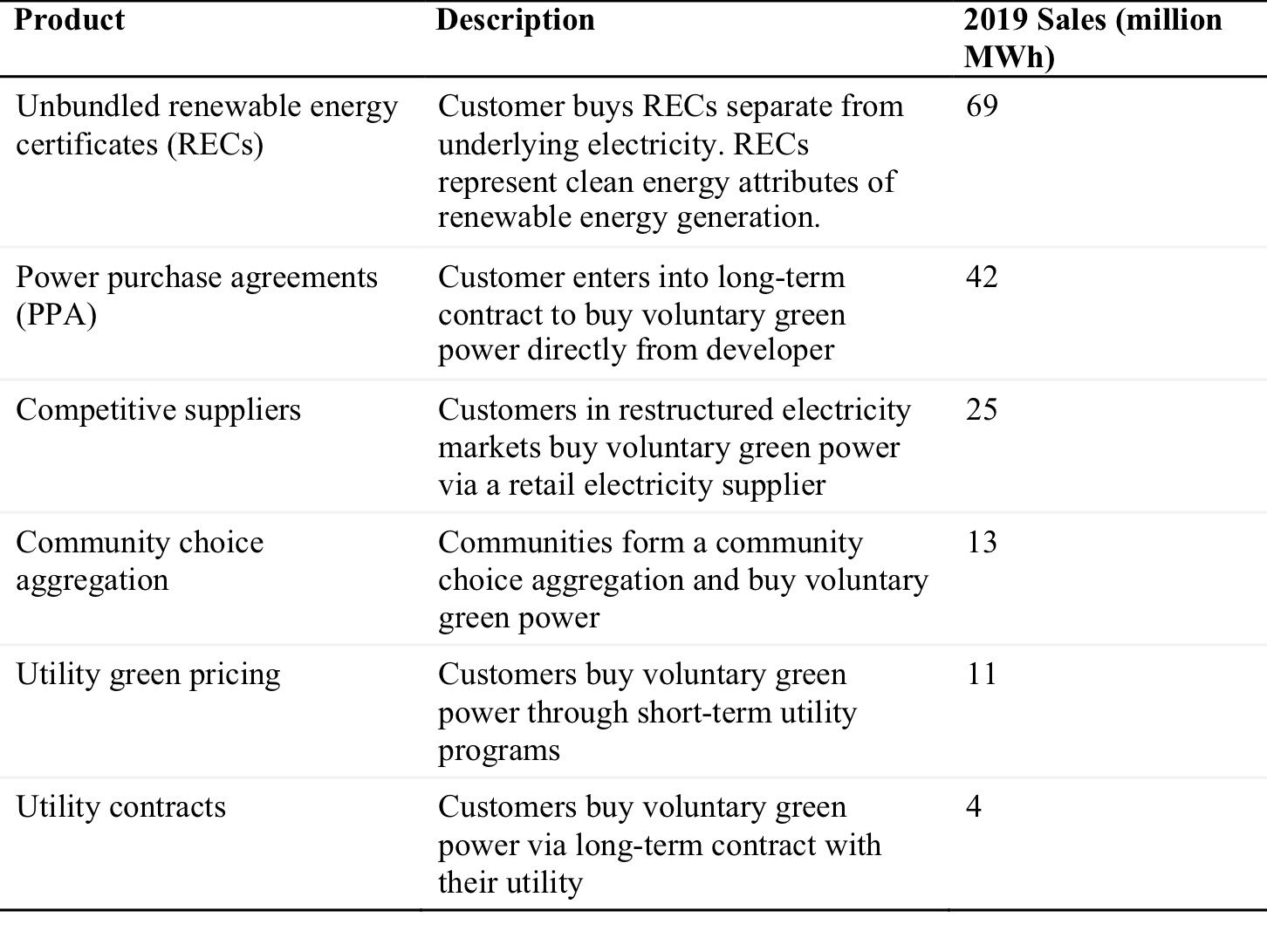

NREL estimates that voluntary clean power sales reached 164 million megawatt-hours in 2019, accounting for around 32 percent of all non-hydropower renewable electricity sales, or just over 4 percent of all retail electricity sales in the United States. While several factors explain this healthy growth, an important one is the increasing number of pathways allowing customers to participate, as the following table shows.

Many retail electricity customers — especially large commercial and industrial customers — have procured unbundled renewable energy certificates (RECs) to fulfill clean energy objectives, with 69 million MWh of unbundled RECs purchased in 2019, according to NREL data. Large customers have also developed a variety of power-purchase agreement (PPA) structures that have become the fastest-growing source of voluntary clean power demand, according to NREL data, reaching about 42 million MWh of sales last year.

Many retail electricity customers — especially large commercial and industrial customers — have procured unbundled renewable energy certificates (RECs) to fulfill clean energy objectives, with 69 million MWh of unbundled RECs purchased in 2019, according to NREL data. Large customers have also developed a variety of power-purchase agreement (PPA) structures that have become the fastest-growing source of voluntary clean power demand, according to NREL data, reaching about 42 million MWh of sales last year.

The emergence of community-choice aggregators has also been pivotal. Due in large part to the proliferation of CCAs in California, customer demand for voluntary clean power in this category has grown from nearly zero in 2010 to 13 million MWh in 2019.

NREL’s data shows that voluntary clean power sales are increasing in all six of the ways that customers buy clean power.

The former categories have received considerable attention from the press and academia. But another key player has maintained a relatively silent but important role in the steady growth of voluntary clean power markets: utilities.

Utility clean power programs by the numbers

NREL estimates about 14 percent of customers buy voluntary clean power through their utility, with utility contracts and pricing programs for clean power accounting for about 9 percent of total sales in the category. And utility clean power sales have consistently increased over the last decade, nearly tripling from 2010 to 2019.

This growth reflects ongoing utility innovations to extend voluntary clean power access to more customers. Utilities have developed a variety of products with different resource, cost and contractual characteristics, allowing more customers to buy renewable energy in ways that address their specific needs.

We believe utility clean power programs are worthy of more attention for two reasons. First, utilities remain the primary and, in many cases, the sole load-serving entity for most U.S. customers. As a result, utility programs are often the simplest, quickest and potentially cheapest way for most to access renewable energy. Yet many customers remain unaware of these options.

Second, the NREL data suggests that participation in these programs could be higher. The top 10 utility programs have enrolled more than 5 percent of their sales, compared to typical participation rates of around 1 percent in most other programs. These results suggest that utility clean power programs could expand renewable energy access to more customers, possibly through the sharing of best practices and product innovations across utilities.

To spark this dialogue, we summarize the primary ways that utilities are providing clean power to their customers, and we provide some market estimates from the most recent publication of the NREL voluntary clean power data.

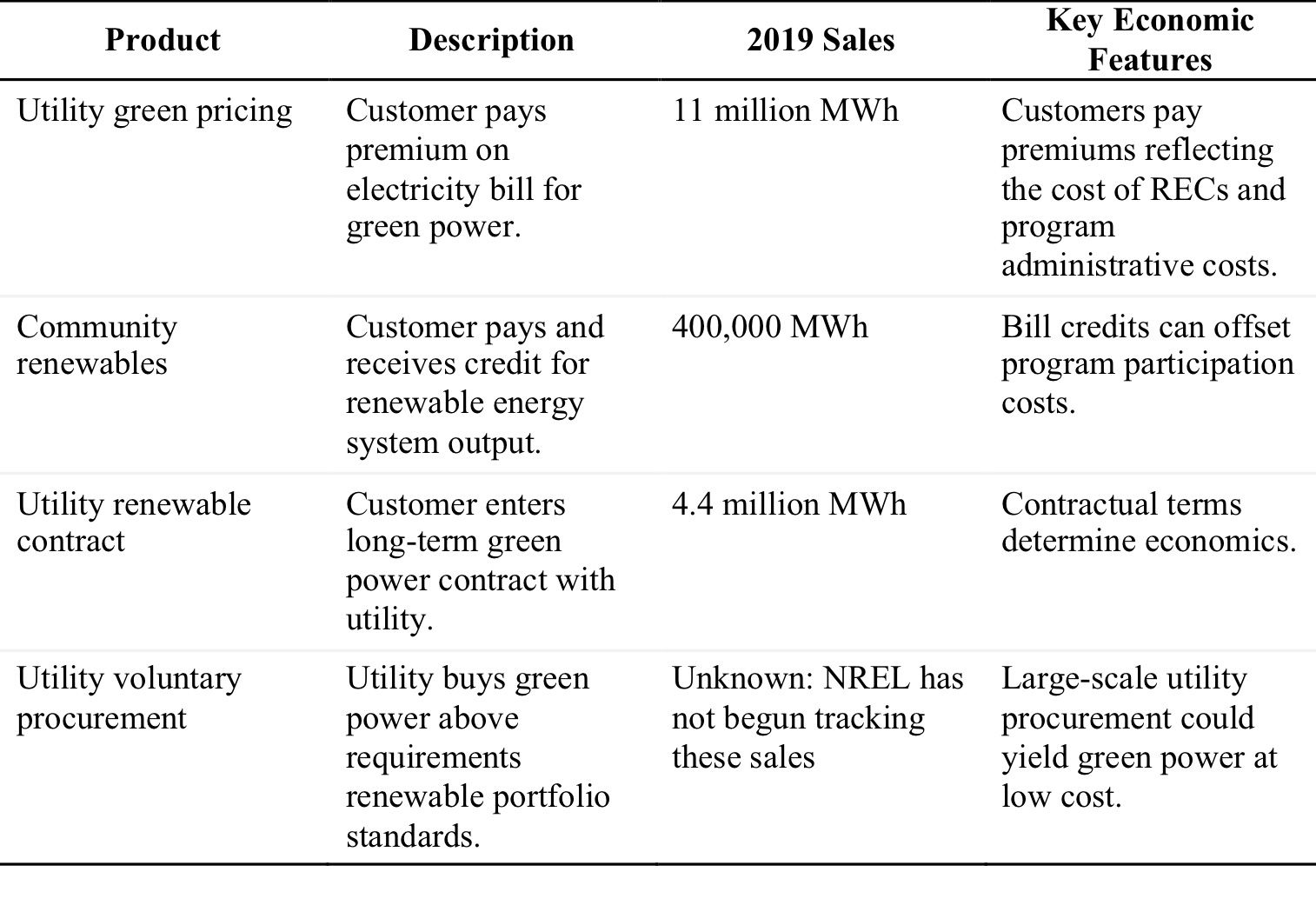

Utility "green" pricing programs

Utility "green" pricing programs are the bread and butter of utility voluntary clean power. They allow retail electricity customers to pay premiums for renewable energy above what the utility would otherwise provide and use those premiums to administer the program and retire RECs on behalf of participants. Participation has grown steadily for two decades, from just over 100,000 customers in 2000 to about 570,000 in 2010, and then to just over 1 million in 2019.

Unlike the growth of other clean power products such as PPAs, utility clean pricing program growth cannot be attributed to falling prices. NREL data suggests that premiums have remained steady or even increased as programs offer more expensive electricity from local solar plants. University of Michigan research indicates that participation growth is attributable to growing customer interest and willingness to pay for renewable energy.

A few large programs consistently lead trends in utility clean pricing, NREL data shows. Large programs from Portland General Electric, Xcel Energy and PacifiCorp have found ways to keep customers engaged and increase sales. One in four of all of Portland General Electric's customers was enrolled in the utility's flagship "Green Source" program as of 2019, providing other utilities a potential model to follow in terms of program marketing best practices.

Community renewables

Community renewables — particularly community solar — have proliferated over the past five years, allowing customers to “subscribe” to a portion of a solar or wind project and receive bill credits for its output as a return on their investment.

While much of this market involved third-party project developers, a growing number of utilities are now offering community renewables that retire RECs on behalf of subscribers. Bundling RECs ensures customers are buying both the power and the underlying clean energy attributes of renewable energy projects — a key differentiation from most third-party community renewables that don’t entitle subscribers to RECs.

Early movers in utility-led community renewables include the Sacramento Municipal Utility District’s SolarShares program, Rocky Mountain Power’s Subscriber Solar program and Xcel Energy’s Renewable*Connect program. NREL data shows that utility community renewables sales reached more than 400,000 MWh in 2019, accounting for approximately 3% of all utility clean power sales.

Utility renewable contracts

The preceding two program models primarily target residential and small nonresidential customers, and in the case of clean pricing programs, they come with premiums that may be prohibitive for larger nonresidential customers. Beginning in around 2015, these customers began pressing utilities for large-scale voluntary clean power products. In some states where large commercial customer PPAs aren’t an option, utilities have effectively served as intermediaries with large customers in transactions resembling a PPA.

These programs allow large nonresidential customers to contractually procure renewable energy in the utility’s service territory, so far in two flavors. The first consists of “green tariffs” to connect customers to specific projects. For instance, Apple used a green tariff in Nevada to contractually procure power from a string of solar projects from 2013 to 2017.

The second takes the form of utility open solicitations for multiple large customers, allowing the utility to plan and procure capacity consistent with the level of customer commitments. For example, Michigan’s DTE Energy used this model to build several wind projects for large in-state customers including Ford, General Motors and the University of Michigan. NREL estimates these voluntary clean power sales have grown from virtually nothing in 2012 to 4.4 million MWh in 2019, with significant project capacity in green tariff program pipelines.

Utility voluntary procurement

Traditional regulated utility business models have historically disincentivized utilities from procuring renewable energy beyond renewable portfolio standard requirements. But due to rapidly falling renewable energy prices and other factors, utilities are increasingly buying their own clean power voluntarily. At least six utilities have publicly committed to providing 100% clean energy within the next several decades.

This is a recent phenomenon, and NREL has yet to collect data to track its impact. But the potential market implications are significant. Voluntary procurement could drastically increase clean power generation, particularly if large utilities with carbon-free goals such as Duke Energy and Xcel stick to those commitments. This raises new questions about the roles of utilities and retail electricity customers in broader voluntary clean power markets. For instance, what will happen to customer-based voluntary programs (e.g., utility pricing programs for clean energy) as utilities reach high levels of utility-level voluntary procurement? And will utility voluntary procurement affect the motivations of large customers to voluntarily buy renewable energy on their own?

The future role of utilities in voluntary clean power markets

All of these innovations have expanded renewable power access in ways that suit the needs of both small and large customers, but two opportunities for expansion remain.

First, utilities can increase participation and sales in existing programs. For instance, as NREL’s annual top 10 lists indicate, five utilities have enrolled more than 10 percent of their sales into voluntary clean power programs, showing that high rates of voluntary participation are possible.

Second, utilities can develop and offer new voluntary clean power programs. Despite the proliferation of community renewables programs, bilateral contracts and utility green tariffs, only a few dozen of the thousands of U.S. utilities offer them. More programs, and more participation in them, could significantly increase voluntary clean power demand.

Voluntary clean power markets also face evolutionary pressures as grids become cleaner due to state mandates or voluntary utility procurement. Utilities could continue to play an important role in this changing landscape by developing new products that connect customers to renewable energy with specific characteristics, as is already happening today. Portland General Electric offers both a relatively low-cost option based primarily on wind power and a premium option sourced from local solar power, for example.

Offerings could become more common, and more diverse, as grids get cleaner. Some customers may demand energy from renewable energy generators meeting increasingly stringent environmental guidelines. Utilities could help customers source energy from specific or nearby projects. Innovations to tap increasing demand could open voluntary clean power programs to millions more Americans in the years to come.

***

Jenny Heeter is a senior energy analyst at the National Renewable Energy Laboratory in Golden, Colorado. She has spent more than 10 years at NREL researching state and local renewable energy policies, corporate purchases of renewable energy and community solar deployment and cost.

Eric O'Shaughnessy is an independent consultant specializing in distributed energy resources and voluntary green power market research. He can be contacted at [email protected].

Sara (Shiyuan) Dong is a graduate intern with the NREL Market and Policy Team. Her work focuses on solar energy policy.