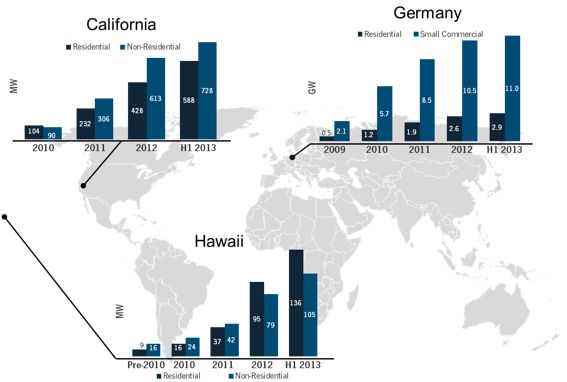

As noted in the most recent U.S. Solar Market Insight report, more solar has been installed in the United States in the last eighteen months than was installed in the prior 30 years. Of the nearly 5 gigawatts installed in 2013, 40 percent was of the distributed variety. Solar's exponential growth is already impacting utility business models and infrastructure in high-penetration markets like Germany and Hawaii.

While there is currently no silver bullet to address the effects of distributed solar, GTM Research identifies technologies and strategies that can be applied to help mitigate PV integration challenges in its most recent report, Advanced Grid Power Electronics for High Penetration PV Integration 2014.

FIGURE: Distributed Solar Deployment in Select Geographies

Source: Advanced Grid Power Electronics for High-Penetration PV Integration 2014

Here are three questions utility executives will face in the coming months and years.

At what saturation point does PV begin to cause serious stability problems?

According to the report, the short answer is 20 percent to 25 percent of total power. More utilities will begin to track solar installations as capacity rises above 250 kilowatt-hours on a single feeder. Once capacity hits 25 percent of the daytime minimum load on a particular feeder, factors like grid topologies, existing equipment placements, and regulatory requirements will be increasingly important.

What technologies can be used to mitigate the effects of instability due to high PV penetration?

The report cites enhanced functionality inverters as a leading tool to integrate PV at high penetration levels. It goes on to describe California’s Rule 21, PREPA’s standards in Puerto Rico, and Hawaii’s connection studies as important in the development of interim local standards in the United States. However, it notes that this is just one piece of the puzzle that will help to push boundaries, but will not be the cost-effective answer to every problem, nor will it alone be able to address very high levels of solar penetration. This is where other power electronics technologies, such as storage or grid electronics, and more traditional upgrades will be important.

Which vendors offer power electronic products for the secondary level of the distribution grid?

The report offers several different taxonomies that break out vendors by services provided. In the U.S. market, ABB, Gridco Systems, MicroPlanet, One-Cycle Control, and Varentec all have solid-state power quality control devices for the secondary grid.

FIGURE: Secondary Power Electronics Ecosystem Taxonomy

Source: Advanced Grid Power Electronics for High-Penetration PV Integration 2014

There's also one important question that vendors in the space should be asking.

Which geographies will be the first to adopt advanced grid power electronics?

Southern Germany and Australia will be early adopters. Within the United States, high-penetration solar states will lead the charge, including California, Hawaii, New Jersey, Arizona, and Massachusetts.

GTM Research forecasts the U.S. market for secondary power electronics equipment for PV integration to grow 134 percent per year and reach $320 million in 2017.

***

Download the brochure and learn more about the report here. Meet report author and grid analyst, Ben Kellison, at Grid Edge Live in June.